- United States

- /

- Life Sciences

- /

- NasdaqCM:BLFS

BioLife Solutions (BLFS): Examining Valuation as Shares Gain Momentum and Analyst Targets Remain Higher

Reviewed by Simply Wall St

BioLife Solutions (BLFS) shares have delivered a month of positive momentum, climbing nearly 3% and standing out among biotech peers. The stock’s moves come as investors keep a close watch on the company’s fundamentals and sector trends.

See our latest analysis for BioLife Solutions.

Momentum has been fairly steady for BioLife Solutions, with a 19% gain in its share price over the last 90 days. This hints at renewed optimism among investors. The company’s one-year total shareholder return sits modestly above breakeven, while its longer-term performance still trails the market. This suggests recent enthusiasm may reflect changing expectations around growth or risk.

If you're looking for other opportunities while momentum is shifting, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares still sitting below analyst price targets and signs of improving growth, the question facing investors now is whether BioLife Solutions trades at a discount or if the market has already priced in its next move higher.

Most Popular Narrative: 13.7% Undervalued

BioLife Solutions finished at $27.02, while the most-followed narrative pegs fair value near $31.30. This highlights a price gap that is drawing bullish attention. The stage is set as investors weigh whether the company’s future growth and market leadership justify this premium valuation.

Momentum in cell and gene therapy commercialization and R&D, as shown by 28% YoY cell processing revenue growth and BioLife's products embedded in 16 approved therapies and 250+ clinical trials, is driving sustained, recurring demand. This is positioning the company for long-term revenue expansion as advanced therapies move through regulatory approval and adoption cycles.

Want to see why the narrative expects a value jump? The secret is aggressive revenue lift and game-changing margins not usually forecast for this sector. How do these future projections stack up to past results and peer multiples? The underlying math could challenge what you think is possible. Find out what’s fueling the hype.

Result: Fair Value of $31.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, key risks remain, including heavy reliance on a small group of customers and potential margin pressure resulting from ongoing changes in the product mix.

Find out about the key risks to this BioLife Solutions narrative.

Another View: Multiple-Based Valuation Raises Questions

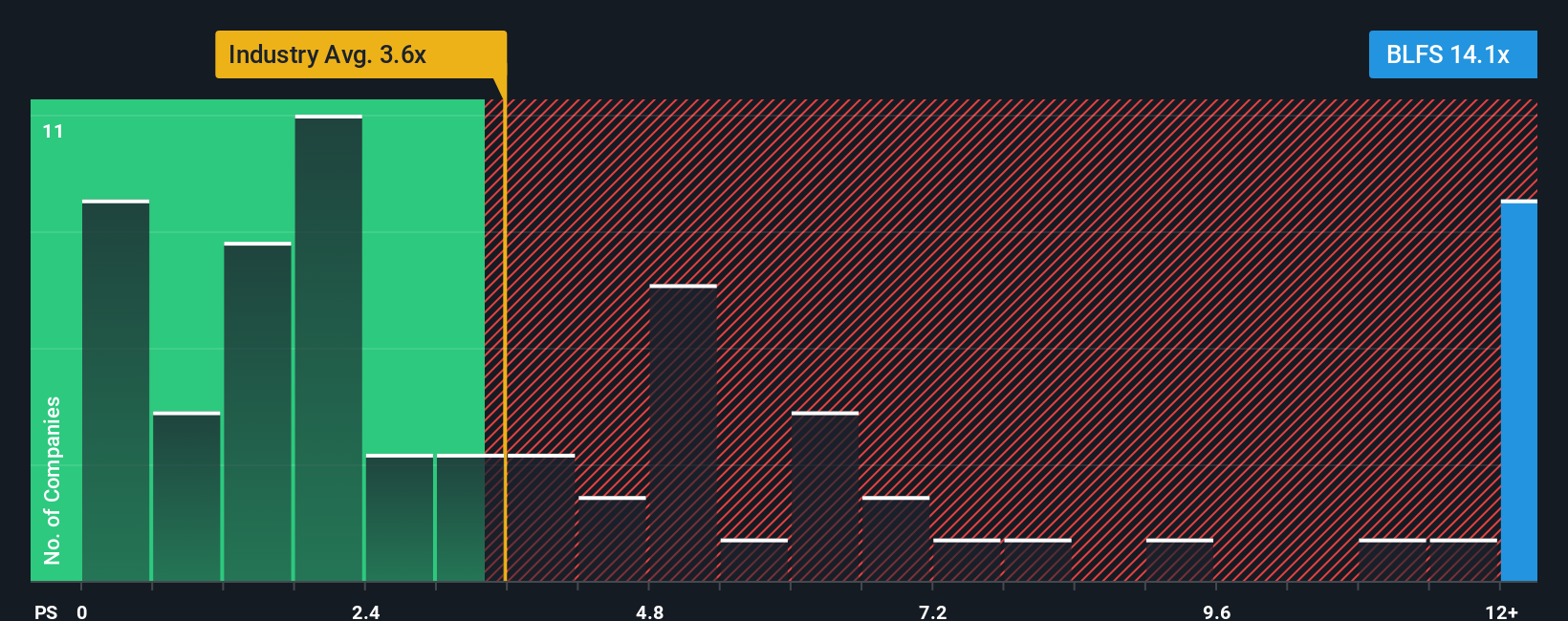

Switching perspectives, BioLife Solutions trades at a hefty price-to-sales ratio of 13.8x. This is much higher than both the US Life Sciences industry average of 3.8x and the peer average of 1.9x, as well as our calculated fair ratio of 5x. Such a gap means investors today are paying a sizeable premium, which could increase downside risk if high growth does not materialize. Is this premium truly justified, or are expectations running ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BioLife Solutions Narrative

If you see the story differently or want to dig deeper into the numbers, shaping your personal narrative is quick and straightforward. Do it your way

A great starting point for your BioLife Solutions research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Give yourself an edge by using the Simply Wall Street Screener to find stocks with unique advantages before the crowd moves in. Here are three strategies to get you started:

- Target strong cash flow and potential with these 860 undervalued stocks based on cash flows as uncovered by our in-depth financial models.

- Capitalize on the latest advances in healthcare by reviewing these 32 healthcare AI stocks, which is shaping tomorrow’s medical landscape.

- Lock in regular income by selecting companies among these 17 dividend stocks with yields > 3% that consistently deliver attractive yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BioLife Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BLFS

BioLife Solutions

Develops, manufactures, and markets bioproduction products and services for the cell and gene therapy (CGT) industry in the United States, Europe, the Middle East, Africa, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives