- United States

- /

- Biotech

- /

- NasdaqGS:BEAM

Beam Therapeutics (BEAM): Evaluating Valuation as Clinical Progress Drives Renewed Investor Focus

Reviewed by Simply Wall St

Beam Therapeutics (BEAM) is drawing investor attention after delivering updates on multiple clinical-stage programs for genetic diseases. Recent focus centers on BEAM-302 for alpha-1 antitrypsin deficiency and the upcoming BEACON trial data release.

See our latest analysis for Beam Therapeutics.

Shares of Beam Therapeutics have swung sharply in recent weeks, with a 30-day share price return of -17.74%, offset by a strong 90-day rally of 26.05%. This hints at shifting investor sentiment around its clinical milestones and hefty R&D spending. Despite momentum from ongoing trials and regulatory wins, longer-term total shareholder returns remain deeply negative at -17.92% over one year and -56.39% over three years. This highlights a challenging journey for long-term holders as the company balances innovation with financial sustainability.

If breakthrough advances in genetic medicine interest you, it might be the perfect moment to explore the healthcare space and see the full list of opportunities in See the full list for free..

With shares still trading well below analyst price targets despite clinical traction, investors must weigh if the current valuation discounts Beam Therapeutics' risk and potential, or if the market is already factoring in future breakthroughs and growth.

Most Popular Narrative: 65.8% Undervalued

Beam Therapeutics' last close at $22.21 stands in stark contrast to the fair value of $65 derived from the most widely tracked narrative by davidlsander. This suggests that the company’s innovative gene editing platform is viewed as having far more upside than the market currently reflects, sparking debate around what could unlock this value.

This sum-of-the-parts rNPV analysis of only the two lead assets (BEAM-101 and BEAM-302) derives a base-case intrinsic value of $65 per share. This valuation is based on the following key assumptions from the report:

The reasoning behind this ambitious price target is not just optimism about pipeline breakthroughs. The narrative is driven by strong revenue growth prospects and a potential profit profile that could disrupt industry norms. Interested in which program and platform might influence the outcome? The full narrative details the calculations and strategic assumptions underlying this valuation.

Result: Fair Value of $65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks in clinical trials or delays in regulatory approvals could undermine the bullish case and quickly shift sentiment in the opposite direction.

Find out about the key risks to this Beam Therapeutics narrative.

Another View: What Do Price Multiples Say?

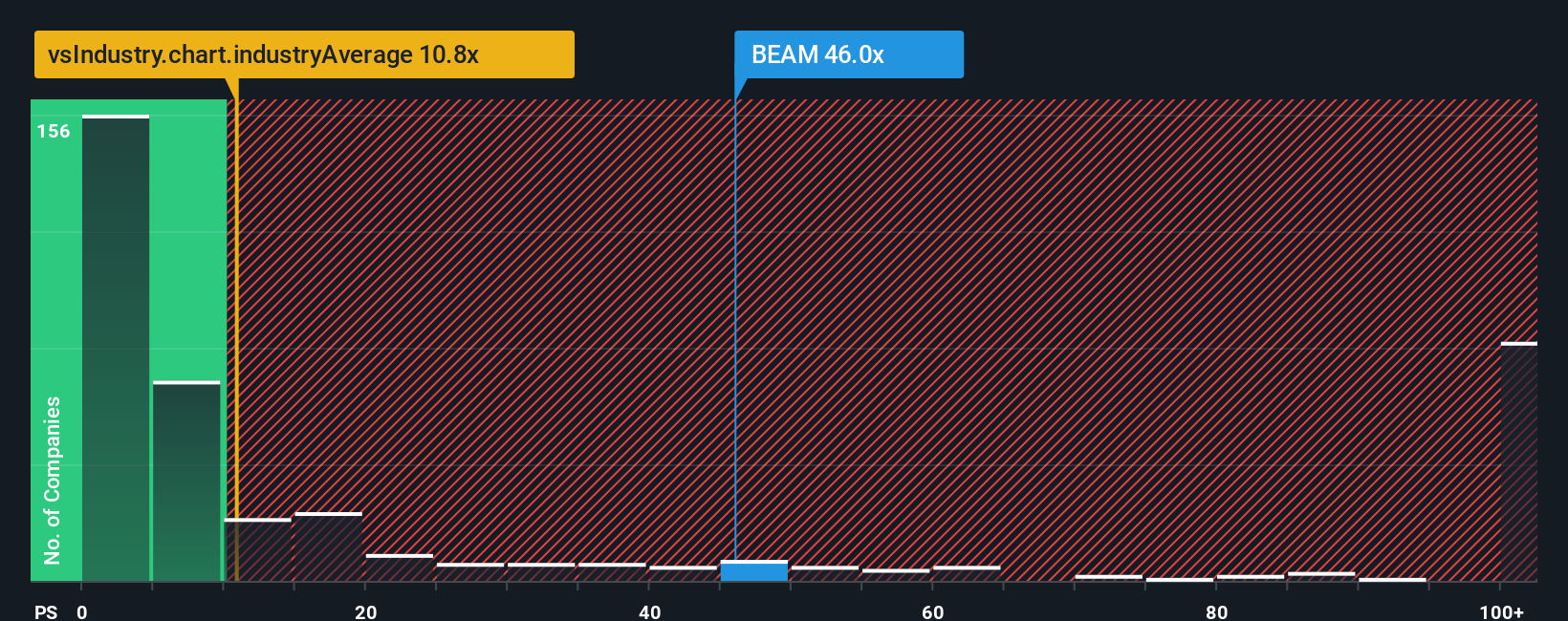

While the sum-of-the-parts approach paints Beam Therapeutics as deeply undervalued, examining the company's sales ratio tells a much less forgiving story. At 39.4 times sales, this figure is far higher than both the industry average of 10.7 and the peer group average of 23.2. Even compared to its fair ratio, the premium is stark. This raises a tough question: is the excitement about Beam’s future already built into today’s price, or is the market still missing the bigger picture?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Beam Therapeutics Narrative

If you see things differently or want to dig deeper into the data, you can craft your own narrative in just a few minutes: Do it your way.

A great starting point for your Beam Therapeutics research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Expand your horizons in seconds and position yourself for tomorrow's biggest gains using Simply Wall Street's handpicked investment screens. Uncover trends before the crowd catches on and take the next step toward a portfolio you can be proud of.

- Tap into exponential growth with these 24 AI penny stocks as artificial intelligence transforms business and accelerates market opportunities.

- Pursue powerful passive income streams by checking out these 16 dividend stocks with yields > 3% and see which companies deliver robust yields above 3%.

- Ride the seismic shifts in digital finance by getting ahead with these 82 cryptocurrency and blockchain stocks, featuring stocks at the forefront of blockchain innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beam Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BEAM

Beam Therapeutics

A biotechnology company, engages in the development of precision genetic medicines for patients suffering from serious diseases in the United States.

Flawless balance sheet with low risk.

Market Insights

Community Narratives