- United States

- /

- Life Sciences

- /

- NasdaqGS:AZTA

Shareholders Should Be Pleased With Azenta, Inc.'s (NASDAQ:AZTA) Price

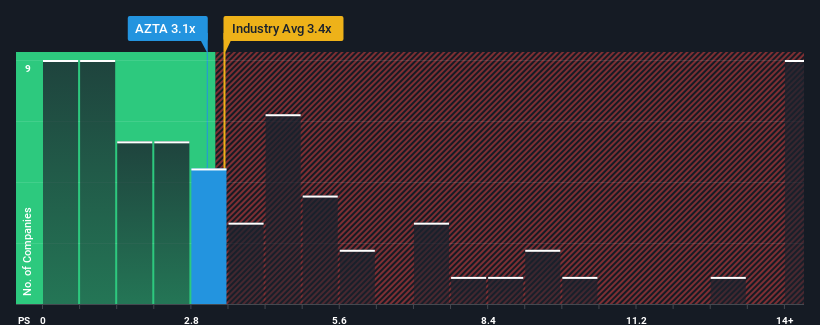

It's not a stretch to say that Azenta, Inc.'s (NASDAQ:AZTA) price-to-sales (or "P/S") ratio of 3.1x right now seems quite "middle-of-the-road" for companies in the Life Sciences industry in the United States, where the median P/S ratio is around 3.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Azenta

How Has Azenta Performed Recently?

While the industry has experienced revenue growth lately, Azenta's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think Azenta's future stacks up against the industry? In that case, our free report is a great place to start.How Is Azenta's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Azenta's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 1.3%. Regardless, revenue has managed to lift by a handy 28% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to climb by 7.3% each year during the coming three years according to the six analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 7.2% per annum, which is not materially different.

With this information, we can see why Azenta is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A Azenta's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Life Sciences industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Azenta with six simple checks will allow you to discover any risks that could be an issue.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:AZTA

Azenta

Provides biological and chemical compound sample exploration and management solutions for the life sciences market in the United States, Africa, China, the United Kingdom, rest of Europe, the Asia Pacific, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives