- United States

- /

- Biotech

- /

- NasdaqGS:ACLX

A Look at Arcellx (ACLX) Valuation Following Recent 25% Share Price Surge

Reviewed by Simply Wall St

See our latest analysis for Arcellx.

The past year has been a rollercoaster for Arcellx shareholders, with a 1-year total shareholder return of -11%. However, the tide may be turning as the company’s share price has surged over 25% in the last three months, signaling renewed momentum and a shift in sentiment. Amid fresh optimism, investors are weighing recent moves against the backdrop of Arcellx’s impressive 291% total return since its 2021 market debut.

If the biotech rally has you curious about other up-and-comers in the sector, check out our picks in the healthcare space: See the full list for free.

With Arcellx’s recent surge, the big question is whether the stock is still undervalued compared to analyst targets or if investors have already priced in its future growth. Could this be the buying opportunity some are waiting for?

Price-to-Book of 12.5x: Is it justified?

Compared to its latest closing price of $88.20, Arcellx’s price-to-book ratio stands out at 12.5x, significantly higher than averages for both peers and the broader sector. This valuation suggests that investors are paying a notable premium for each dollar of net assets on the company’s books.

The price-to-book ratio measures how much investors are willing to pay for the company’s net assets relative to their book value. In the biotech industry, high price-to-book ratios can reflect enthusiasm for future innovation or anticipated revenue growth. However, they may also signal overly optimistic expectations if not supported by improving fundamentals.

For Arcellx, the market’s optimism does not yet align with its current financials. The company remains unprofitable and its losses have increased in recent years. Meanwhile, the industry average price-to-book is much lower at just 2.4x, and its peer group averages 10.7x. The current premium signals that investors might be factoring in substantial future progress. This gap could widen or close depending on how Arcellx delivers on its growth outlook.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 12.5x (OVERVALUED)

However, investors should remember that Arcellx’s steep losses and its reliance on future growth leave the stock vulnerable if clinical or market setbacks arise.

Find out about the key risks to this Arcellx narrative.

Another View: What Does the DCF Model Say?

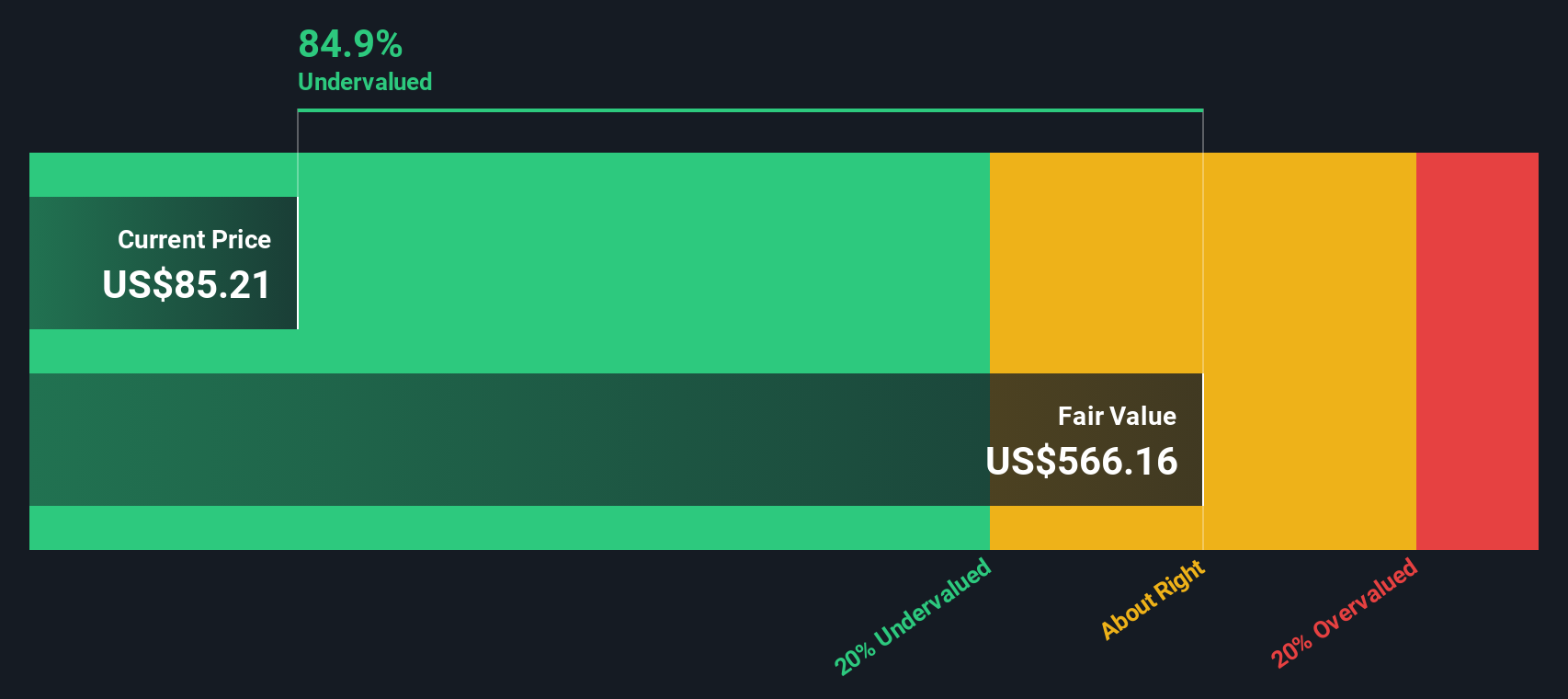

While the price-to-book ratio signals that Arcellx is trading at a steep premium, the SWS DCF model offers a different perspective. Based on our DCF analysis, Arcellx appears massively undervalued, with current trading levels well below our estimate of its fair value. Could this divergence hint at a hidden opportunity, or does it reflect deeper market caution?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Arcellx for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 857 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Arcellx Narrative

If you want to dig deeper or think the story looks different through your own lens, you can build a unique investment case in just minutes. Do it your way

A great starting point for your Arcellx research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know that one stock is never the whole story. Unlock opportunities you might be missing by checking out these unique stock screens tailored for savvy portfolios:

- Maximize potential with unbeatable value by tapping into these 857 undervalued stocks based on cash flows to see which companies are trading for less than their fundamentals suggest.

- Get ahead in a high-growth arena when you explore these 25 AI penny stocks, where artificial intelligence innovation is shaping tomorrow’s winners.

- Secure steady returns and income stability by targeting these 17 dividend stocks with yields > 3%, highlighting companies that deliver strong dividend yields above market averages.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ACLX

Arcellx

Together with its subsidiary, engages in the development of various immunotherapies for patients with cancer and other incurable diseases in the United States.

Excellent balance sheet and fair value.

Market Insights

Community Narratives