- United States

- /

- Biotech

- /

- NasdaqGM:ADMA

A Fresh Look at ADMA Biologics (ADMA) Valuation After Record Q3, Raised Guidance, and Operational Wins

Reviewed by Simply Wall St

ADMA Biologics (ADMA) shares moved higher after the company delivered a strong third quarter. The company reported record revenue growth, raised guidance for 2025 and 2026, and detailed multiple operational milestones that reinforce its growth trajectory.

See our latest analysis for ADMA Biologics.

ADMA Biologics’ share price has surged nearly 9% in just one day following its upbeat earnings and raised guidance, signaling renewed enthusiasm among investors. While the stock is still down about 11% year-to-date and has faced a 26% total shareholder return decline over the past year, its three- and five-year total shareholder returns of 395% and 753% highlight big-picture momentum for long-term holders. Recent operational wins and buybacks suggest sentiment could be shifting, with the market rewarding growth and execution.

Curious where the next breakout might be? This could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

The surge in ADMA’s share price raises a critical question: Is the company now trading at a discount given its growth story, or are expectations for future performance already fully reflected in the share price?

Most Popular Narrative: 41.2% Undervalued

The most closely followed narrative sets a fair value for ADMA Biologics at $27.25, which is well above the last close of $16.03. The gap suggests there are significant drivers underlying this upside, and the latest momentum may only be part of the story.

Commercial-scale implementation of the FDA-approved yield enhancement process is producing a 20%+ increase in bulk immunoglobulin output. This is expected to drive sustained gross margin expansion and higher net income starting in early 2026 and beyond.

Want to know what’s fueling this bullish viewpoint? The narrative’s massive upside hinges on a single operating breakthrough that could increase both profit margins and future earnings. Ready to uncover the strategic assumption the market may have missed? Dive in to see how this fair value is really built.

Result: Fair Value of $27.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a heavy reliance on just a few products and potential manufacturing setbacks could easily disrupt ADMA’s growth story and change its outlook.

Find out about the key risks to this ADMA Biologics narrative.

Another View: Multiples Tell a Different Story

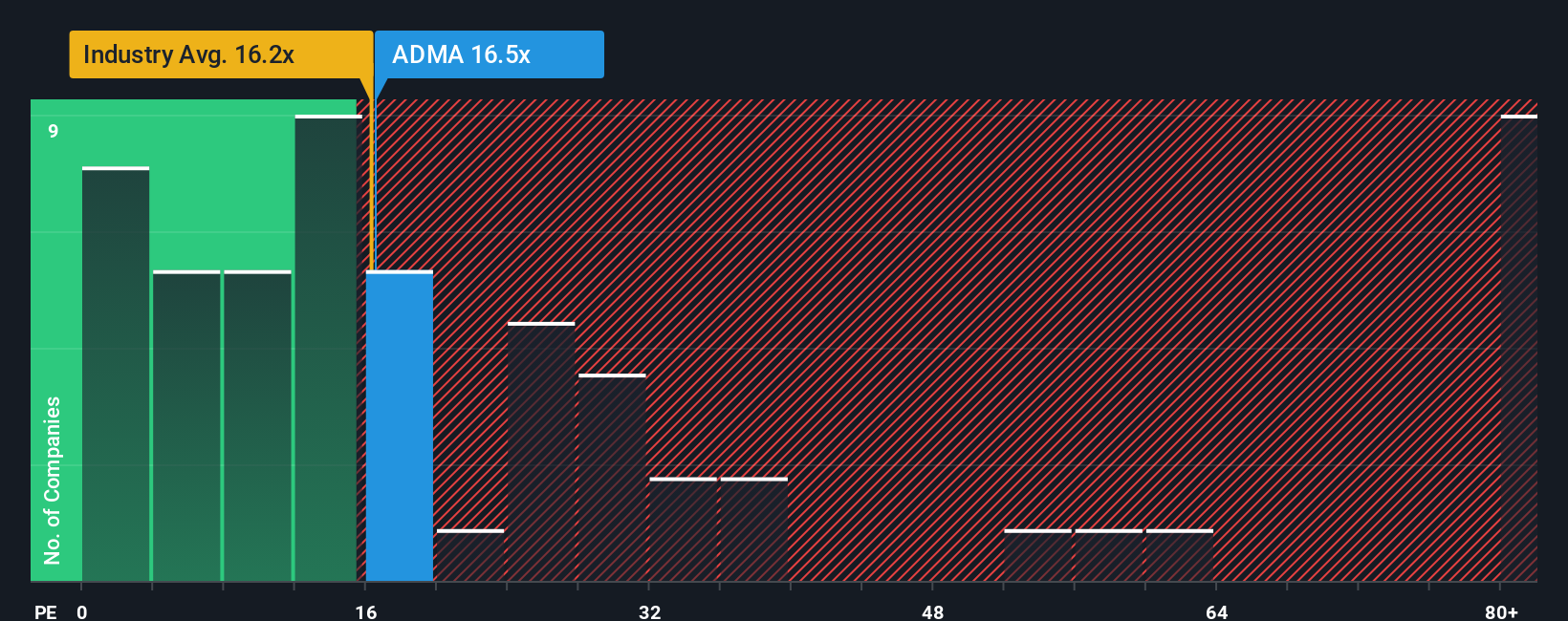

While the fair value estimate points to significant upside, a glance at the price-to-earnings ratio highlights a more cautious perspective. ADMA currently trades at 18.2x earnings, which is nearly identical to the US Biotechs industry average of 18x and well below the peer average of 56.3x. Its fair ratio stands at 24.5x, leaving the possibility that the market could re-rate the stock higher if optimism grows. Will the momentum last long enough for the company's valuation to catch up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ADMA Biologics Narrative

If you think the story here is missing something or would rather dig into the numbers yourself, you can put together your own perspective in under 3 minutes. Do it your way.

A great starting point for your ADMA Biologics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Seize the moment and expand your portfolio with smart stock ideas that others might be missing out on. Make your next move with confidence and see what’s possible beyond the obvious picks.

- Unlock high-yield opportunities and tap into reliable income with these 15 dividend stocks with yields > 3% that consistently deliver dividends above 3%.

- Spot industry disruptors by starting your search with these 26 AI penny stocks, which are shaping tomorrow’s landscape in artificial intelligence and automation.

- Capitalize on market mispricings by analyzing these 872 undervalued stocks based on cash flows based on robust cash flow fundamentals before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ADMA

ADMA Biologics

A biopharmaceutical company, develops, manufactures, and markets specialty plasma-derived biologics for the treatment of immune deficiencies and infectious diseases in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives