Subdued Growth No Barrier To DHI Group, Inc. (NYSE:DHX) With Shares Advancing 30%

Despite an already strong run, DHI Group, Inc. (NYSE:DHX) shares have been powering on, with a gain of 30% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 38% in the last year.

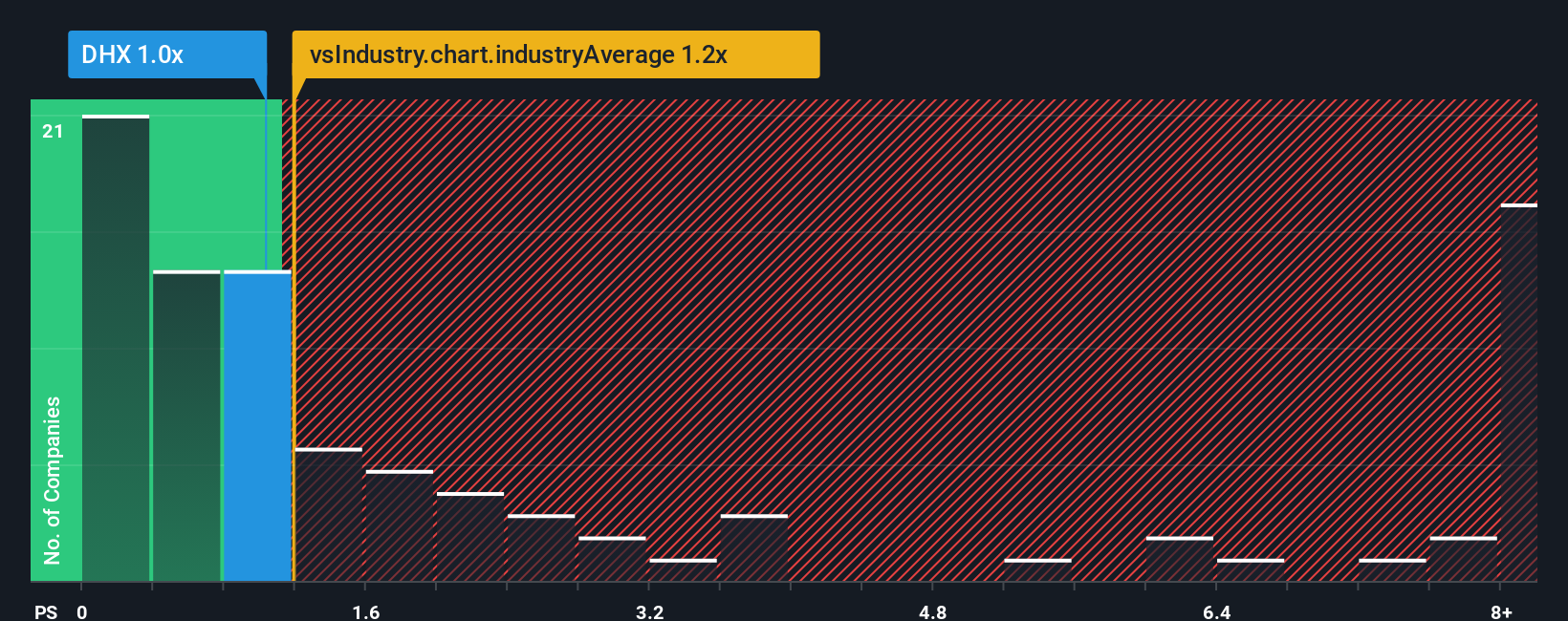

Although its price has surged higher, it's still not a stretch to say that DHI Group's price-to-sales (or "P/S") ratio of 1x right now seems quite "middle-of-the-road" compared to the Interactive Media and Services industry in the United States, where the median P/S ratio is around 1.2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for DHI Group

What Does DHI Group's Recent Performance Look Like?

DHI Group could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on DHI Group will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

DHI Group's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a frustrating 7.4% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 8.3% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 5.3% during the coming year according to the three analysts following the company. That's not great when the rest of the industry is expected to grow by 12%.

With this information, we find it concerning that DHI Group is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

The Key Takeaway

Its shares have lifted substantially and now DHI Group's P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It appears that DHI Group currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

And what about other risks? Every company has them, and we've spotted 1 warning sign for DHI Group you should know about.

If you're unsure about the strength of DHI Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:DHX

DHI Group

Provides data, insights, and employment connections through specialized services for technology professionals and other select online communities in the United States.

Slightly overvalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives