- United States

- /

- Biotech

- /

- NasdaqGS:BMRN

BioMarin Pharmaceutical (BMRN): Fresh Valuation Insights Following Raised Guidance and Product Momentum

Reviewed by Simply Wall St

BioMarin Pharmaceutical (BMRN) recently delivered its third quarter results, demonstrating ongoing revenue growth led by strong uptake of VOXZOGO and PALYNZIQ. The company also nudged its full-year revenue guidance higher, signaling steady confidence.

See our latest analysis for BioMarin Pharmaceutical.

Despite an encouraging run of product successes, including the FDA’s acceptance of PALYNZIQ for expanded review and a modestly raised revenue forecast, BioMarin’s share price has had a tough stretch. The stock is now trading at $51.46, with a year-to-date share price return of -22.60% and a total shareholder return of -23.27% over the past year. Momentum has faded as investors weigh higher spending and short-term headwinds against long-term pipeline opportunities.

If breakthroughs in rare disease treatments spark your curiosity, you might also want to discover other innovators. Check out See the full list for free. for more healthcare stocks making moves.

After such a challenging year, is BioMarin trading at a steep discount for patient investors? Or are current prices already factoring in the company’s projected growth and pipeline potential?

Most Popular Narrative: 43.2% Undervalued

Compared to its last close price of $51.46, the most widely followed narrative sets BioMarin’s fair value much higher. This reflects optimism in the stock’s recovery potential. The difference between market price and valuation prompts a fresh look at how revenue growth and pipeline developments could shape the next chapter.

Expanding global demand, new therapies, and strategic acquisitions strengthen BioMarin's revenue growth, market reach, and future pipeline potential. Operational efficiency, disciplined cost management, and regulatory advantages support sustained profitability and long-term margin stability.

Want to know what’s fueling this bold estimate? The numbers behind this narrative hinge on aggressive profit gains and margin expansion, with future earnings in the spotlight. Intrigued by what’s driving such a big upside call? Unlock the full narrative for a look at the assumptions that could send BioMarin shares soaring.

Result: Fair Value of $90.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, mounting competition in rare diseases and pricing pressure overseas could undermine BioMarin’s growth outlook. These factors present real challenges to the optimistic thesis.

Find out about the key risks to this BioMarin Pharmaceutical narrative.

Another View: What Do Earnings Ratios Say?

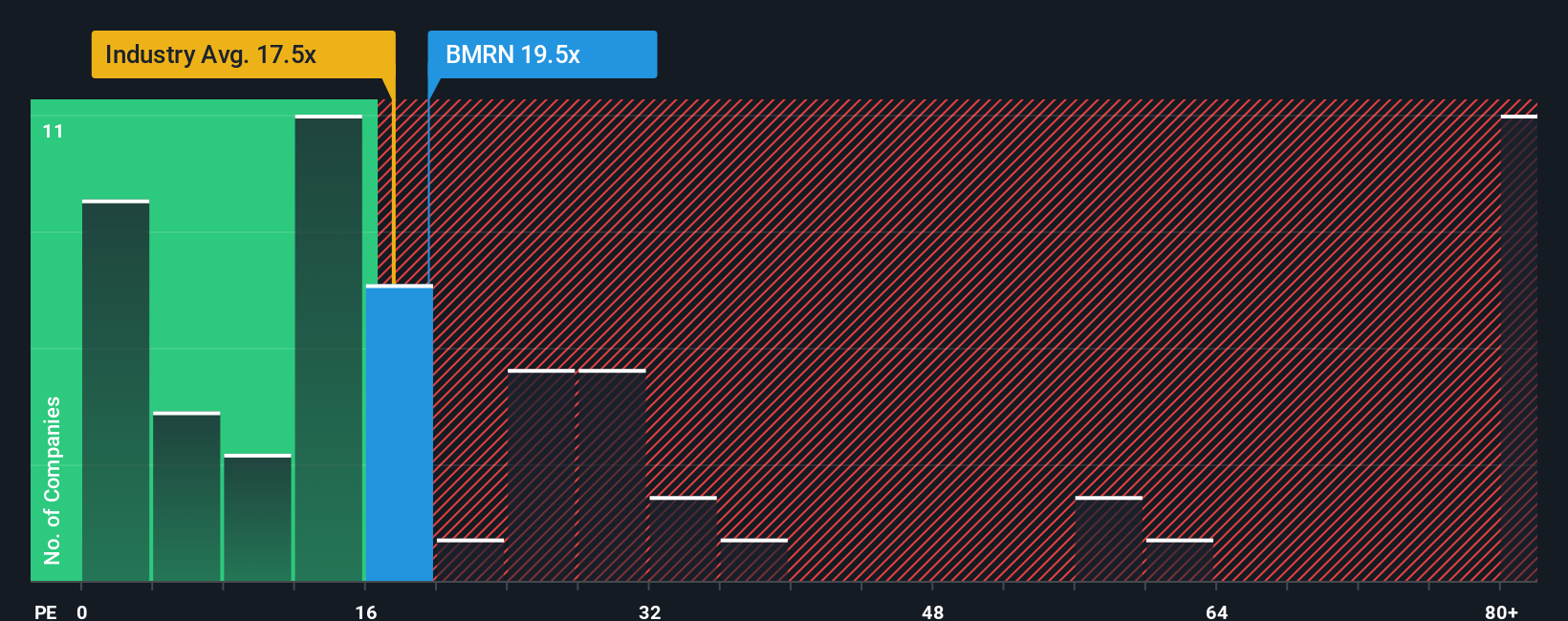

Looking through the lens of earnings multiples, BioMarin trades at a price-to-earnings ratio of 19x. This is higher than the typical US Biotechs company at 16.2x, although still a step below similar peers, who average 20.7x. The market's fair ratio sits at 22.5x. This gap hints at both valuation risk and possible opportunity for investors, but which direction will sentiment go next?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BioMarin Pharmaceutical Narrative

If you’d rather chart your own course or think differently about BioMarin’s outlook, you can explore the data and build your own story in just minutes, then Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding BioMarin Pharmaceutical.

Looking for More Smart Investment Opportunities?

Successful investing means keeping your options open and staying ahead of the latest trends. Don’t let the next opportunity slip by. See where your money could work harder with handpicked ideas below.

- Pocket higher yields and strengthen your portfolio by targeting income with these 16 dividend stocks with yields > 3% offering consistent returns above 3%.

- Ride the unstoppable wave of artificial intelligence by jumping into these 24 AI penny stocks poised to benefit from rapid sector growth and innovation.

- Take advantage of overlooked gems by snapping up these 870 undervalued stocks based on cash flows trading below their fair value, right when opportunities emerge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BioMarin Pharmaceutical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BMRN

BioMarin Pharmaceutical

A biotechnology company, engages in the development and commercialization of therapies for life-threatening rare diseases and medical conditions in the United States, Europe, Latin America, the Middle East, the Asia Pacific, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives