- United States

- /

- Entertainment

- /

- NYSE:SPHR

Can Sphere Entertainment’s (SPHR) Vegas Success Translate Into Sustainable Growth and Shareholder Returns?

Reviewed by Sasha Jovanovic

- Earlier this week, Sphere Entertainment Co. reported third-quarter results with revenue rising to US$262.51 million, driven by strong demand for The Wizard of Oz at its Las Vegas venue, while its net loss narrowed to US$101.2 million from US$105.28 million a year earlier.

- The company also highlighted its expanding Sphere segment, new venue developments, and share buyback activity, marking ongoing confidence in future growth opportunities despite missing some analyst expectations.

- We'll explore how Sphere's successful Las Vegas expansion and events are shaping its current investment narrative and growth outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Sphere Entertainment Investment Narrative Recap

To be a shareholder in Sphere Entertainment, you need to believe that immersive venue experiences and unique content like "The Wizard of Oz at Sphere" will keep drawing strong crowds and supporting revenue growth, even as expansion projects press on. The latest earnings report, while showing a year-over-year revenue increase and narrowing losses, did little to alter the big picture: near-term results remain sensitive to Las Vegas ticket sales and the ongoing ability to keep blockbuster events in high demand, while significant venue expansion remains a longer-term risk. For now, there is no material change to the primary catalyst or risk, continued Las Vegas momentum remains central, but so does the potential for event-driven revenue swings.

Among recent company news, Sphere’s announcement of the share buyback in Q3 stands out as most connected to current investor sentiment. The US$50 million repurchase signals management’s optimism around Sphere’s long-term growth potential and cash flow prospects, especially in the wake of another quarter influenced by Las Vegas demand. In the context of short-term catalysts, this buyback underscores confidence but does not offset the ongoing challenge of filling new venues profitably as the Sphere concept scales globally.

On the other hand, investors should be aware that if demand for new immersive events fails to match expectations, the risk of unpredictable earnings could...

Read the full narrative on Sphere Entertainment (it's free!)

Sphere Entertainment's outlook anticipates $1.3 billion in revenue and $118.7 million in earnings by 2028. This projection involves a 6.5% annual revenue growth rate and a $392.8 million earnings increase from current earnings of -$274.1 million.

Uncover how Sphere Entertainment's forecasts yield a $64.90 fair value, a 11% downside to its current price.

Exploring Other Perspectives

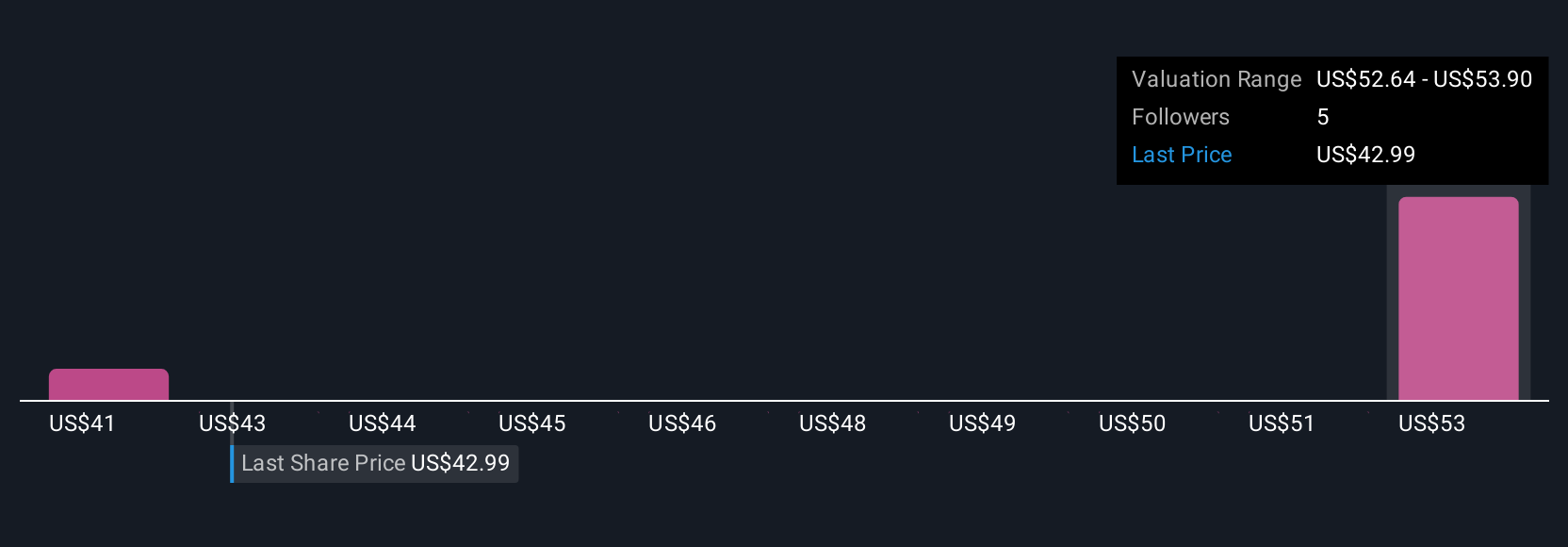

Fair value estimates from the Simply Wall St Community range from US$35 to US$64.90, based on three unique analyses. Against this diversity of outlooks, maintaining blockbuster event demand remains critical for Sphere’s future performance, see how other investors are weighing their options.

Explore 3 other fair value estimates on Sphere Entertainment - why the stock might be worth as much as $64.90!

Build Your Own Sphere Entertainment Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sphere Entertainment research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Sphere Entertainment research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sphere Entertainment's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPHR

Sphere Entertainment

Operates as a live entertainment and media company in the United States.

Fair value with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives