- United States

- /

- Biotech

- /

- NasdaqGS:BBIO

BridgeBio Pharma (NASDAQ:BBIO) investors are sitting on a loss of 53% if they invested three years ago

If you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. But the last three years have been particularly tough on longer term BridgeBio Pharma, Inc. (NASDAQ:BBIO) shareholders. Regrettably, they have had to cope with a 53% drop in the share price over that period.

So let's have a look and see if the longer term performance of the company has been in line with the underlying business' progress.

View our latest analysis for BridgeBio Pharma

BridgeBio Pharma wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over three years, BridgeBio Pharma grew revenue at 21% per year. That is faster than most pre-profit companies. The share price has moved in quite the opposite direction, down 15% over that time, a bad result. It seems likely that the market is worried about the continual losses. When we see revenue growth, paired with a falling share price, we can't help wonder if there is an opportunity for those who are willing to dig deeper.

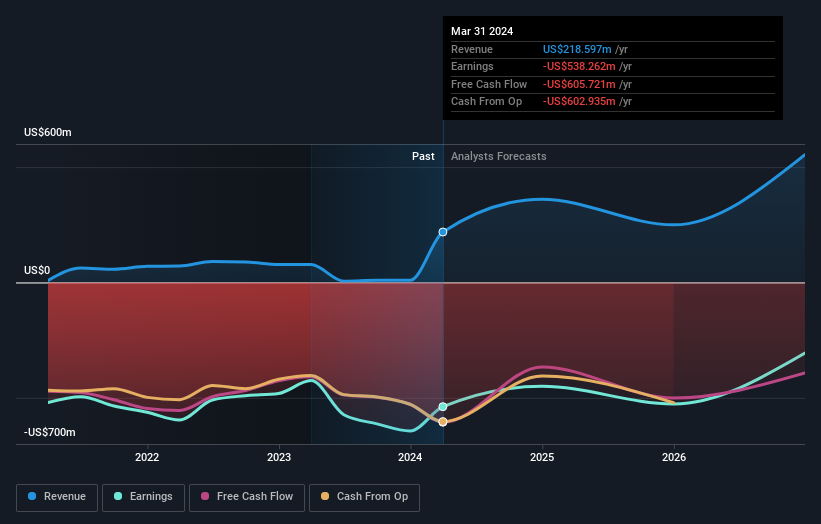

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

BridgeBio Pharma is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

While the broader market gained around 21% in the last year, BridgeBio Pharma shareholders lost 18%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 2% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand BridgeBio Pharma better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with BridgeBio Pharma (at least 1 which is a bit unpleasant) , and understanding them should be part of your investment process.

Of course BridgeBio Pharma may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if BridgeBio Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BBIO

BridgeBio Pharma

A commercial-stage biopharmaceutical company, discovers, creates, tests, and delivers transformative medicines to treat patients who suffer from genetic diseases and cancers.

Slight and slightly overvalued.