- United States

- /

- Pharma

- /

- NasdaqGM:ANIP

Assessing ANI Pharmaceuticals (ANIP) Valuation After Strong Share Price Performance

Reviewed by Simply Wall St

See our latest analysis for ANI Pharmaceuticals.

It is not just the recent month that has been strong for ANI Pharmaceuticals. The company’s 63% share price return year-to-date and three-year total shareholder return of 140% indicate that longer-term momentum is firmly in place, driven by renewed optimism around its growth outlook and possibly improving risk sentiment in the sector.

If you’re scanning the healthcare space for opportunities with similar momentum, broaden your search and discover See the full list for free.

Yet with such performance already in the rear-view mirror, the question now is whether ANI Pharmaceuticals’ current valuation leaves room for further gains or if the market has already factored in future growth prospects.

Most Popular Narrative: 13.9% Undervalued

Compared to the recent closing price of $90.43, the narrative’s calculated fair value of $105 points to more potential upside. The following quote highlights a major revenue driver underpinning this view.

There is significant, untapped growth potential for Cortrophin Gel across core and emerging indications (neurology, nephrology, rheumatology, pulmonology, ophthalmology, and gout), with patient populations far below prior peaks and epidemiological data suggesting the addressable market could be several times larger due to an aging population and the rising prevalence of chronic diseases, supporting multiyear revenue expansion.

Curious about the story behind that bold fair value? The outlook hinges on a fresh wave of revenue momentum, surging net margins, and ambitious future earnings benchmarks. The full narrative reveals powerful financial assumptions that most investors haven’t spotted yet. Do you see the opportunity that others might miss?

Result: Fair Value of $105 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressures from rising costs or increased payer pushback on ACTH pricing could quickly dampen the bullish momentum surrounding ANI Pharmaceuticals.

Find out about the key risks to this ANI Pharmaceuticals narrative.

Another View: Multiples Tell a Harsher Story

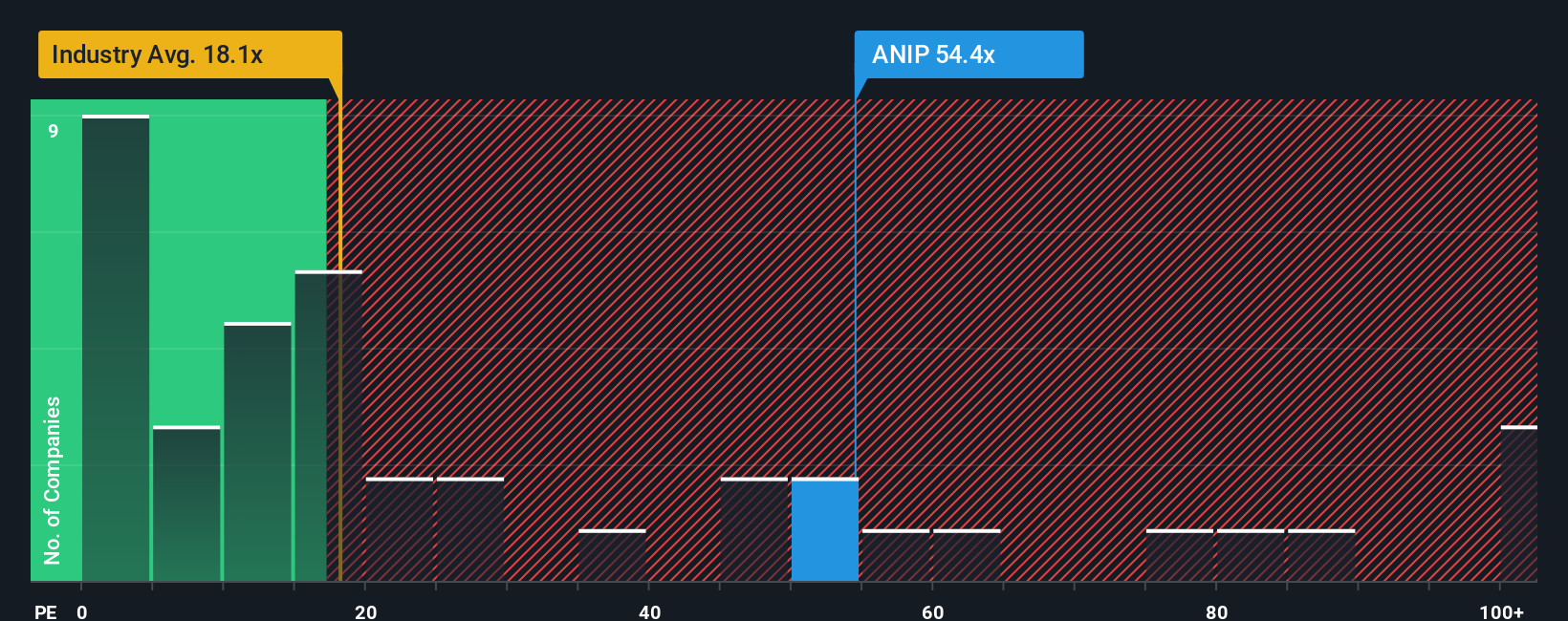

Looking from another angle, ANI Pharmaceuticals is trading at a price-to-earnings ratio of 55.4x, which is well above both the US Pharmaceuticals industry average of 17.9x and the peer average of 15.3x. This is also much higher than its fair ratio of 21.5x. Such a wide gap may point to substantial risks if earnings growth does not keep pace. Could the momentum be overdone, or is there more upside ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ANI Pharmaceuticals Narrative

If you have a different perspective or want to see how your own analysis stacks up, you can build your own insight in just a few minutes with Do it your way.

A great starting point for your ANI Pharmaceuticals research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Moves?

Don’t limit your portfolio to a single winner. Expand your horizons with top opportunities other investors are tracking right now on Simply Wall Street.

- Secure reliable income streams by considering these 16 dividend stocks with yields > 3% that consistently offer yields above 3% for steady cash flow.

- Capitalize on the AI revolution by exploring market leaders through these 25 AI penny stocks positioned at the forefront of artificial intelligence breakthroughs.

- Seize the moment by evaluating these 876 undervalued stocks based on cash flows that may be trading below intrinsic value and primed for upward movement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ANIP

ANI Pharmaceuticals

A biopharmaceutical company, develops, manufactures, and markets branded and generic pharmaceutical products in the United States and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives