- United States

- /

- Biotech

- /

- NasdaqGS:BCRX

Is BioCryst’s Surging ORLADEYO Sales and Astria Deal Reshaping the Investment Case for BCRX?

Reviewed by Sasha Jovanovic

- In early November 2025, BioCryst Pharmaceuticals reported substantial year-over-year growth for its HAE therapy ORLADEYO, unveiled positive new clinical data for pediatric patients, raised its full-year revenue guidance to between US$590 million and US$600 million, and announced the acquisition of Astria Therapeutics while confirming the sale of its European operations.

- These developments highlight BioCryst’s focused strategy of expanding its rare disease pipeline, strengthening financial flexibility, and reinforcing its presence in hereditary angioedema through both organic and inorganic growth initiatives.

- Next, we'll explore how BioCryst’s raised sales outlook and Astria acquisition reshape the company’s investment narrative and growth outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

BioCryst Pharmaceuticals Investment Narrative Recap

To be a shareholder in BioCryst Pharmaceuticals, you need to believe in the company’s ability to deliver consistent growth from its rare disease therapy ORLADEYO while expanding its portfolio through new indications and strategic acquisitions. The recent announcement of strong clinical data and a raised full-year revenue outlook reinforces optimism over the FDA’s upcoming decision on the pediatric ORLADEYO granule application, which remains the most important near-term catalyst. The main risk continues to be dependence on ORLADEYO, but there is no material change to this risk following the latest news.

Among the recent developments, the Q3 2025 earnings report stands out: BioCryst reported a sharp improvement, swinging to a net income of US$12.9 million from a loss a year earlier and raising sales guidance for ORLADEYO to between US$590 million and US$600 million. This upward revision signals strong momentum heading into the upcoming FDA review, an event closely linked to the company's sales outlook and future product mix.

However, investors should be aware that competitive pressures in the hereditary angioedema therapy market could...

Read the full narrative on BioCryst Pharmaceuticals (it's free!)

BioCryst Pharmaceuticals' narrative projects $777.6 million revenue and $212.3 million earnings by 2028. This requires 11.7% yearly revenue growth and a $248 million earnings increase from the current earnings of -$35.7 million.

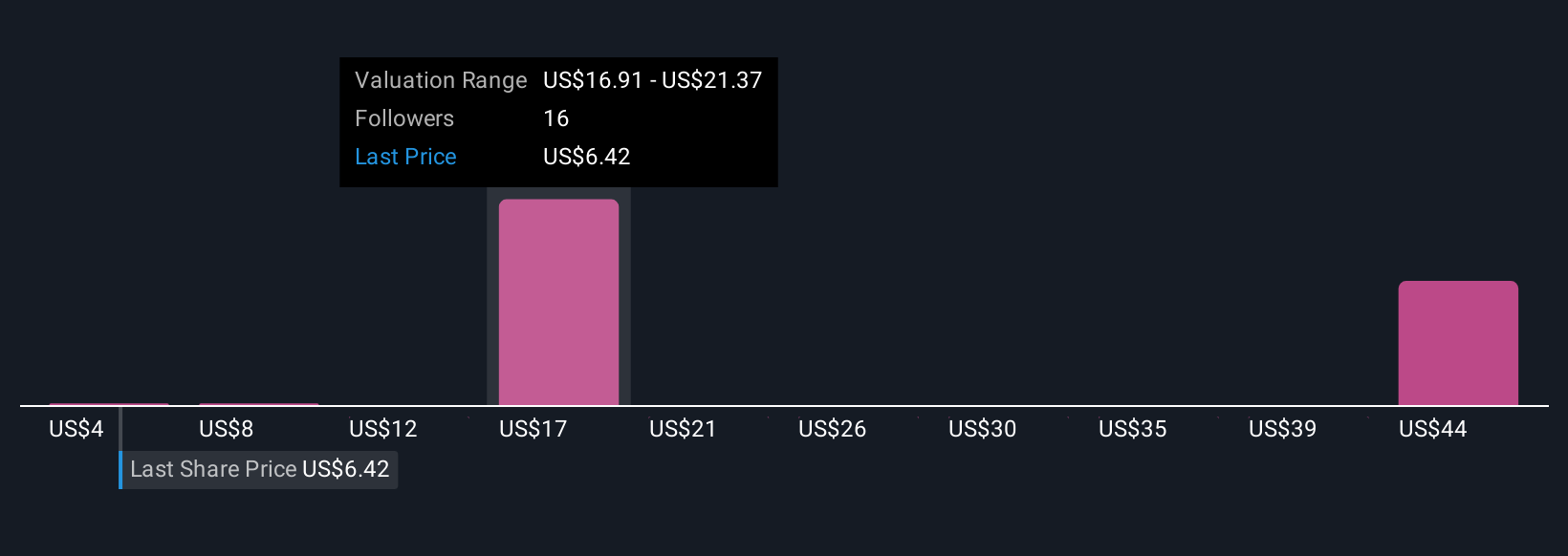

Uncover how BioCryst Pharmaceuticals' forecasts yield a $20.27 fair value, a 186% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community’s fair value estimates for BioCryst Pharmaceuticals range from US$3.53 to US$69.29 across four perspectives. While revenue growth for ORLADEYO is a key focus, differing opinions highlight the importance of assessing how single-product risk might affect the company’s outlook.

Explore 4 other fair value estimates on BioCryst Pharmaceuticals - why the stock might be worth over 9x more than the current price!

Build Your Own BioCryst Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BioCryst Pharmaceuticals research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free BioCryst Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BioCryst Pharmaceuticals' overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BioCryst Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BCRX

BioCryst Pharmaceuticals

A biotechnology company, develops oral small-molecule and injectable protein therapeutics to treat rare diseases.

Undervalued with high growth potential.

Market Insights

Community Narratives