- United States

- /

- Interactive Media and Services

- /

- NYSE:GRND

What Grindr (GRND)'s Strong Earnings and Board Changes Mean for Shareholders

Reviewed by Sasha Jovanovic

- Grindr Inc. announced its third quarter earnings for the period ending September 30, 2025, reporting sales of US$115.77 million and net income of US$30.83 million, both up from the previous year, along with key changes to its Board of Directors as James Lu stepped down and J. Michael Gearon, Jr. was appointed Lead Independent Director.

- The shift from a net loss to sustained profitability over the nine months, combined with leadership transitions, reflects significant operational progress and evolving corporate governance at the company.

- Given Grindr’s strong quarterly results and board changes, we'll consider how these developments may influence its investment narrative going forward.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Grindr Investment Narrative Recap

To own Grindr stock, you likely need to believe that its expansion across international markets, higher-value premium features, and ongoing product innovation will fuel sustainable user growth and stronger margins, even as near-term headwinds persist. The latest earnings show impressive revenue and net income gains, though the board reshuffle appears immaterial to the company's biggest near-term catalyst: growing monthly active users and engagement. The largest current risk still centers on profiting from recent feature launches fast enough to offset escalating expenses and preserve margins.

Among recent developments, Grindr reaffirmed guidance for at least 26% full-year revenue growth, directly underscoring management's confidence in user monetization and international expansion. While such momentum supports top-line optimism, it remains closely tied to Grindr’s ability to effectively roll out value-added products and maintain user engagement at scale, a focal point for its growth story.

On the other hand, investors should not lose sight of the risk lurking in...

Read the full narrative on Grindr (it's free!)

Grindr's narrative projects $698.7 million revenue and $166.0 million earnings by 2028. This requires 22.0% yearly revenue growth and a $221.5 million earnings increase from -$55.5 million.

Uncover how Grindr's forecasts yield a $22.75 fair value, a 67% upside to its current price.

Exploring Other Perspectives

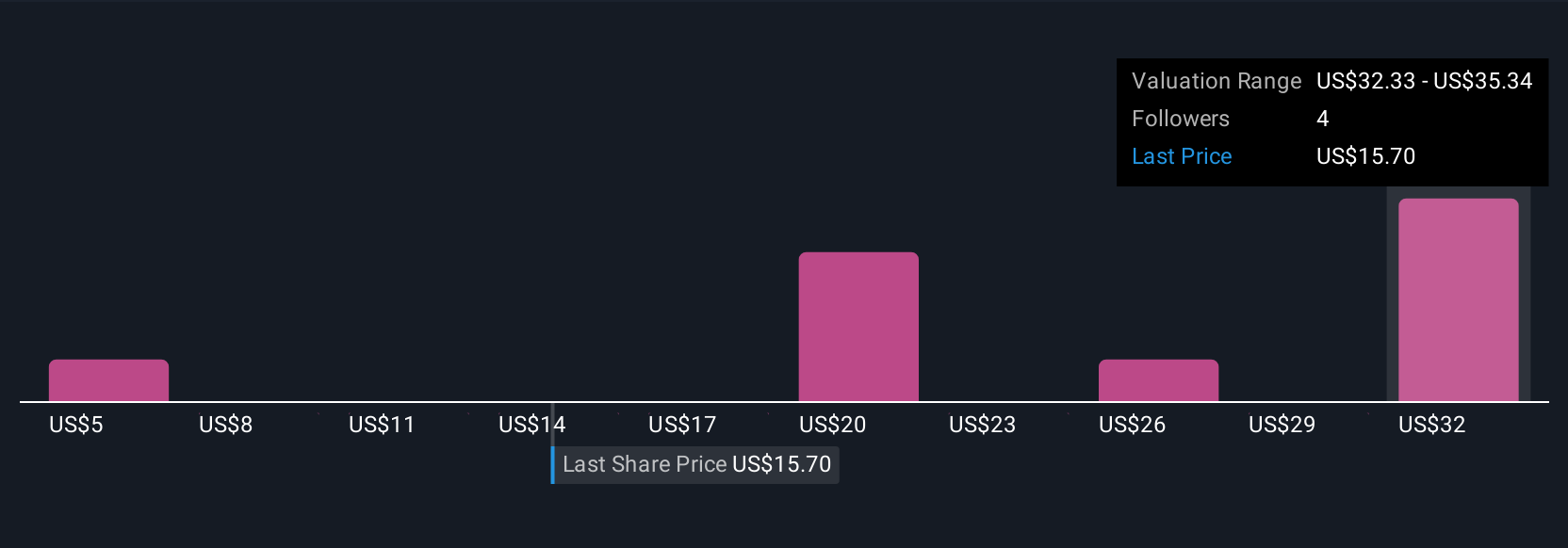

Six individual fair value estimates from the Simply Wall St Community range from US$5.24 to US$37.37 per share. With such a spread, consider how rising operating expenses and margin pressures could further widen opinions on Grindr’s trajectory; explore several viewpoints before deciding where you stand.

Explore 6 other fair value estimates on Grindr - why the stock might be worth over 2x more than the current price!

Build Your Own Grindr Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Grindr research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Grindr research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Grindr's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GRND

Grindr

Operates a social networking and dating application for the lesbian, gay, bisexual, transgender, and queer (LGBTQ) communities worldwide.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives