Stock Analysis

- United States

- /

- Entertainment

- /

- NYSE:SPHR

Sphere Entertainment (NYSE:SPHR) pulls back 3.4% this week, but still delivers shareholders 6.2% CAGR over 3 years

It is a pleasure to report that the Sphere Entertainment Co. (NYSE:SPHR) is up 34% in the last quarter. But that cannot eclipse the less-than-impressive returns over the last three years. Truth be told the share price declined 45% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

After losing 3.4% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

See our latest analysis for Sphere Entertainment

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Sphere Entertainment became profitable within the last five years. We would usually expect to see the share price rise as a result. So it's worth looking at other metrics to try to understand the share price move.

Arguably the revenue decline of 11% per year has people thinking Sphere Entertainment is shrinking. After all, if revenue keeps shrinking, it may be difficult to find earnings growth in the future.

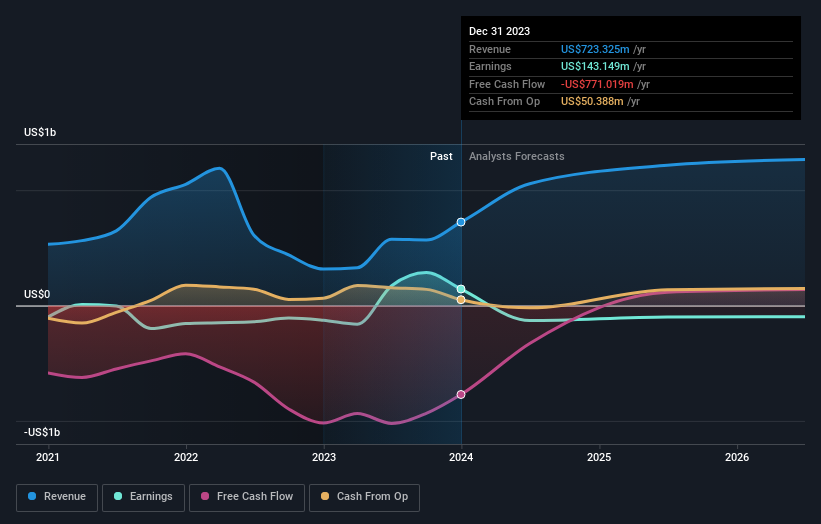

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. So we recommend checking out this free report showing consensus forecasts

What About The Total Shareholder Return (TSR)?

We've already covered Sphere Entertainment's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Sphere Entertainment hasn't been paying dividends, but its TSR of 20% exceeds its share price return of -45%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

Pleasingly, Sphere Entertainment's total shareholder return last year was 78%. So this year's TSR was actually better than the three-year TSR (annualized) of 6%. These improved returns may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Sphere Entertainment better, we need to consider many other factors. Case in point: We've spotted 2 warning signs for Sphere Entertainment you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Sphere Entertainment is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:SPHR

Sphere Entertainment

Sphere Entertainment Co. engages in the entertainment business.

Fair value with questionable track record.