- United States

- /

- Interactive Media and Services

- /

- NYSE:PINS

Pinterest (PINS) Profit Margin Jumps to 49.3%, Reinforcing Bullish Community Narrative

Reviewed by Simply Wall St

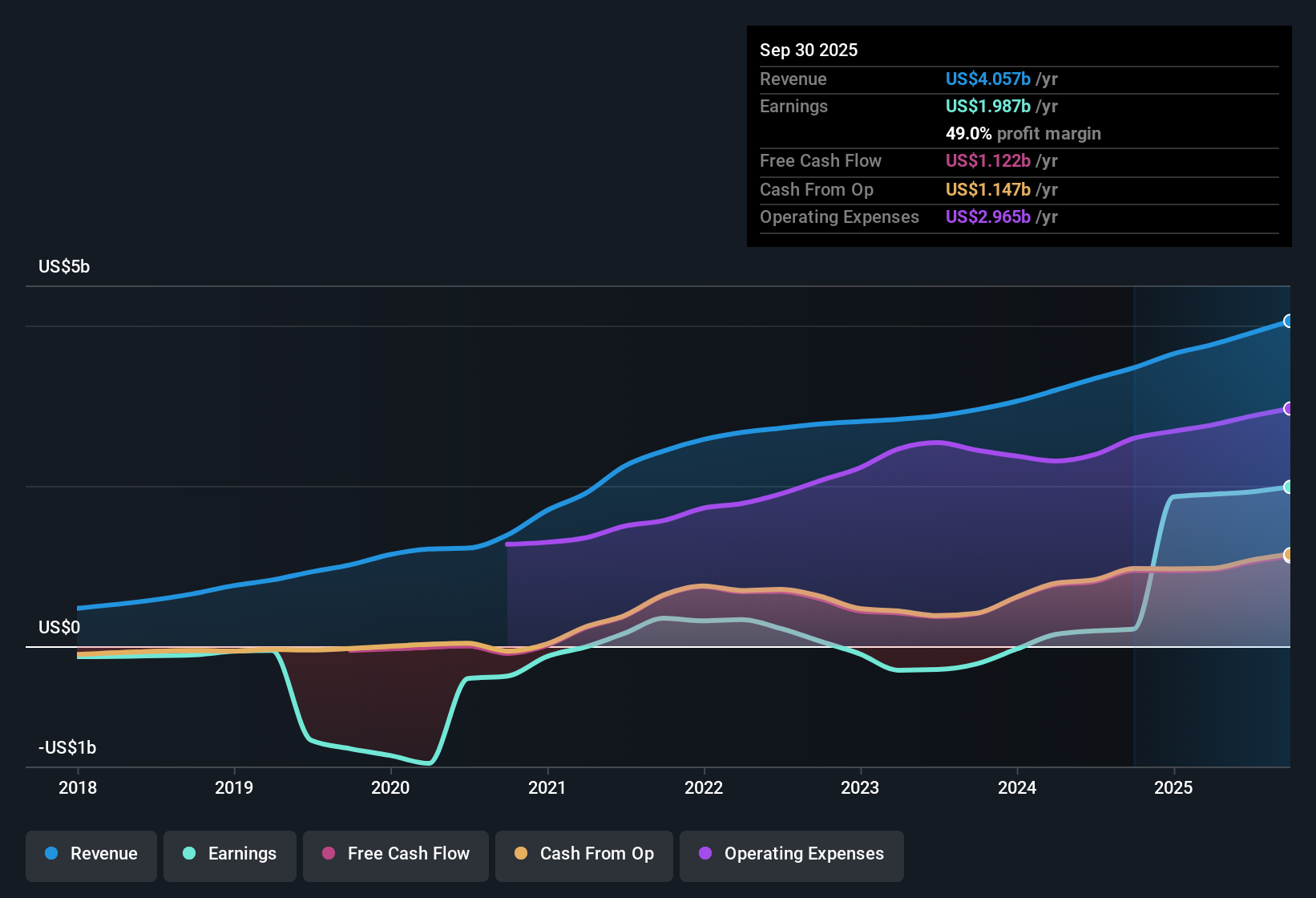

Pinterest (PINS) posted a net profit margin of 49.3% this quarter, a major jump from 5.8% one year ago, while its earnings over the past year soared 903%, far outpacing its five-year annual average of 64.3%. Looking ahead, Wall Street expects earnings to climb by 28% per year, with revenue projected to rise 11.8% annually. Both figures are running ahead of the US market’s 10.4% forecast. With the stock now trading at 9x earnings and below some valuation estimates and analyst targets, sentiment is leaning positive as investors weigh robust profit momentum against an attractive valuation.

See our full analysis for Pinterest.Next, let's see how these headline results square up with the key narratives driving sentiment on Pinterest, whether the numbers reinforce or challenge those prevailing market stories.

See what the community is saying about Pinterest

Profit Margin Surges but Analyst Doubts Linger

- Pinterest’s net profit margin hit 49.3%, a sharp rise from 5.8% last year. However, analysts project margins could drop back to 17.1% over the coming three years according to the consensus narrative.

- Consensus narrative notes that while AI-driven personalization, international expansion, and new commerce features should deepen engagement and diversify revenues, analysts believe profit margins may normalize closer to industry averages as competition heats up and regional ad monetization lags.

- This surprising margin pullback directly tests the bullish angle that recent earnings durability will be easy to sustain. This suggests that even with new ARPU drivers, profitability trends could face pressure as Pinterest grows abroad and faces evolving privacy regulation.

- Despite explosive recent growth, with earnings soaring 903% over the past year, analysts expect a far slower pace ahead, forecasting a 28% per year increase versus historical five-year averages of 64.3%.

- Consensus narrative highlights that enhanced ad products and global growth may drive ongoing revenue gains, but wide analyst disagreement on forward earnings ($607.4 million to $1.2 billion by 2028) underlines uncertainty about how much of these gains will stick once early catalysts fade.

- This gap between recent rapid growth and the more moderate consensus forecast exposes tension between those who see Pinterest as a new category winner and those who worry it is nearing a plateau.

Strong margin expansion and headline growth shape a bullish argument, but the consensus narrative leans cautious, underscoring the debate over durability of Pinterest’s elevated profitability as the platform evolves.

📊 Read the full Pinterest Consensus Narrative.International Expansion: Opportunity and Monetization Challenge

- Accelerated ARPU growth in Europe and the "Rest of World" regions is narrowing Pinterest’s monetization gap with North America, lifting revenue diversification but still leaving the company reliant on mature U.S. and Canadian markets for profit strength.

- Consensus narrative finds that investments in commerce partnerships (like Instacart) and localized ad formats expand international engagement. However, bulls’ hopes for global lift are challenged by the slower pace of international ad pricing increases and persistent regional concentration risk.

- What is surprising is the consensus that without faster monetization in new markets, recent headline growth may not translate into long-term profit stability or margin upside.

- Performance-ad product launches and growing global user bases are seen as levers to address these gaps, but privacy regulation and direct competition from Meta, Google, and TikTok may slow progress.

- Consensus narrative stresses that even as Pinterest rolls out tailored AI ad tools and more shoppable features, its differentiation advantage is at risk if international ARPU convergence stalls, raising doubts over the scalability of its current business model.

- Critics highlight that heavy investment may be needed in new regions, potentially compressing margins and delaying expected payback on international growth initiatives.

Valuation Discount Relative to Peers Remains

- Pinterest trades at a price-to-earnings ratio of 9x, well below the industry average of 16.3x and a peer average of 43.7x. The current share price of $25.75 sits 37% below both the DCF fair value ($70.21) and 58% under the analyst price target ($40.91).

- Consensus narrative underscores that this relative discount, when combined with ongoing revenue growth and margin improvement, creates a case for multiple expansion if future performance meets even conservative analyst expectations.

- Yet with analysts assuming future PE ratios rising to 37.4x by 2028, the downside risk is that slowing growth or margin drag could leave Pinterest trading well below industry norms, especially if bulls’ optimism about new platforms, ad formats, and e-commerce does not materialize in financial results.

- Analysts expect the number of shares outstanding to grow by only 0.61% per year over the next three years, providing some protection against dilution even if Pinterest invests heavily in international or product initiatives.

- Consensus narrative points out that while mild share expansion may help support per-share value, the valuation gap will only close if Pinterest delivers stronger

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Pinterest on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got a fresh angle on the results? Share your unique perspective in a narrative in just a few minutes to shape the next conversation. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Pinterest.

See What Else Is Out There

Pinterest’s margin outlook is clouded by analyst doubts about sustained profitability and concerns that rapid earnings growth may hit a plateau as international monetization lags.

Want to target steadier performance? Use our stable growth stocks screener (2074 results) to find companies where consistent revenue and earnings expansion lead to more dependable results through different cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

- Consensus narrative points out that while mild share expansion may help support per-share value, the valuation gap will only close if Pinterest delivers stronger

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PINS

Operates as a visual search and discovery platform in the United States, Canada, Europe, and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives