- United States

- /

- Biotech

- /

- NasdaqCM:DNTH

How New Phase 2 MaGic Data on Claseprubart Has Changed the Investment Story at Dianthus Therapeutics (DNTH)

Reviewed by Sasha Jovanovic

- Dianthus Therapeutics recently reviewed new data from its Phase 2 MaGic trial of claseprubart in generalized Myasthenia Gravis, with results and expert discussions shared at the MGFA Scientific Session during the AANEM Annual Meeting and a dedicated virtual industry forum.

- The new findings included improvements in clinical scores, insights supporting flexible dosing, and mechanistic data highlighting potential advantages over existing therapies.

- We'll explore how these trial results and expert insights into claseprubart's clinical and mechanistic impact shape Dianthus Therapeutics' investment narrative.

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Dianthus Therapeutics' Investment Narrative?

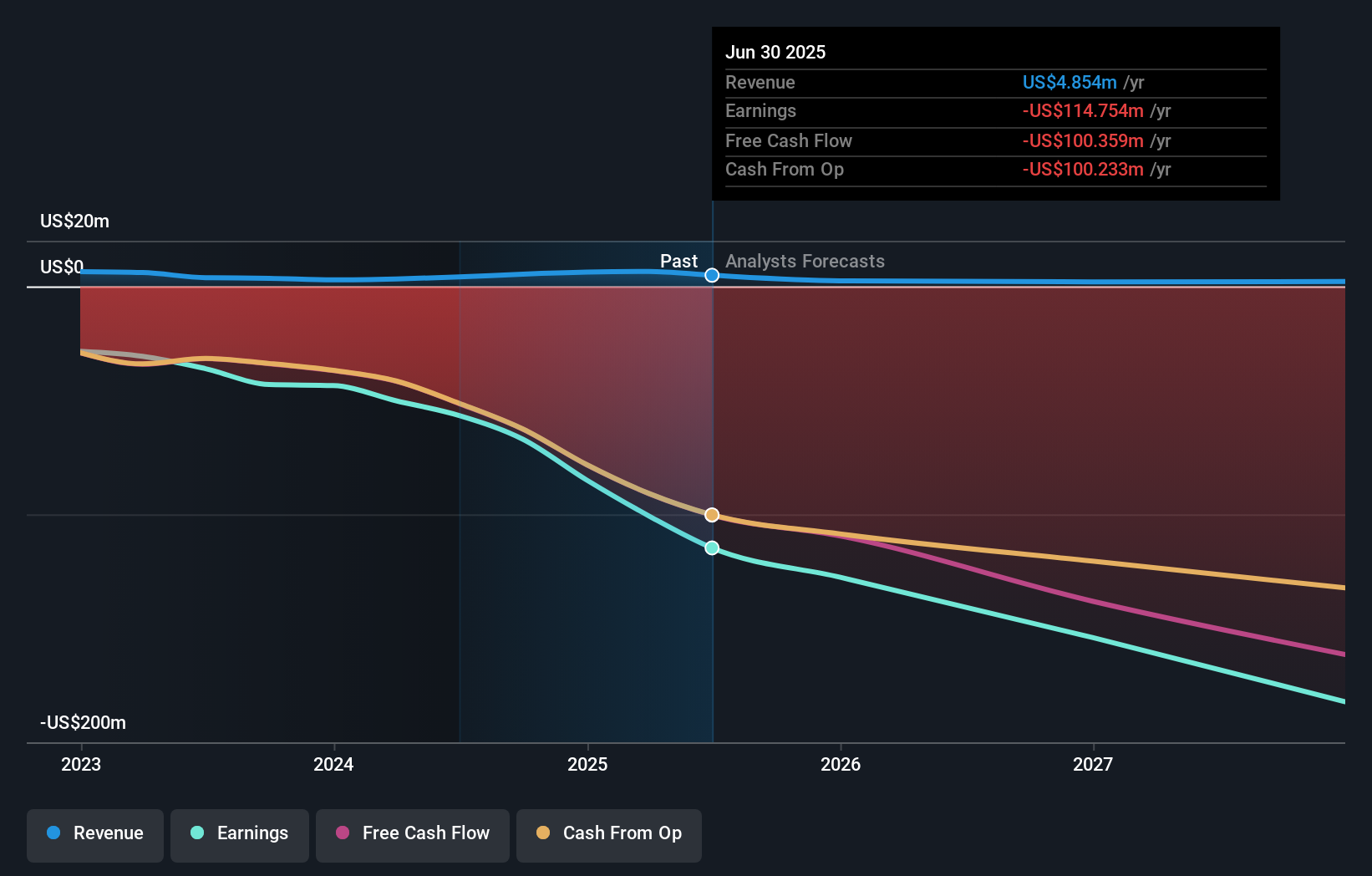

To be a shareholder in Dianthus Therapeutics, you need to believe that the company’s scientific approach, particularly its focus on upstream complement inhibition with claseprubart, will deliver meaningful breakthroughs in rare neuromuscular diseases like generalized Myasthenia Gravis. The latest Phase 2 MaGic trial data, reviewed at major medical meetings, offered tangible clinical improvements and suggested flexible dosing advantages which could impact the perception of pipeline risk and timeline to late-stage studies. While revenue remains negligible and losses have widened, having fresh, data-driven momentum can serve as a key short-term catalyst, supporting the company’s efforts to build confidence among investors and potential partners. However, faced with a lack of profitability forecasts for the next three years, shareholder dilution after sizable recent equity offerings, and challenging valuation metrics compared to peers, execution on commercial and clinical fronts remains the biggest test. The new clinical results may help reduce perceived risk around the lead asset, but do not address the company’s dependence on further capital and trial success.

On the other hand, the risk of further dilution as Dianthus remains unprofitable is something investors should weigh.

Exploring Other Perspectives

Explore another fair value estimate on Dianthus Therapeutics - why the stock might be worth as much as 84% more than the current price!

Build Your Own Dianthus Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dianthus Therapeutics research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Dianthus Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dianthus Therapeutics' overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:DNTH

Dianthus Therapeutics

A clinical-stage biotechnology company, develops complement therapeutics for patients with severe autoimmune and inflammatory diseases.

Flawless balance sheet with low risk.

Market Insights

Community Narratives