- United States

- /

- Biotech

- /

- NasdaqGS:BIIB

Is Biogen Worth a Fresh Look After Major Drug Approvals in 2025?

Reviewed by Bailey Pemberton

- Thinking about whether Biogen is a great buy right now? You are not alone if you are wondering whether its current stock price represents real value or just wishful thinking.

- In the last month, Biogen shares have climbed 6.1%. This adds to a modest gain of 3.7% for the year to date, though the stock is still down 10.1% over the past year.

- This recent upward move comes as investors respond to major drug approvals and new partnerships in the pipeline, which suggests renewed optimism. Market sentiment seems to have shifted, especially as regulatory developments and trial results have made headlines for Biogen in recent months.

- According to valuation checks, Biogen scores 5 out of 6 for undervaluation. This puts it ahead of many of its peers. Let us break down the different ways valuation is measured and, later on, introduce a fresh approach that might give even deeper insight into Biogen's true worth.

Find out why Biogen's -10.1% return over the last year is lagging behind its peers.

Approach 1: Biogen Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's dollars. This approach helps investors determine whether a stock is currently undervalued or overvalued based on its expected long-term financial performance.

For Biogen, the DCF valuation is based on a 2 Stage Free Cash Flow to Equity model. The company currently generates Free Cash Flow of $2.18 billion. Analyst projections suggest Free Cash Flow will rise to $2.55 billion by the end of 2029. While analysts only provide reliable estimates for the next five years, further cash flows up to 2035 are carefully extrapolated by Simply Wall St using established trends and sector expectations.

According to this analysis, Biogen's estimated intrinsic value is $315.04 per share. This valuation indicates the stock is trading at a 50.6% discount compared to its calculated fair value, which may suggest the shares are undervalued today.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Biogen is undervalued by 50.6%. Track this in your watchlist or portfolio, or discover 876 more undervalued stocks based on cash flows.

Approach 2: Biogen Price vs Earnings

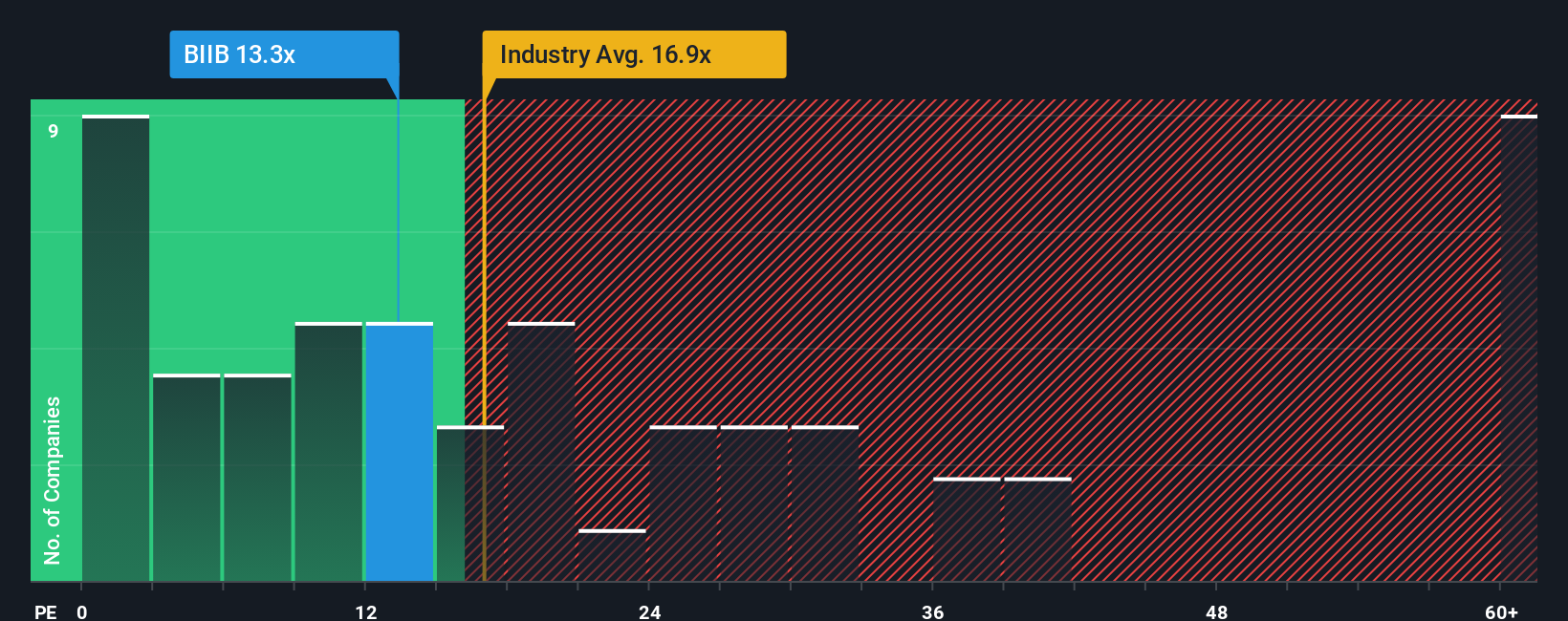

For profitable companies like Biogen, the Price-to-Earnings (PE) ratio is a key valuation tool. It allows investors to gauge how much the market is willing to pay for each dollar of the company's current earnings. Typically, the PE ratio works best when a business is consistently generating profit, as it closely reflects how investors view profitability and prospects.

It's important to remember that a reasonable PE ratio depends on factors like future earnings growth and business risks. Fast-growing or lower-risk companies tend to justify a higher PE, while slower growth or higher risks might pull it down.

At present, Biogen’s PE stands at 14.18x. This is well below the average for similar biotech companies, with peers at 21.10x and the broader industry trading at an average of 17.00x. On the surface, this could suggest that Biogen’s stock is undervalued relative to its competitors.

To get a more accurate sense of value, Simply Wall St calculates a proprietary “Fair Ratio.” This factors in the company’s unique earnings growth, profit margins, market cap, and industry risks, going much deeper than simple peer or industry comparisons. Biogen’s Fair Ratio calculates to 21.55x, meaning based on its characteristics, this is the multiple you would expect its shares to command.

Since Biogen’s current PE is well below both its Fair Ratio and industry average, Simply Wall St’s model suggests the stock is undervalued at today’s price.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1404 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Biogen Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your own story or belief about a company. You connect the dots on where you think Biogen is headed, then tie those insights to your expected future revenues, earnings, and profit margins, arriving at your fair value for the stock.

Think of Narratives as a bridge between the numbers and your real-world perspective. It empowers you to plainly lay out why the company may win or lose and reflect those reasons in your own earnings forecasts, then instantly see how they impact fair value. This tool, offered right inside the Simply Wall St Community page and used by millions of investors, makes it easy to share and compare your outlooks with others.

With Narratives, you can act decisively. You will see whether your personal fair value signals that Biogen is a buy, hold, or sell by comparing it directly with today's stock price. They automatically update whenever important news or earnings are released, ensuring your view stays relevant.

For example, one investor might craft a bullish Biogen narrative by projecting earnings could hit $3.1 billion and set a fair value at $260, while a more cautious investor sees just $1.6 billion in earnings and values the stock at $128.

Do you think there's more to the story for Biogen? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Biogen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BIIB

Biogen

Biogen Inc. discovers, develops, manufactures, and delivers therapies for treating neurological and neurodegenerative diseases in the United States, Europe, Germany, Asia, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives