- United States

- /

- Entertainment

- /

- NYSE:DIS

Disney (DIS): Assessing Valuation as Shareholder Optimism Gradually Builds

Reviewed by Simply Wall St

Walt Disney (DIS) shares have seen mild movement this week, as investors assess the company’s recent performance and its long-term outlook. Over the past month, the stock is up about 1%, suggesting stable sentiment.

See our latest analysis for Walt Disney.

Disney’s stock has charted a slow but steady climb, with a 1-year total shareholder return of 12.8% reflecting renewed optimism as the company shifts gears from recent challenges. Momentum is tentatively building, but long-term investors remain watchful on valuation and growth signals.

If Disney’s recent resurgence has you thinking bigger, now is a great moment to broaden your search and discover fast growing stocks with high insider ownership

Yet with shares still more than 20% below average analyst price targets, the key question for investors is whether Disney's future growth is already reflected in its stock price or if a true buying opportunity remains.

Most Popular Narrative: 15.8% Undervalued

According to Cashflow_Queen's widely followed narrative, Walt Disney's fair value stands at $131.50, which is well above its recent closing price of $110.74. The numbers suggest that the market may be overlooking some powerful catalysts that could reshape Disney’s growth story in the years ahead.

ESPN remains the most valuable live sports platform, and its evolving partnership with the NFL is a game changer. Exclusive rights, expanded streaming packages, and the launch of ESPN Unlimited could make Disney the default home for professional football.

Want to know what’s fueling this bullish view? There is a bold assumption about Disney’s transformation into a digital sports powerhouse. Curious which ambitious margin targets and blockbuster growth drivers underpin this fair value? Get the details that move the forecast. See the full narrative.

Result: Fair Value of $131.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising sports rights costs or unexpected streaming competition could quickly undermine the bullish outlook that investors are hoping for in Disney’s next chapter.

Find out about the key risks to this Walt Disney narrative.

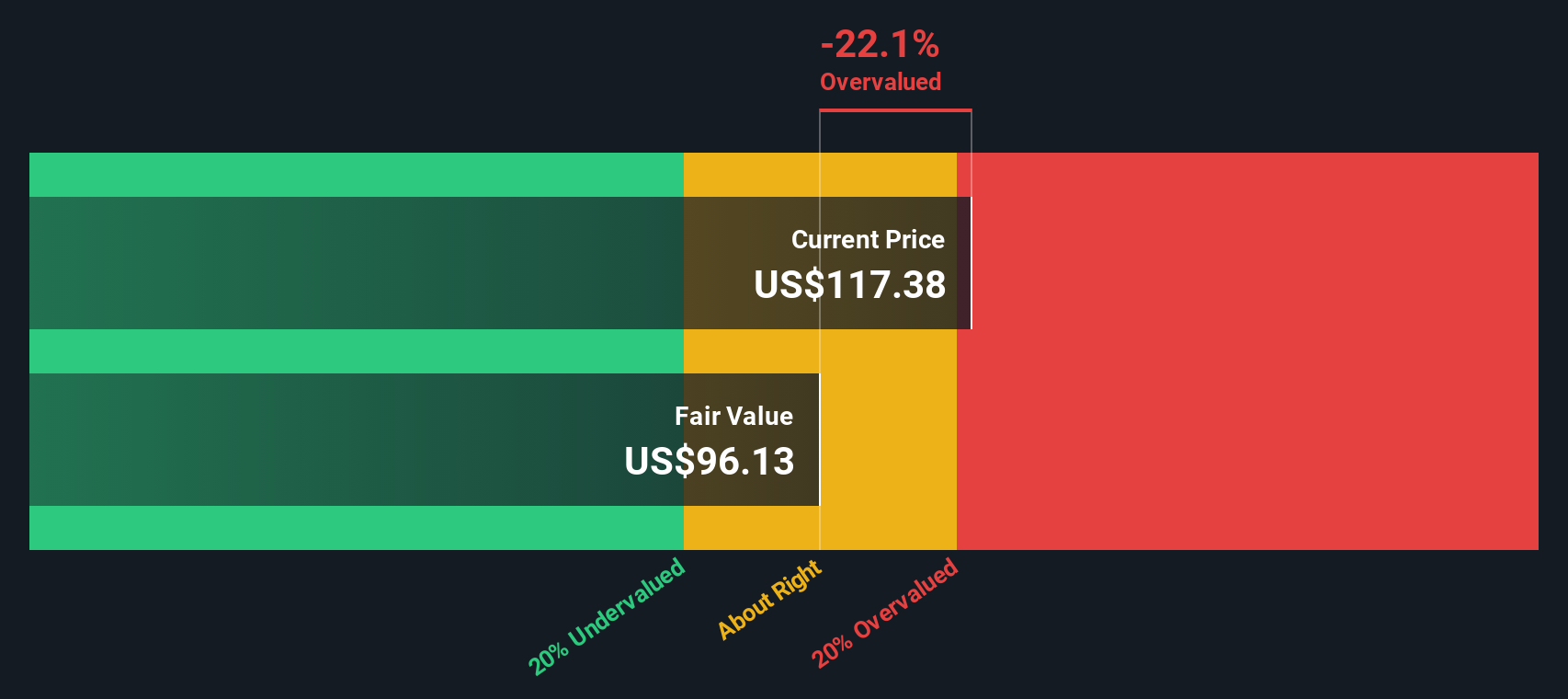

Another View: Fundamental Value Signal

Taking a step back from narrative and analyst targets, our SWS DCF model arrives at a more conservative estimate. The model suggests Disney may actually be trading above its calculated fair value of $104.51 per share. This leaves room for debate about the level of optimism already priced in. Is the market’s faith a little too far ahead of reality?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Walt Disney for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Walt Disney Narrative

If you’re keen to dig into the data and shape your own take on where Disney is headed, it only takes a few minutes to craft and share your perspective. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Walt Disney.

Looking for More Investment Ideas?

Don't let opportunities slip by while others put their money to work. Use the Simply Wall Street Screener to identify stocks with serious upside potential. You could stumble onto your next winning move in minutes.

- Capture income with ease by checking out these 16 dividend stocks with yields > 3% with yields above 3% and consistent cash flow potential.

- Stay ahead in innovation and ride the wave of breakthroughs through these 25 AI penny stocks as companies revolutionize industries with artificial intelligence.

- Step into tomorrow’s digital economy with these 82 cryptocurrency and blockchain stocks to gain exposure to cryptocurrency and blockchain-focused companies pushing new frontiers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Walt Disney might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DIS

Walt Disney

Operates as an entertainment company in the Americas, Europe, and the Asia Pacific.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives