- United States

- /

- Entertainment

- /

- NYSE:TKO

How Investors Are Reacting To TKO Group Holdings (TKO) Raising Guidance Despite Lower Quarterly Sales

Reviewed by Sasha Jovanovic

- On November 5, 2025, TKO Group Holdings reported third quarter 2025 results with net income rising to US$41.01 million while sales fell year-over-year to US$1.12 billion, and the company raised its full-year revenue guidance to US$4.69 billion–US$4.72 billion.

- Despite lower quarterly sales, TKO achieved substantial improvements in profitability, marking a significant turnaround from a net loss position in the prior nine-month period.

- We'll look at how TKO's raised full-year revenue outlook shapes its investment narrative and highlights the company's path to improved profitability.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is TKO Group Holdings' Investment Narrative?

To be comfortable as a TKO Group Holdings shareholder today, you need to see the big picture: this is a company with ambitious revenue and earnings growth forecasts, influential entertainment partnerships, and a rising dividend, all while riding out fluctuations in quarterly sales. The recent quarter’s improvement in profitability and the higher full-year revenue outlook could prove to be a material update, especially as fresh media deals with major players like Paramount+ come into focus, promising expanded international reach from 2026. Short term, renewed guidance helps reassure around the company’s post-merger revenue path and puts the spotlight on earnings quality, but the large one-off items and ongoing antitrust lawsuit continue to be key wildcards. As a result, the risk profile may shift for some, particularly in light of these legal overhangs and the speed of integration of new deals into actual revenue streams.

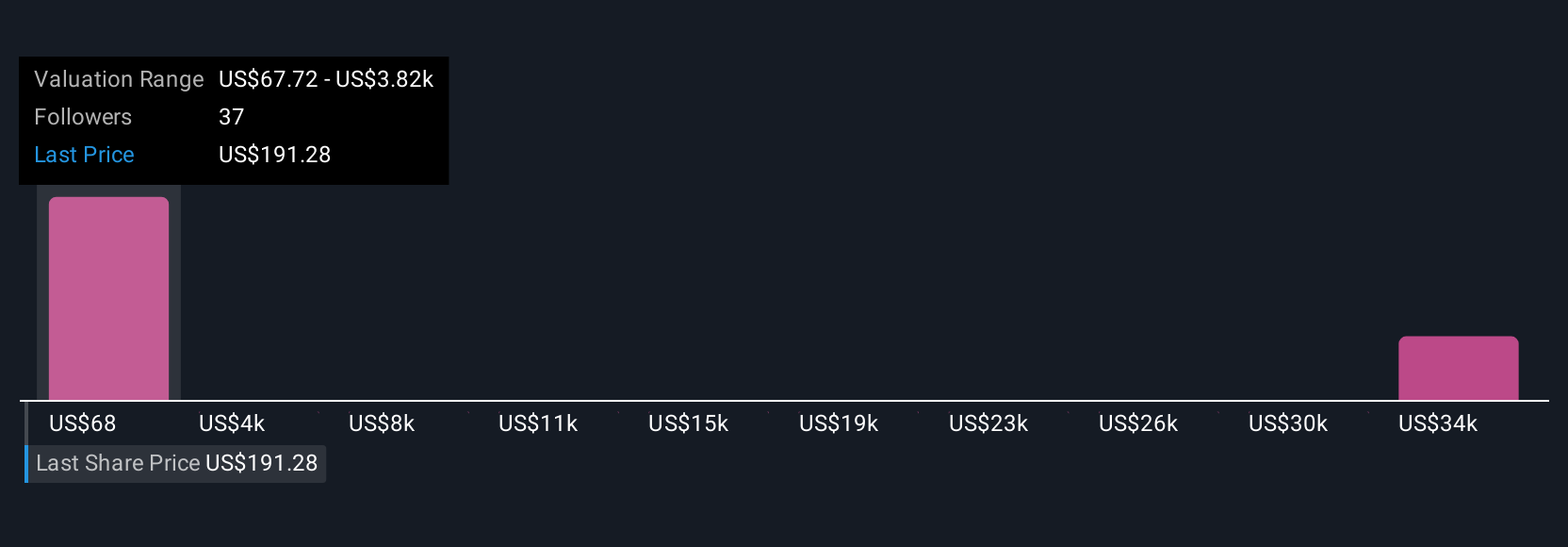

On the flip side, legal risks remain a point investors should pay close attention to. Despite retreating, TKO Group Holdings' shares might still be trading 9% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 10 other fair value estimates on TKO Group Holdings - why the stock might be worth less than half the current price!

Build Your Own TKO Group Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TKO Group Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free TKO Group Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TKO Group Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TKO Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TKO

High growth potential with adequate balance sheet.

Market Insights

Community Narratives