Stock Analysis

- United States

- /

- Biotech

- /

- NasdaqGS:BPMC

High Growth Tech Stocks to Watch in November 2024

Reviewed by Simply Wall St

Over the last 7 days, the United States market has dropped 1.6%, but over the longer term, it has risen by 30% in the past year with earnings forecast to grow by 15% annually. In this context, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation and potential for sustained revenue expansion in alignment with these market trends.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.92% | 27.84% | ★★★★★★ |

| TG Therapeutics | 30.63% | 46.00% | ★★★★★★ |

| Sarepta Therapeutics | 23.80% | 44.01% | ★★★★★★ |

| Invivyd | 47.87% | 67.72% | ★★★★★★ |

| Ardelyx | 27.52% | 65.97% | ★★★★★★ |

| Alkami Technology | 21.90% | 101.89% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.21% | 70.72% | ★★★★★★ |

| Travere Therapeutics | 28.78% | 72.86% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 243 stocks from our US High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Appian (NasdaqGM:APPN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Appian Corporation is a software company specializing in low-code design platforms, operating in the United States, Mexico, Portugal, and internationally with a market capitalization of approximately $2.59 billion.

Operations: Appian generates revenue primarily from its software and programming segment, amounting to $578.70 million. The company focuses on providing low-code design platforms across various regions.

Appian, amidst a flurry of executive changes and strategic partnerships, is navigating through a transformative phase with significant investments in innovation. With R&D expenses constituting 10.4% of its revenue, the company underscores its commitment to advancing its low-code automation platform—a move critical in an industry gravitating towards SaaS models for enhanced scalability and customer retention. Despite reporting a net loss of $43.59 million in Q2 2024, Appian's aggressive growth strategy is evident from its expected annual revenue increase by 10.4%, outpacing the US market projection of 8.8%. This approach is further exemplified by their recent collaboration with Outsourcing Technology Co., aimed at reducing workload by approximately 25% through process automation, signaling potential for future profitability and market share expansion.

- Navigate through the intricacies of Appian with our comprehensive health report here.

Evaluate Appian's historical performance by accessing our past performance report.

Blueprint Medicines (NasdaqGS:BPMC)

Simply Wall St Growth Rating: ★★★★★★

Overview: Blueprint Medicines Corporation is a precision therapy company that develops medicines for genomically defined cancers and blood disorders, operating both in the United States and internationally, with a market cap of $5.56 billion.

Operations: Blueprint Medicines generates revenue primarily from its pharmaceuticals segment, amounting to $434.42 million. The company focuses on developing targeted therapies for specific genetic profiles in cancer and blood disorders.

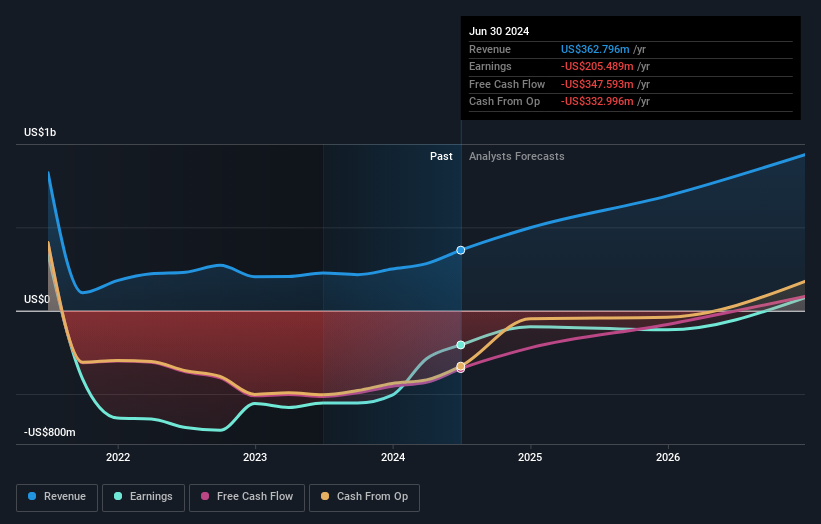

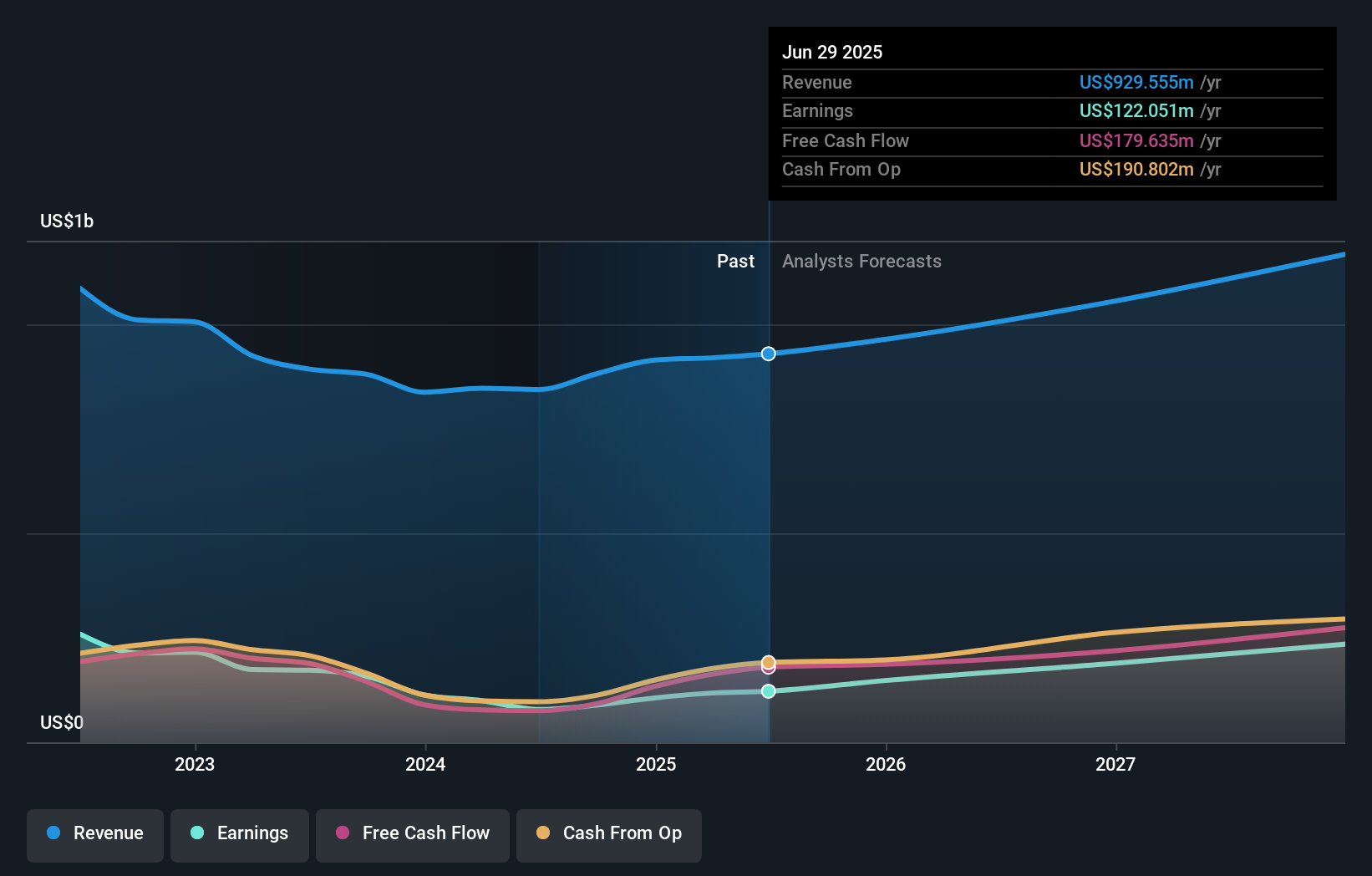

Blueprint Medicines has demonstrated a remarkable revenue surge, reporting a growth from $56.57 million to $128.18 million in Q3 2024, illustrating a robust 71.1% increase year-over-year. This growth trajectory is supported by an aggressive R&D strategy, with expenditures significantly contributing to their innovative pipeline; the company's focus on advancing targeted therapies is evident as they aim for profitability within three years. Despite current unprofitability, BPMC's strategic direction and substantial investment in R&D—aiming for high returns on equity of 48.2%—position it as a potential leader in biotech innovation, especially as its revenue growth outpaces the US market forecast of 8.9%.

- Dive into the specifics of Blueprint Medicines here with our thorough health report.

Explore historical data to track Blueprint Medicines' performance over time in our Past section.

Cognex (NasdaqGS:CGNX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Cognex Corporation specializes in machine vision products designed to capture and analyze visual information, facilitating the automation of manufacturing and distribution processes globally, with a market cap of $6.90 billion.

Operations: The company generates revenue by providing machine vision products that automate tasks in manufacturing and distribution. With a market cap of approximately $6.90 billion, it plays a significant role in enhancing operational efficiency across various industries globally.

Cognex's recent financial performance underscores its resilience and adaptability in the tech sector, with Q3 sales rising to $234.74 million from $197.24 million year-over-year, reflecting a robust growth trajectory. This surge is complemented by a net income increase to $29.59 million, up from $18.92 million in the same period last year, showcasing effective cost management and operational efficiency. The company's commitment to innovation is evident in its R&D investments, aligning with industry trends towards enhanced AI applications as seen in their latest AI-enabled counting tool for quality control across various industries. Despite a challenging market environment marked by a 43.5% earnings contraction over the past year due to external pressures, Cognex's strategic focus on high-quality earnings and significant projected annual profit growth of 31.8% positions it favorably for future scalability and market competitiveness.

- Click here and access our complete health analysis report to understand the dynamics of Cognex.

Gain insights into Cognex's past trends and performance with our Past report.

Turning Ideas Into Actions

- Unlock our comprehensive list of 243 US High Growth Tech and AI Stocks by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blueprint Medicines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BPMC

Blueprint Medicines

A precision therapy company, develops medicines for genomically defined cancers and blood disorders in the United States and internationally.