- United States

- /

- Biotech

- /

- NasdaqGS:BBIO

BridgeBio Pharma (BBIO): Assessing Valuation After Recent Share Price Surge

Reviewed by Simply Wall St

BridgeBio Pharma (BBIO) has drawn renewed interest following a steady upward trend in its stock price. Over the past month, the company’s shares have advanced 13%. This increase has caught the attention of investors considering its long-term trajectory.

See our latest analysis for BridgeBio Pharma.

It has been a breakout year for BridgeBio Pharma, as momentum has built steadily from recent clinical updates and investor enthusiasm for biotech. With the share price up over 120% year-to-date and a remarkable 140% total shareholder return in the past twelve months, the stock’s rapid climb reflects changing perceptions around growth potential and risk. Long-term holders have been especially rewarded, with a total return of nearly 485% over three years.

If BridgeBio’s impressive run inspires you to look further, consider expanding your watchlist with other healthcare innovators by exploring See the full list for free.

With such a dramatic rise in share price, the key debate is whether BridgeBio Pharma remains undervalued or if recent gains have already accounted for future growth prospects. This has left investors to question if there is still a buying opportunity.

Most Popular Narrative: 24.4% Undervalued

The market is currently pricing BridgeBio Pharma at $62.81, while the most-followed narrative sets a fair value at $83.11. This suggests a significant upside if projections hold. The consensus centers on strong future growth drivers that could support the higher valuation target.

The company's late-stage pipeline, with three Phase III readouts imminent across high unmet need rare disease indications, positions BridgeBio to leverage advancements in biotechnology for potential first-to-market and best-in-class therapies. This creates the opportunity for multiple revenue inflection points and margin improvement as the portfolio diversifies.

Curious how ambitious revenue targets and a pivot to profitability shape this compelling price target? The most popular narrative forecasts major gains from new drug launches, bold margin expansion, and a valuation multiple fit for market leaders. Want to see the specific growth rates and profit margins that drive this outlook? Unlock the details that could change your perspective on where BBIO goes next.

Result: Fair Value of $83.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, BridgeBio’s reliance on a single revenue source and upcoming trial results still present risks that could affect investor optimism.

Find out about the key risks to this BridgeBio Pharma narrative.

Another View: Multiples Tell a Different Story

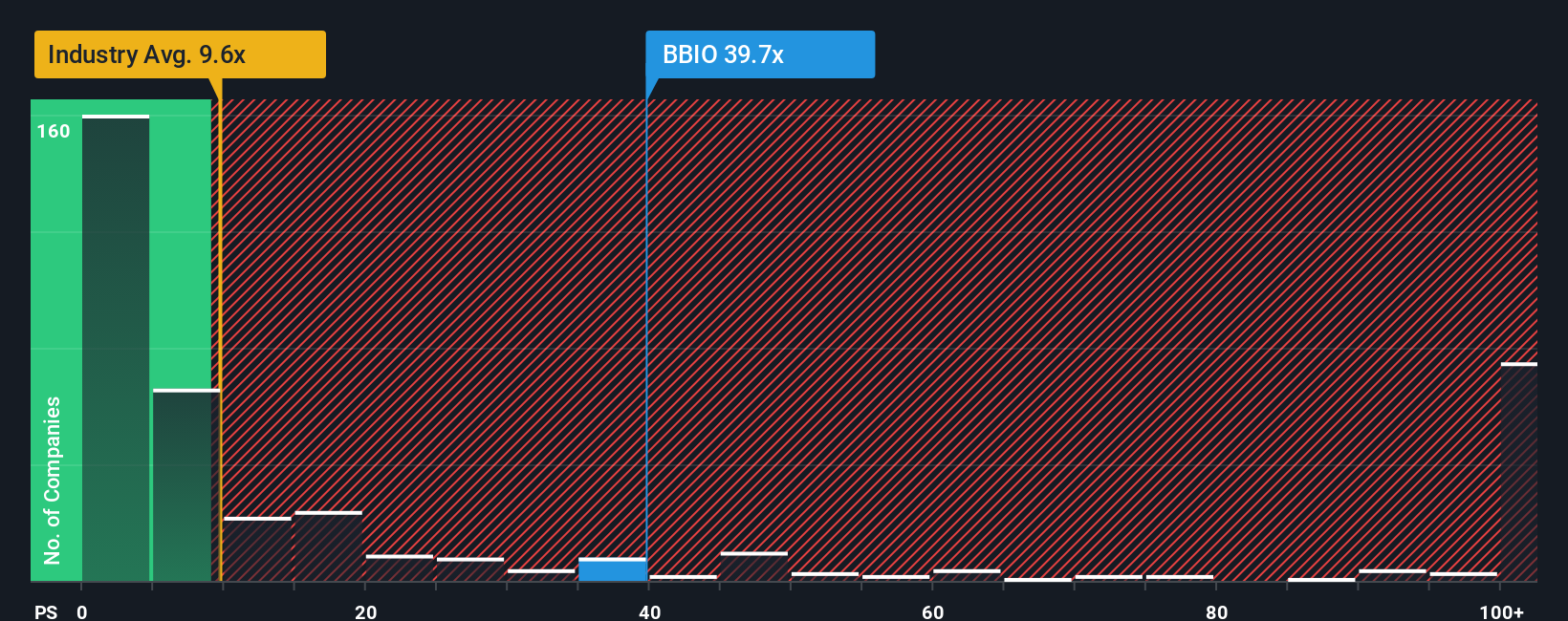

Looking through the lens of industry ratios, BridgeBio Pharma’s price-to-sales ratio stands at 34.2x. This is over three times the US biotech industry average of 10.8x and also sits above peer averages at 22.7x. Even when compared to its fair ratio of 24.4x, the stock appears expensive, raising questions about the potential for future pullbacks. Does this strong premium signal a risk investors should weigh more carefully?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BridgeBio Pharma Narrative

If you see the story differently or want your own take, you can check the numbers and put together your own narrative in just a few minutes with Do it your way.

A great starting point for your BridgeBio Pharma research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always stay one step ahead. Don’t limit yourself to just one opportunity. Expand your horizons and see what other compelling stocks are out there.

- Benefit from stable income opportunities and start building wealth with these 16 dividend stocks with yields > 3%, offering yields above 3% for steady cash flow.

- Tap into the powerhouse of artificial intelligence by checking out these 24 AI penny stocks to spot companies making waves in tech innovation.

- Access groundbreaking advances in medical technology with these 32 healthcare AI stocks and find firms transforming healthcare through machine learning and data-driven solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BridgeBio Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BBIO

BridgeBio Pharma

A commercial-stage biopharmaceutical company, discovers, creates, tests, and delivers transformative medicines to treat patients who suffer from genetic diseases and cancers.

High growth potential and slightly overvalued.

Market Insights

Community Narratives