- United States

- /

- Entertainment

- /

- NYSE:MSGE

Madison Square Garden Entertainment (MSGE): Assessing Valuation After Record Q1 Results and Upbeat Growth Outlook

Reviewed by Simply Wall St

Madison Square Garden Entertainment (MSGE) released its Q1 2026 earnings, showing revenue jumped 14% from last year as the company set a new record for the number of concerts at its flagship arena.

See our latest analysis for Madison Square Garden Entertainment.

MSGE’s upbeat earnings and record concert bookings appear to have struck a chord with investors. The stock’s year-to-date share price return has climbed over 30%, and total shareholder return for the past year is nearly 19%. Strong business momentum, management’s positive outlook, and steady share repurchases have helped fuel this rally. This suggests that market sentiment is growing increasingly optimistic about MSGE’s long-term prospects.

If you’re intrigued by MSGE’s momentum, now is a perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares already up sharply and results exceeding expectations, investors now face a key question: does MSGE remain undervalued after this rally, or is the stock price already reflecting all of the anticipated growth ahead?

Most Popular Narrative: 5.1% Undervalued

Madison Square Garden Entertainment’s last close at $46.51 is just below the most popular narrative fair value of $49. This sets up a debate about how much future earnings growth is already priced in, as the margin between current price and fair value is very slim.

Ongoing investments in premium hospitality and suite renovations, coupled with rising urban affluence and a focus on upgrading the guest experience, are expected to further boost ancillary and high-margin revenue streams, improving overall profitability.

Want to know the engine behind this price target? The narrative stakes its fair value on bold profit margin improvements and ambitious earnings growth projections. Which specific financial leap do analysts see that justifies the current premium, and can management deliver? Explore the “how” and “why” beneath the headline value to see the full rationale behind this number.

Result: Fair Value of $49 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, weaker ticket demand or missing out on high-profile residency events could quickly shift expectations for MSGE's revenue and profit trajectory.

Find out about the key risks to this Madison Square Garden Entertainment narrative.

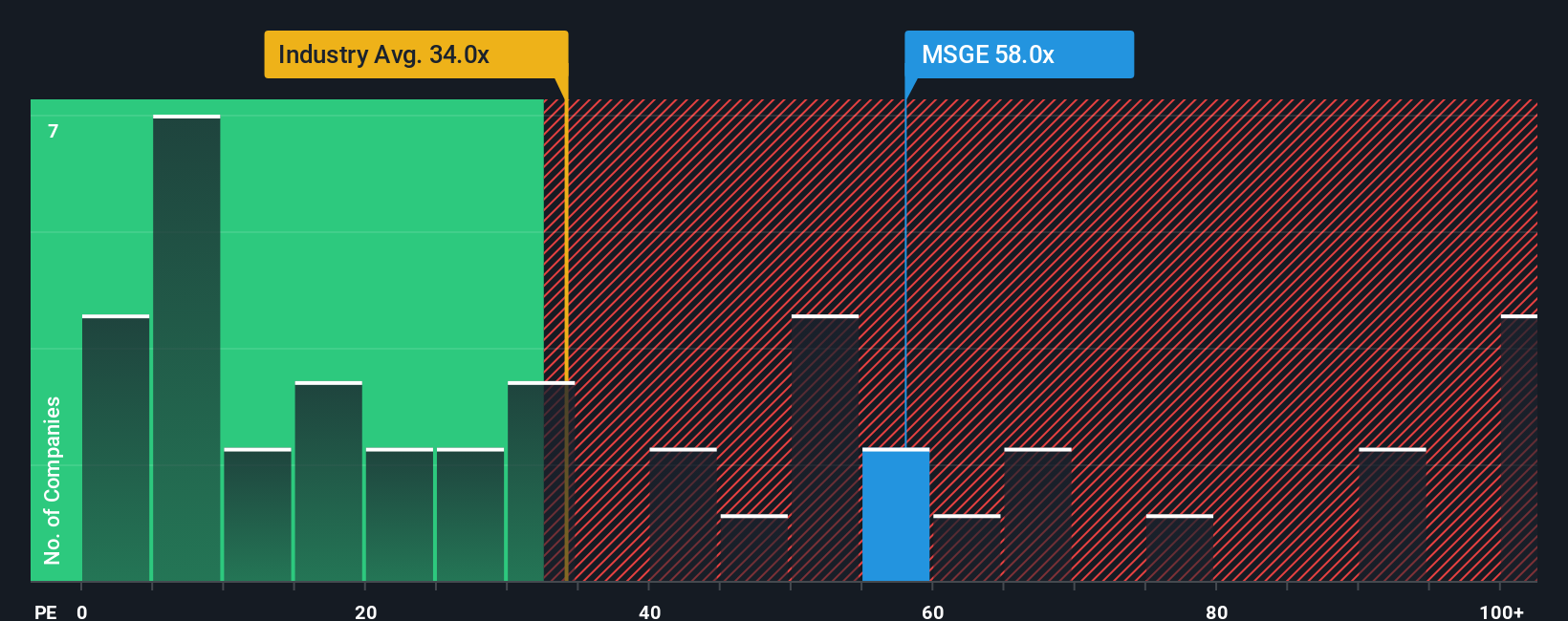

Another View: Market Ratios Paint a Different Picture

While the fair value analysis suggests MSGE is undervalued, a look at its actual price-to-earnings ratio tells another story. At 62.6x, the company trades much higher than both the US Entertainment industry average of 23.4x and the peer average of 71.2x. This also sits far above the fair ratio of 22.8x. This suggests the stock may be priced for near-perfect execution, leaving little room for error if growth expectations stumble. Is the current premium truly justified, or could the market sentiment shift just as quickly?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Madison Square Garden Entertainment Narrative

If you have a different take or want to dig deeper into the numbers yourself, it’s easy to build your own view about MSGE in just a few minutes. Do it your way

A great starting point for your Madison Square Garden Entertainment research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

You don’t want to stop here. Set yourself up for smart moves with proven ideas and fresh opportunities using the Simply Wall St Screener.

- Spot growth potential by jumping into these 25 AI penny stocks, leading innovation in artificial intelligence and transforming entire industries at a rapid pace.

- Unlock reliable passive income with access to these 16 dividend stocks with yields > 3%, which deliver attractive yields and consistent returns for long-term wealth building.

- Gear up for tomorrow by seeking out these 876 undervalued stocks based on cash flows, trading below their intrinsic worth and possibly offering exceptional upside if the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MSGE

Madison Square Garden Entertainment

Through its subsidiaries, engages in live entertainment business.

Reasonable growth potential with low risk.

Market Insights

Community Narratives