- United States

- /

- Entertainment

- /

- NYSE:TKO

Assessing TKO Group Holdings’s (TKO) Valuation After Raised Guidance and New Media Rights Deals

Reviewed by Simply Wall St

TKO Group Holdings (TKO) gave investors plenty to digest after releasing third-quarter results that showed rising profitability, especially in the WWE and IMG segments. Following these numbers, the company raised its full-year 2025 revenue guidance, emphasizing confidence in its ongoing operational gains.

See our latest analysis for TKO Group Holdings.

After raising full-year guidance and announcing lucrative multi-year media rights deals, TKO Group Holdings has caught investors’ attention, helping drive a year-to-date share price return of 27.91% and a stellar one-year total shareholder return of 54.71%. Momentum is building as the company’s brand power and new partnerships continue to fuel optimism about its long-term growth potential.

If you’re interested in companies with this kind of dynamic growth and strong insider stakes, now is a smart time to explore fast growing stocks with high insider ownership.

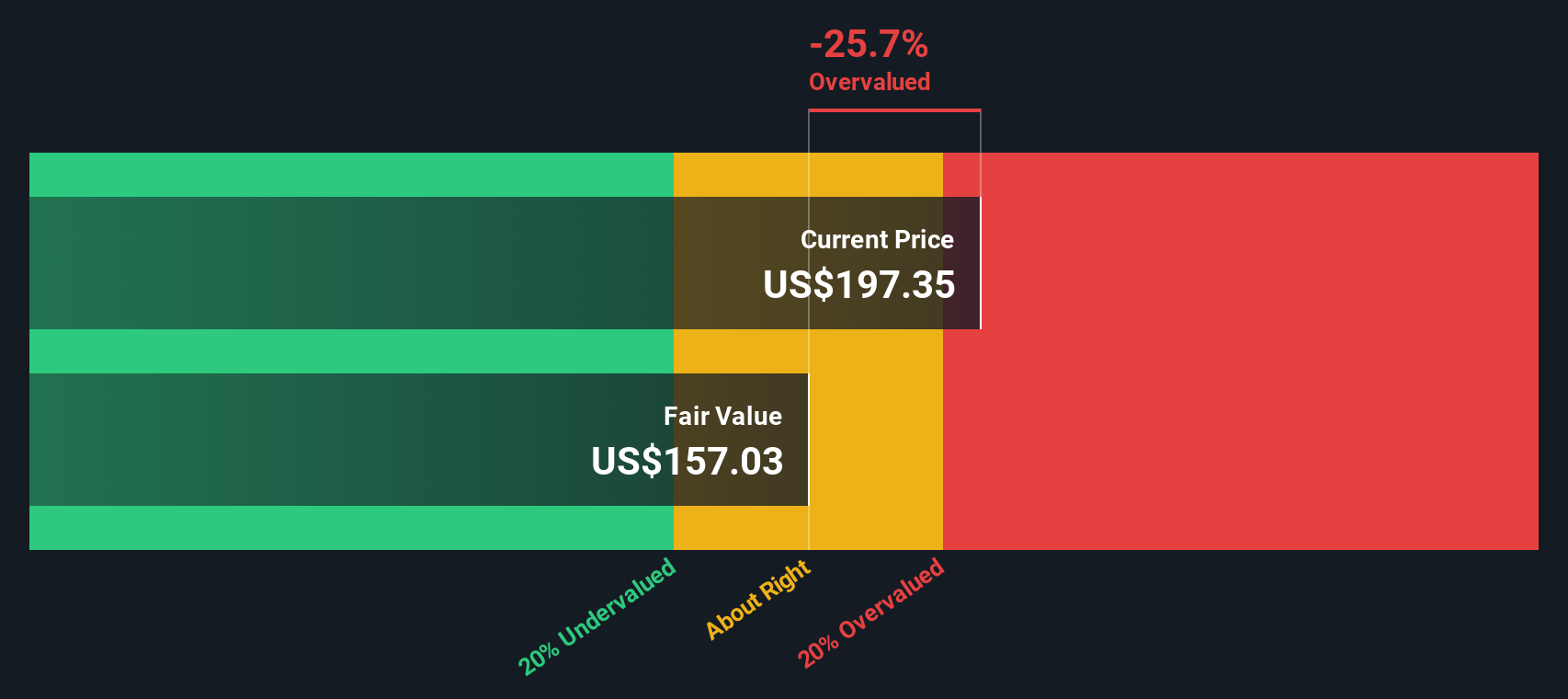

But with shares near all-time highs, analysts are now debating whether TKO’s future upside is already reflected in the stock price or if there is still room for investors to buy in before the next growth phase unfolds.

Price-to-Earnings of 63x: Is it justified?

TKO Group Holdings is currently trading at a lofty price-to-earnings (P/E) ratio of 63x, measured against a last closing price of $182.56. By comparison, this multiple significantly outpaces both its industry peers and typical market valuations, signaling the market may be pricing in very high growth or unique advantages.

The price-to-earnings ratio tells investors how much they are paying for each dollar of company earnings. In sectors like Entertainment, the P/E multiple often reflects expectations for future profit growth, brand strength, and market leadership. For TKO, this heightened multiple suggests investors have high confidence in sustained profitability and future earnings expansion.

However, TKO’s P/E ratio is almost three times higher than the US Entertainment industry average of 23.4x. That is a premium that the market awards only to companies expected to outperform their peers by a wide margin. Even compared to its peers’ average P/E of 88.6x, TKO may appear a relative bargain, though neither figure is low. Notably, the estimated fair P/E ratio for TKO is 35.4x, indicating that current prices may be running well ahead of where the market could ultimately settle if growth expectations moderate.

Explore the SWS fair ratio for TKO Group Holdings

Result: Price-to-Earnings of 63x (OVERVALUED)

However, slowing recent share performance and a lofty P/E create little margin for error if revenue or earnings growth begins to disappoint investors.

Find out about the key risks to this TKO Group Holdings narrative.

Another View: What Does DCF Say?

While the current price-to-earnings ratio suggests TKO shares are overvalued, our DCF model tells a different story. The SWS DCF model estimates TKO is trading roughly 8% below its fair value, which could indicate undervaluation if cash flow projections hold up.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out TKO Group Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 883 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own TKO Group Holdings Narrative

If you have a different perspective or want to see the numbers for yourself, it's easy to build your own view of the story in just a few minutes. Do it your way.

A great starting point for your TKO Group Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you want to make sure you're not missing out on breakthrough opportunities beyond TKO, put your investing strategy ahead of the curve with these unique stock ideas:

- Uncover attractive yields by targeting stable payouts with these 16 dividend stocks with yields > 3%, and grow your wealth while earning consistent income.

- Catalyze your portfolio with innovation when you start tracking these 32 healthcare AI stocks, and see which companies are revolutionizing medicine with artificial intelligence.

- Spot tomorrow’s breakthroughs in technology by checking out these 28 quantum computing stocks, featuring early movers in the world of quantum computing and next-generation solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TKO Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TKO

High growth potential with adequate balance sheet.

Market Insights

Community Narratives