- United States

- /

- Life Sciences

- /

- NasdaqGS:ADPT

Adaptive Biotechnologies (ADPT): Assessing Valuation After Strong Q3 Growth and Upgraded MRD Outlook

Reviewed by Simply Wall St

Adaptive Biotechnologies (ADPT) delivered strong third quarter earnings, more than doubling revenue compared to last year and returning to profitability. The company also raised its full-year MRD revenue guidance, signaling growing momentum.

See our latest analysis for Adaptive Biotechnologies.

Adaptive Biotechnologies’ comeback is showing up in the share price, too. After a choppy few months, the stock is up an impressive 138.9% year-to-date, and its 154.1% total shareholder return over the past year highlights renewed confidence in the company’s growth path. While there was a sharp pullback this week, strong quarterly results and raised guidance suggest that momentum may not be fading just yet.

If you’re interested in other innovators pushing boundaries in this space, take a look at opportunities in the market using our See the full list for free..

With shares soaring, improved guidance, and a recent return to profitability, the big question is whether Adaptive Biotechnologies is still undervalued or if the recent rally means future growth is already priced in.

Most Popular Narrative: 13.7% Undervalued

With a fair value estimate of $17.14 per share, the most popular narrative sees Adaptive Biotechnologies trading below where it could be valued based on its future growth. This gap versus the last close at $14.79 spotlights earnings expectations and underlying optimism, setting the backdrop for a closer look at what shapes this view.

Marked improvement in profitability, with the MRD segment now EBITDA positive and company-wide cash burn improving 36% year-over-year, signals the business reaching scale and positions Adaptive for operating leverage and expanding net margins as revenue continues to rise.

Curious what blend of growth and margin projections support this bullish stance? One crucial assumption flips recent losses into sustainable profits, playing with valuation multiples that are the envy of its peers. Want to crack the model that justifies this price target? The full narrative lays bare the underlying logic and the numbers you need to know.

Result: Fair Value of $17.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued operating losses and overreliance on a few key partnerships remain significant risks. These factors could challenge Adaptive Biotechnologies’ bullish narrative.

Find out about the key risks to this Adaptive Biotechnologies narrative.

Another View: The Multiple Tells a Different Story

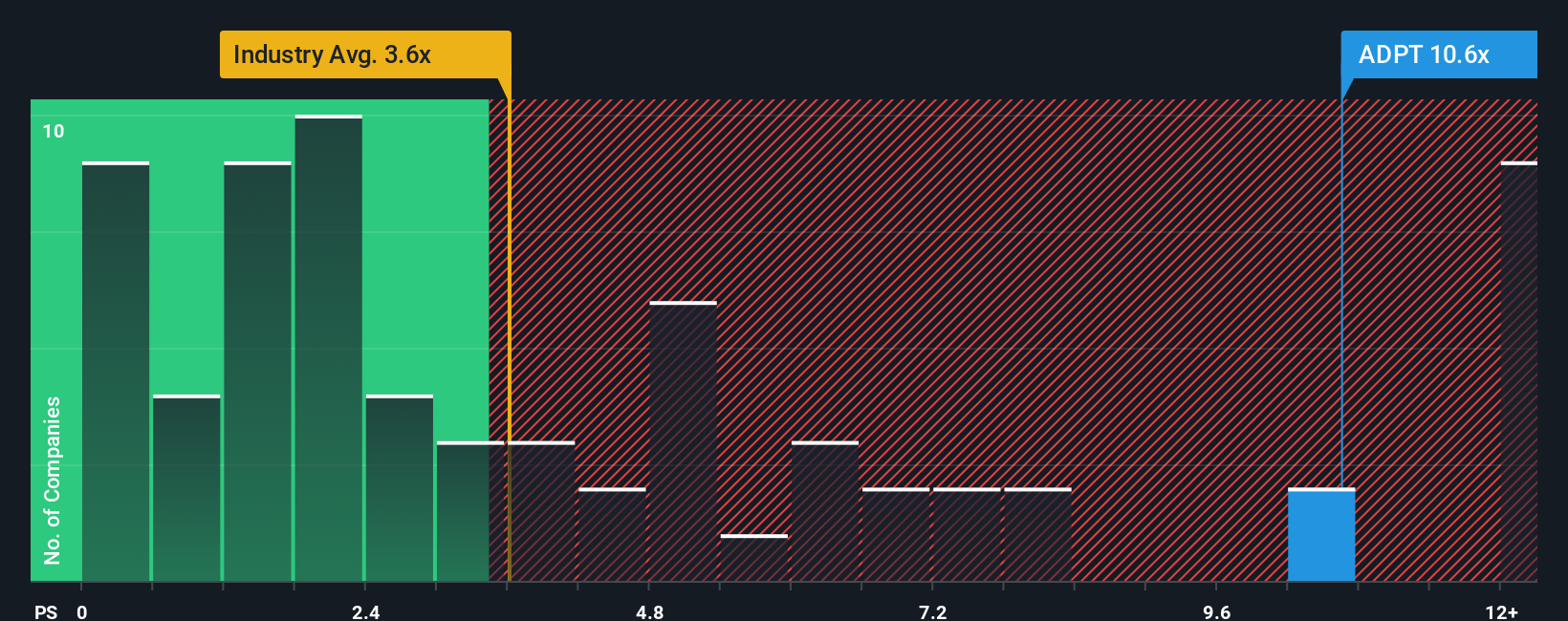

When you look at Adaptive Biotechnologies through the lens of its price-to-sales ratio, the picture shifts. The company’s 8.9x ratio stands much higher than both the US Life Sciences industry average (3.4x) and its peer group (2.7x), and even tops the fair ratio of 5.3x that the market could gravitate towards. This significant gap raises the question: does the market see unique growth potential, or is the stock simply expensive relative to its fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Adaptive Biotechnologies Narrative

If you think the story could unfold differently or want to put your own assumptions to the test, it only takes a few minutes to craft your personal scenario. Do it your way.

A great starting point for your Adaptive Biotechnologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Standout Opportunities?

Don’t miss your chance to get ahead. These stock ideas could set your portfolio apart and help position you for tomorrow’s breakthroughs and steady long-term returns.

- Capitalize on companies rewarding shareholders. Review these 16 dividend stocks with yields > 3% and see which stable payers are delivering yields above 3%.

- Seize the future in artificial intelligence by checking out these 24 AI penny stocks reshaping automation, machine learning, and smarter business solutions worldwide.

- Tap into undervalued opportunities with solid fundamentals. Start your hunt with these 870 undervalued stocks based on cash flows that may be poised for a market re-rate.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADPT

Adaptive Biotechnologies

A commercial-stage company, develops an immune medicine platform for the diagnosis and treatment of various diseases.

Adequate balance sheet with concerning outlook.

Similar Companies

Market Insights

Community Narratives