- United States

- /

- Life Sciences

- /

- NasdaqGS:ABCL

Can AbCellera (ABCL) Balance Rising Revenues and Widening Losses to Fund Its Innovation Pipeline?

Reviewed by Sasha Jovanovic

- AbCellera Biologics Inc. recently reported third quarter 2025 earnings, showing revenue of US$8.96 million versus US$6.51 million a year earlier, alongside a net loss of US$57.12 million compared to US$51.11 million previously.

- While the company achieved revenue growth both in the quarter and year-to-date, its net losses widened, reflecting ongoing investment in pipeline development and research initiatives.

- We'll examine how the combination of growing revenues and increasing losses could influence AbCellera Biologics' investment outlook moving forward.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

AbCellera Biologics Investment Narrative Recap

To be a shareholder in AbCellera Biologics, you have to believe in the company’s potential to convert early-stage R&D into approved drugs and future revenue streams, particularly in areas with unmet medical need. The latest quarterly results, higher revenue but wider net losses, do not materially shift the near-term catalysts, such as clinical progress for ABCL635 and ABCL575, or the most immediate risk: whether pipeline assets can demonstrate effectiveness and gain traction in competitive markets.

Among recent announcements, the initiation of the Phase 1 trial for ABCL575 in atopic dermatitis stands out for its relevance; early clinical milestones remain a key driver for the company. This adds some momentum to AbCellera's story, but as with any early-stage biotech, investors are focused on how successfully these programs advance toward meaningful data and commercial opportunities.

By contrast, investors should also be aware that ongoing investment requirements mean the company’s widening net losses could...

Read the full narrative on AbCellera Biologics (it's free!)

AbCellera Biologics' outlook anticipates $123.3 million in revenue and $17.5 million in earnings by 2028. Achieving this would require 55.4% annual revenue growth and a $183.2 million increase in earnings from the current level of -$165.7 million.

Uncover how AbCellera Biologics' forecasts yield a $9.33 fair value, a 139% upside to its current price.

Exploring Other Perspectives

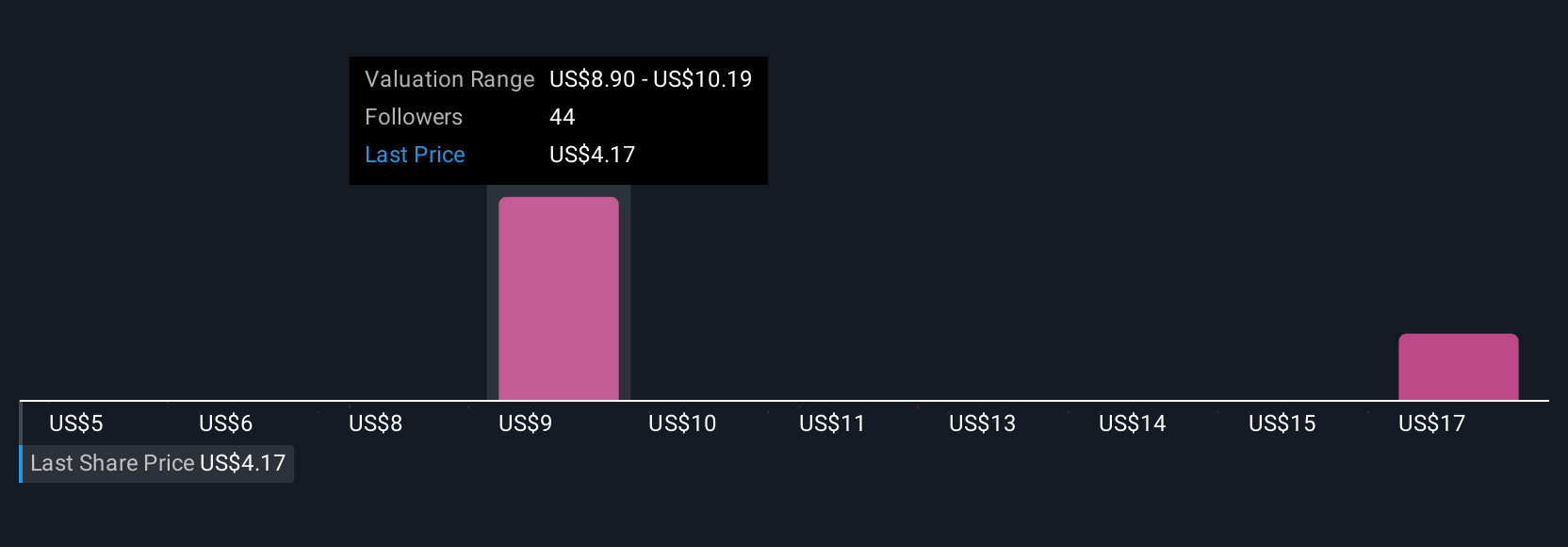

Nine individual fair value estimates from the Simply Wall St Community fall between US$5 and US$17 per share, reflecting a wide spread of investor expectations. Amid this diversity, share price potential hinges on successful clinical milestones and the company's ability to turn pipeline progress into revenue growth.

Explore 9 other fair value estimates on AbCellera Biologics - why the stock might be worth just $5.00!

Build Your Own AbCellera Biologics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AbCellera Biologics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free AbCellera Biologics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AbCellera Biologics' overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ABCL

AbCellera Biologics

Engages in discovering and developing antibody-based medicines for indications with unmet medical need in the United States.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives