- United States

- /

- Media

- /

- NYSE:DV

DoubleVerify (DV): Assessing Valuation After New AI and Streaming Ad Product Launches

Reviewed by Simply Wall St

DoubleVerify Holdings (DV) just provided earnings guidance for both the fourth quarter and upcoming year, highlighting an expected revenue increase of about 10% for Q4 and nearly 14% for 2025. The announcement follows a wave of product launches. These initiatives are aimed at helping advertisers improve transparency and brand safety across streaming and AI-driven platforms.

See our latest analysis for DoubleVerify Holdings.

Despite a steady pace of innovation and collaboration announcements in AI and streaming fraud prevention, DoubleVerify's share price return tells a different story, falling over 50% year-to-date and posting a three-year total shareholder return of -64%. Short-term momentum has faded sharply, but long-term growth prospects could still appeal to investors willing to wait for sentiment to shift.

If the latest product launches have you scanning the digital media space, consider exploring the landscape of fast-growing companies led by insiders with something to prove. Discover fast growing stocks with high insider ownership

The disconnect between DoubleVerify's falling share price and its healthy projected growth raises a key question for investors: is all the bad news now reflected in the valuation, or does the recent selloff offer a genuine buying opportunity?

Most Popular Narrative: 42.2% Undervalued

DoubleVerify’s most widely followed narrative sees a fair value of $16.24, compared to its last closing price of $9.39. The gap between these numbers sets the stage for a bold view on the company’s future prospects.

The increasing complexity of global digital ad spend and tightening regulatory/brand safety requirements continue to drive advertisers towards trusted, independent verification partners like DoubleVerify. This positions the company to capture incremental market share as the digital ad market grows, supporting both topline revenue growth and margin durability.

Want to see what’s behind this striking upside? The fair value estimate leans on aggressive projections: revenue acceleration, fatter profit margins, and a bold long-term earnings runway. Curious which piece matters most? The full narrative breaks down the assumptions and the numbers driving this valuation.

Result: Fair Value of $16.24 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, DoubleVerify’s growth assumptions could be challenged if key digital platforms tighten data-sharing rules or if major advertisers choose to handle verification in-house.

Find out about the key risks to this DoubleVerify Holdings narrative.

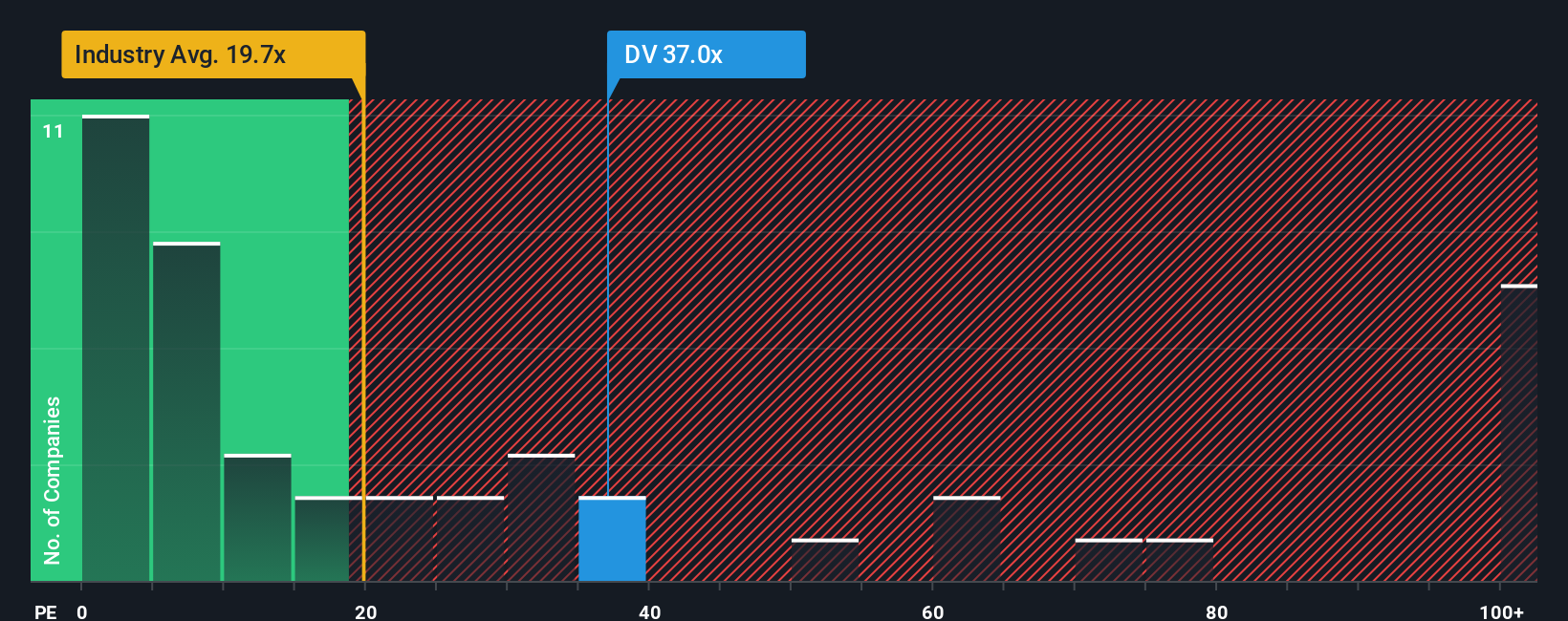

Another View: Digging Into Price Ratios

While the fair value calculation points to an undervalued story, the price-to-earnings ratio shows a different risk. DoubleVerify trades at 33.8 times earnings, distinctly higher than the industry average of 16.6 and well above the fair ratio estimate of 22. If market sentiment shifts, these elevated ratios could spark added volatility. Which method truly signals opportunity here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DoubleVerify Holdings Narrative

If you want to dig deeper or see things differently, the platform gives you everything you need to build your own view in minutes. Do it your way

A great starting point for your DoubleVerify Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't let the next opportunity slip through your fingers. Unlock smarter investment options hand-picked by the Simply Wall Street platform to help you get ahead and stay informed in a fast-moving market.

- Uncover surprising value by starting with these 876 undervalued stocks based on cash flows, which markets may have overlooked. This could help position you for potential gains if sentiment shifts.

- Boost your portfolio's income stream by checking out these 16 dividend stocks with yields > 3%, featuring yields above 3% from dependable companies.

- Ride the momentum in artificial intelligence by tapping into these 25 AI penny stocks, which are powering the next advances in data, automation, and innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DV

DoubleVerify Holdings

Provides media effectiveness platforms in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives