- United States

- /

- Biotech

- /

- NasdaqGS:AGIO

Agios Pharmaceuticals, Inc. (NASDAQ:AGIO) Analysts Just Trimmed Their Revenue Forecasts By 46%

The latest analyst coverage could presage a bad day for Agios Pharmaceuticals, Inc. (NASDAQ:AGIO), with the analysts making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. There was a fairly draconian cut to their revenue estimates, perhaps an implicit admission that previous forecasts were much too optimistic. Shares are up 6.8% to US$33.83 in the past week. It will be interesting to see if this downgrade motivates investors to start selling their holdings.

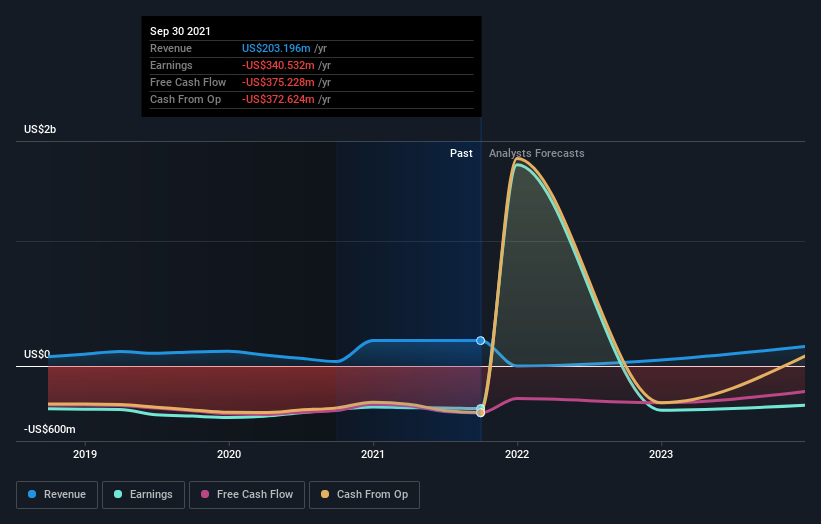

Following the latest downgrade, the current consensus, from the eleven analysts covering Agios Pharmaceuticals, is for revenues of US$26m in 2022, which would reflect a substantial 87% reduction in Agios Pharmaceuticals' sales over the past 12 months. The loss per share is expected to ameliorate slightly, reducing to US$6.08. Yet prior to the latest estimates, the analysts had been forecasting revenues of US$49m and losses of US$5.86 per share in 2022. So there's been quite a change-up of views after the recent consensus updates, with the analysts making a serious cut to their revenue forecasts while also expecting losses per share to increase.

See our latest analysis for Agios Pharmaceuticals

The consensus price target fell 11% to US$53.00, implicitly signalling that lower earnings per share are a leading indicator for Agios Pharmaceuticals' valuation. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. Currently, the most bullish analyst values Agios Pharmaceuticals at US$68.00 per share, while the most bearish prices it at US$37.00. There are definitely some different views on the stock, but the range of estimates is not wide enough as to imply that the situation is unforecastable, in our view.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. We would highlight that sales are expected to reverse, with a forecast 81% annualised revenue decline to the end of 2022. That is a notable change from historical growth of 29% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 16% annually for the foreseeable future. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Agios Pharmaceuticals is expected to lag the wider industry.

The Bottom Line

The most important thing to note from this downgrade is that the consensus increased its forecast losses next year, suggesting all may not be well at Agios Pharmaceuticals. Unfortunately analysts also downgraded their revenue estimates, and industry data suggests that Agios Pharmaceuticals' revenues are expected to grow slower than the wider market. The consensus price target fell measurably, with analysts seemingly not reassured by recent business developments, leading to a lower estimate of Agios Pharmaceuticals' future valuation. Often, one downgrade can set off a daisy-chain of cuts, especially if an industry is in decline. So we wouldn't be surprised if the market became a lot more cautious on Agios Pharmaceuticals after today.

Still, the long-term prospects of the business are much more relevant than next year's earnings. We have estimates - from multiple Agios Pharmaceuticals analysts - going out to 2023, and you can see them free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:AGIO

Agios Pharmaceuticals

A biopharmaceutical company, discovers and develops medicines in the field of cellular metabolism in the United States.

Flawless balance sheet and undervalued.