- United States

- /

- Media

- /

- NYSE:MNTN

Why MNTN (MNTN) Is Up After First Profit in Years and Launch of QuickFrame AI

Reviewed by Sasha Jovanovic

- MNTN, Inc. reported its first quarterly profit in four years for the third quarter of 2025, with sales reaching US$70.02 million and net income of US$6.44 million, alongside the launch of QuickFrame AI, an innovative video production platform powered by artificial intelligence.

- A key insight is the company’s accelerating shift toward small business customers, now representing 15% of revenue, suggesting expanding market reach beyond its traditional base.

- We'll explore how MNTN's debut of QuickFrame AI may shape investor perception and support its growth story in connected TV advertising.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

What Is MNTN's Investment Narrative?

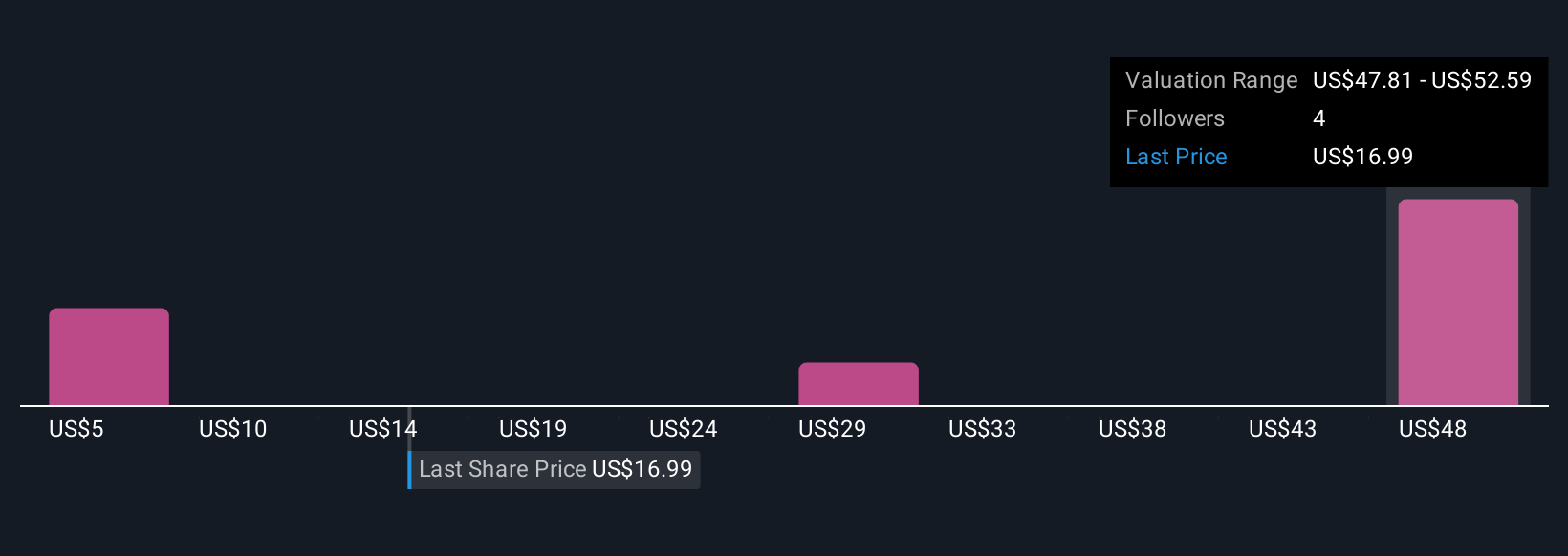

For investors eyeing MNTN, Inc., the story now centers on whether its first quarterly profit in four years marks a true inflection point. The launch of QuickFrame AI, which speeds up and democratizes ad production, could accelerate customer growth and broaden its market beyond large advertisers to small businesses, a demographic now accounting for 15% of revenue. This matters because previous risk assessments have focused on mounting losses and the challenge of scaling in an expensive sector. Now, positive net income, a robust Q4 revenue forecast, and recent platform enhancements all suggest stronger near-term growth catalysts than previously anticipated. However, it's important to note that profitability remains early-stage, legal risks (including a patent lawsuit) linger, and the share price’s recent sharp decline signals persistent investor caution. The recent earnings milestone has meaningfully shifted the short-term narrative, but fundamental risks are still in play.

Yet, legal headwinds and volatile price swings shouldn't be underestimated.

Exploring Other Perspectives

Explore 5 other fair value estimates on MNTN - why the stock might be worth over 3x more than the current price!

Build Your Own MNTN Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MNTN research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free MNTN research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MNTN's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MNTN

MNTN

Operates a technology platform that brings performance marketing to Connected TV.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives