- United States

- /

- Biotech

- /

- NasdaqGM:ADMA

Is ADMA Biologics a Hidden Gem After Recent FDA Approval and 35% Share Drop?

Reviewed by Bailey Pemberton

- Curious if ADMA Biologics is actually a bargain or just another biotech story catching attention? You’re not the only one watching for signs of value in this dynamic stock.

- Despite a rocky patch lately, with shares down 6.2% over the last week and 35.8% in the past year, ADMA Biologics still sports massive long-term gains of 656.2% over five years.

- Recent headlines highlight ongoing interest in the company’s plasma-derived therapies and new product expansion, with news of expanded FDA approvals and strategic partnerships driving investor conversation and adding important context to recent price shifts.

- When it comes to the numbers, ADMA earns a valuation score of 4 out of 6 for being undervalued in several key areas. Here’s how this was calculated, and read on for a smarter way to spot value beyond the usual checks.

Find out why ADMA Biologics's -35.8% return over the last year is lagging behind its peers.

Approach 1: ADMA Biologics Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's true worth by projecting its future cash flows and then discounting them back to today’s dollars. This approach looks beyond short-term movements and provides a long-range perspective grounded in real business performance.

For ADMA Biologics, analysts start with a current Free Cash Flow of $65.0 million in USD. Looking ahead, their forecasts suggest substantial growth, projecting Free Cash Flow to reach approximately $454 million by 2029. While analyst consensus gives direct estimates for the next five years, further cash flow projections up to 2035 are extrapolated using data trends and assumptions from Simply Wall St’s methodology.

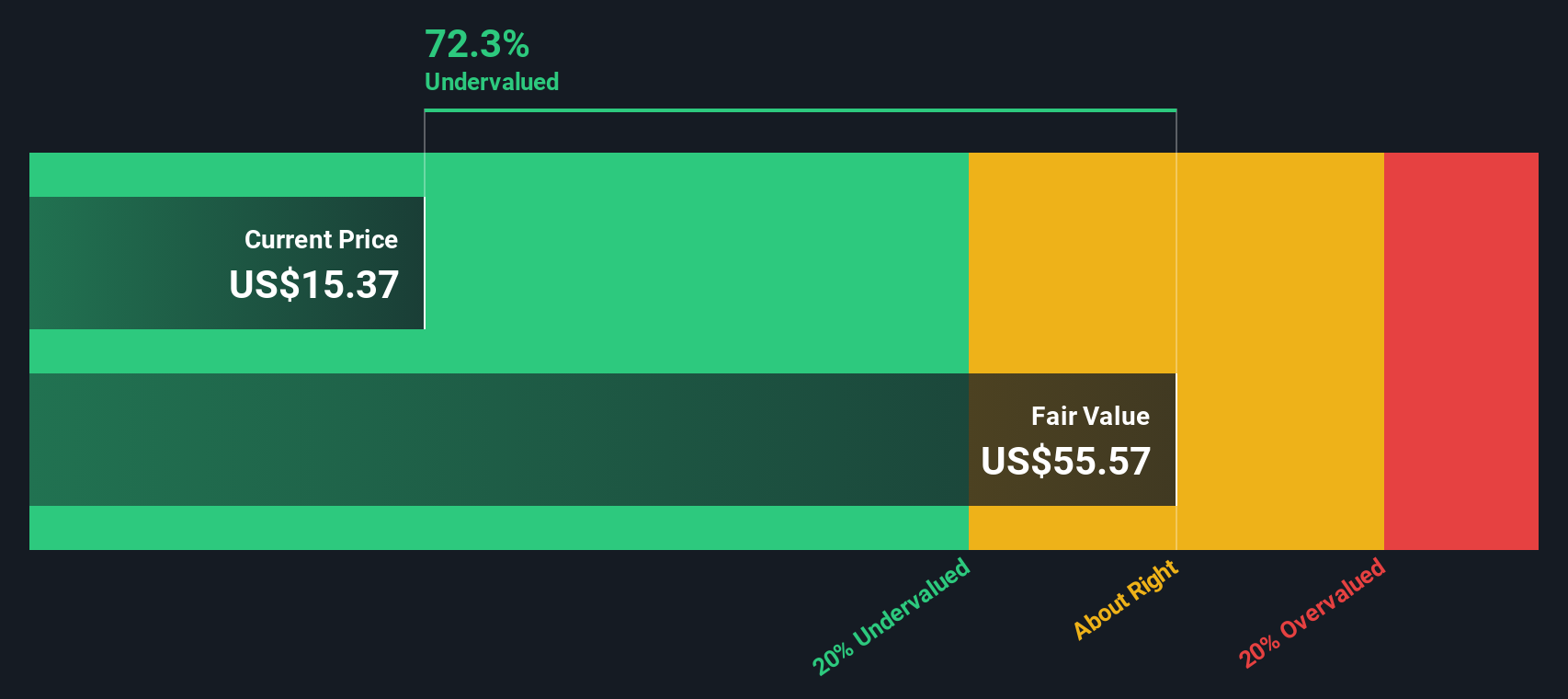

Applying the DCF model, the estimated intrinsic value of ADMA Biologics stock stands at $55.48 per share. This figure implies a deep 73.8% discount compared to the current share price. This may indicate that the market is not fully reflecting the company’s projected growth and future earnings potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests ADMA Biologics is undervalued by 73.8%. Track this in your watchlist or portfolio, or discover 870 more undervalued stocks based on cash flows.

Approach 2: ADMA Biologics Price vs Earnings

The Price-to-Earnings (PE) ratio is widely regarded as the go-to valuation metric for profitable companies like ADMA Biologics, because it directly compares a company's share price with its earnings, giving investors a quick sense of how much they are paying for each dollar of profit. For businesses generating consistent profits, PE becomes a reliable barometer for assessing market expectations and company value.

Not all PE ratios are created equal. A higher ratio can be justified if investors expect strong profit growth, while a lower PE may reflect slower growth prospects or higher risks unique to the business or its industry. Essentially, the "right" PE for a stock depends on how it stacks up in growth, risk, competitiveness, and financial health compared to both peers and the broader industry.

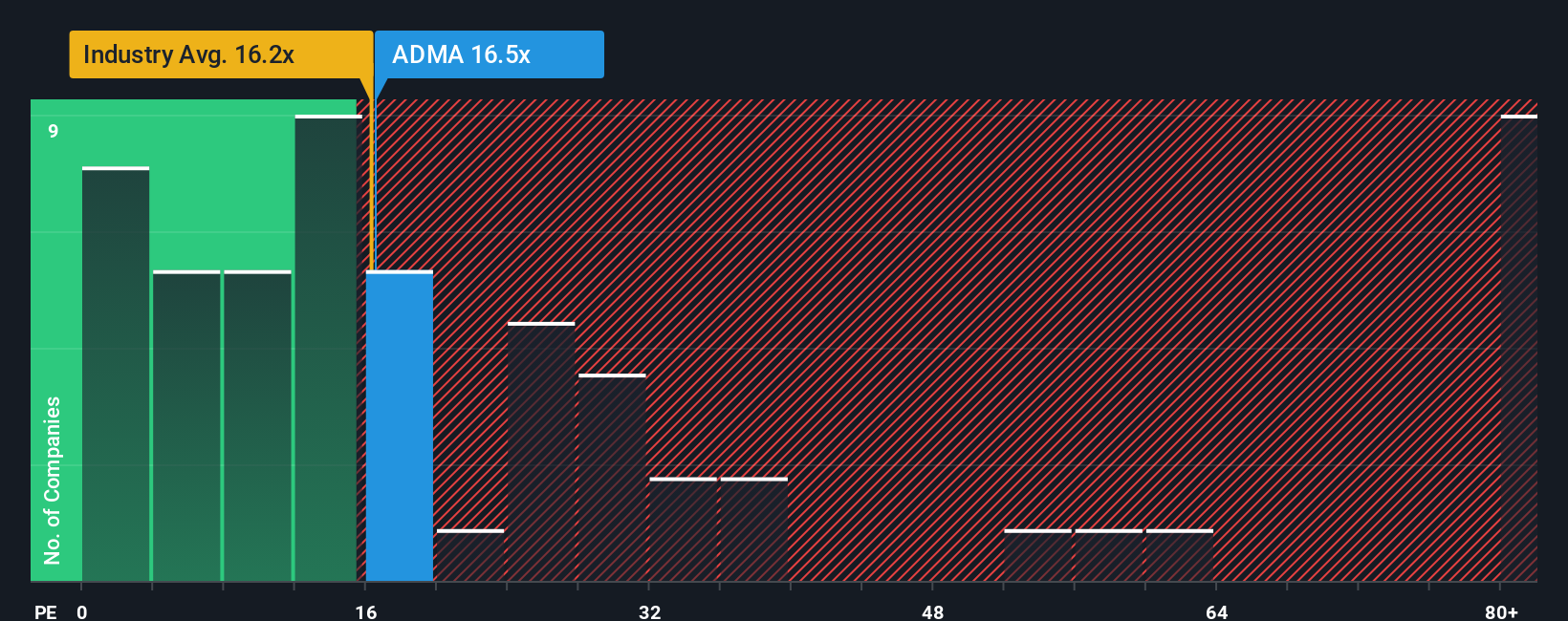

Currently, ADMA Biologics trades on a PE ratio of 16.5x. This lines up closely with the average for its Biotechs industry at 16.2x, but is well below the average for its peer group, which sits at 28.8x. This disparity highlights that while the stock is priced in line with its industry, the broader peer set commands far higher valuations, possibly due to differing growth profiles or risk appetite among investors.

This is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio, calculated as 23.9x for ADMA Biologics, considers a variety of company specifics, including earnings growth, profit margins, market cap, and sector risks. This provides a fuller picture than simply comparing with the broad industry or arbitrary peer averages. By tailoring the ratio to ADMA's precise profile, it offers investors a more relevant yardstick for judging value.

With ADMA Biologics’ current PE ratio at 16.5x, compared against its Fair Ratio of 23.9x, the stock appears to be fundamentally undervalued. This larger-than-normal discount suggests that the market may be underappreciating the company's growth potential and earnings strength based on current fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1396 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your ADMA Biologics Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story or your perspective on a company like ADMA Biologics, woven directly into your own financial forecasts and fair value assumptions. Narratives connect the company’s real-world story to its projected numbers, letting you map out how revenue, margins, and market conditions might play out, and instantly see how these influence what the business is actually worth.

On Simply Wall St’s Community page, Narratives are a free and accessible tool used by millions of investors to set their own expectations, test 'what if' scenarios, and share their views. When you create or follow a Narrative, it keeps your fair value up to date in real time, automatically adjusting whenever new reports, earnings, or big news hits.

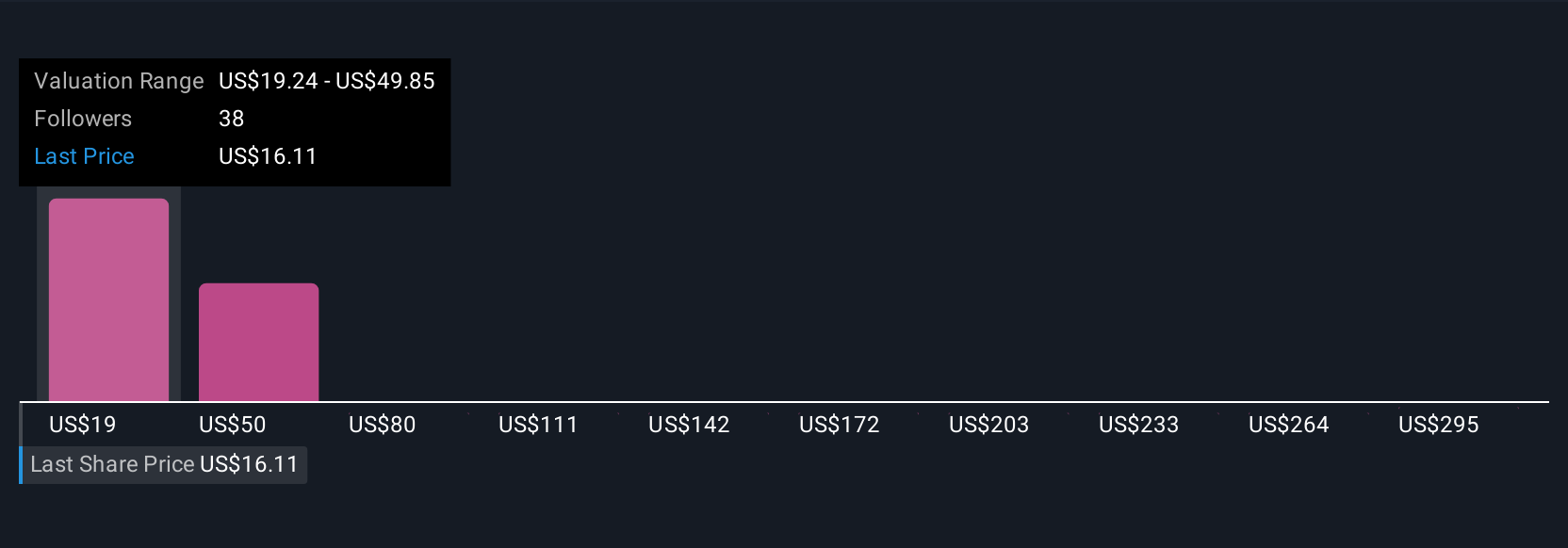

This means you can decide when to buy, hold, or sell based not just on share price changes, but on how your story and numbers have evolved. For example, with ADMA Biologics, the most bullish investor expects a fair value of $35.00, while a more cautious outlook lands at just $19.24. These are two very different Narratives, but both are transparently grounded in real forecasts and public information.

Do you think there's more to the story for ADMA Biologics? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ADMA

ADMA Biologics

A biopharmaceutical company, develops, manufactures, and markets specialty plasma-derived biologics for the treatment of immune deficiencies and infectious diseases in the United States and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives