- United States

- /

- Media

- /

- NYSE:NYT

New York Times (NYT): A Fresh Look at Valuation Following Strong Revenue and Profit Growth

Reviewed by Simply Wall St

The New York Times (NYT) just released its latest earnings report, showing growth in both revenue and net income for the recent quarter and the past nine months. This highlights the company's ongoing profitability and business momentum.

See our latest analysis for New York Times.

New York Times shares are attracting attention, with a 17.28% year-to-date share price return and a 13.23% total shareholder return over the last year. The company’s solid earnings and continued share buybacks appear to be fueling momentum, highlighting long-term growth potential as well as steady confidence from investors.

If this momentum in media has you looking for the next big opportunity, it might be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares trading just below analyst targets after a strong run, the key question is whether New York Times remains undervalued at current levels or if the market has already priced in the company’s growth prospects.

Most Popular Narrative: 3.4% Undervalued

Market watchers are taking note as the most widely followed narrative puts New York Times' fair value at $63.50, slightly above its recent close of $61.35. The narrow gap suggests that analysts believe the market is close to an accurate assessment of the company's prospects but hints there may still be room for upside.

Robust growth in digital subscriptions driven by an expanding portfolio of bundled offerings (news, Cooking, Games, The Athletic) and a focus on direct consumer relationships positions the company to capture more recurring revenue, strengthen ARPU, and reduce churn. This directly supports long-term revenue and margin expansion.

Want to know the growth blueprint justifying this premium? There's one crucial ingredient: record subscriber expansion and a profit profile that rivals digital-first giants. What’s the bold leap analysts expect New York Times to make next? Click through to decode the financial levers behind this valuation.

Result: Fair Value of $63.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent competition from digital media platforms and growing reliance on traffic from large tech companies could limit subscriber growth and put pressure on future revenues.

Find out about the key risks to this New York Times narrative.

Another View: A Look at Earnings Multiples

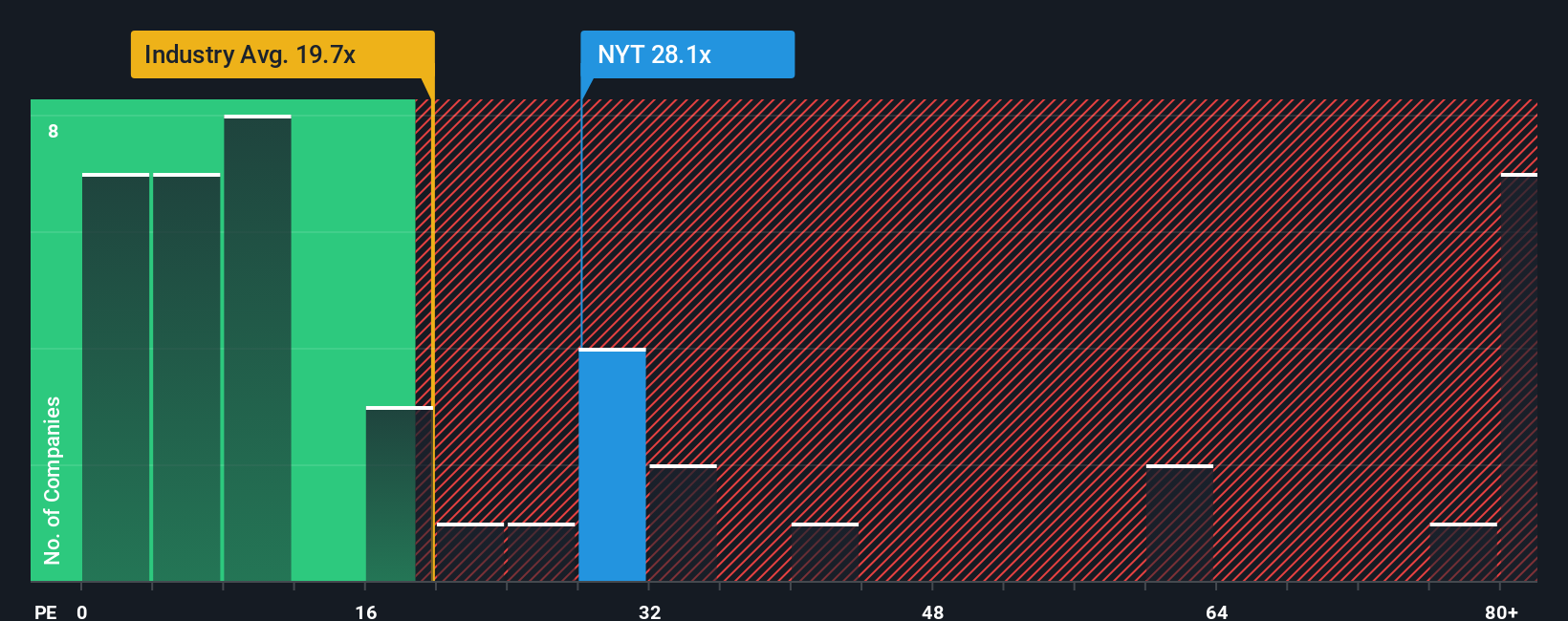

While some see upside based on analyst price targets, looking at the company's price-to-earnings ratio tells a more cautious story. New York Times is trading at 29.5x earnings, noticeably higher than both the US Media industry average of 16.6x and the peer average of 20.1x, as well as the fair ratio of 20.3x. This gap suggests the market has priced in more growth than its peers, which increases the risk of a pullback if expectations are not met.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own New York Times Narrative

If you see things differently or want a deeper dive, you can review the figures and shape your own perspective in just a few minutes with Do it your way

A great starting point for your New York Times research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let the opportunity pass you by. Unlock your next winning move by checking out stocks poised for explosive growth, AI innovation, and attractive dividends. These could be the game-changers missing from your portfolio.

- Power up your portfolio with these 25 AI penny stocks, which are shaping everything from automation to smarter enterprise solutions.

- Catch a steady stream of passive income when you scan these 16 dividend stocks with yields > 3%, offering yields above 3%.

- Get ahead of the curve and turn volatility into opportunity by reviewing these 3585 penny stocks with strong financials with exceptional financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New York Times might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NYT

New York Times

The New York Times Company, together with its subsidiaries, creates, collects, and distributes news and information worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives