- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:ZD

Will Ziff Davis’ (ZD) Return to Profitability Redefine Its Investment Narrative?

Reviewed by Sasha Jovanovic

- Ziff Davis, Inc. released its third-quarter and nine-month results for the period ended September 30, 2025, reporting quarterly sales of US$363.71 million and a quarterly net loss of US$3.6 million, compared to sales of US$353.58 million and a much larger net loss a year earlier.

- Over the first nine months of 2025, the company moved from a net loss to a net income of US$46.98 million, reflecting a significant operational turnaround from the prior period.

- We'll explore how this earnings improvement, especially the return to positive net income, reshapes Ziff Davis's broader investment narrative.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Ziff Davis Investment Narrative Recap

To be a shareholder in Ziff Davis, you need to believe in the company’s ability to shift from heavy reliance on acquisitions to consistent performance in its digital content and SaaS-driven verticals. The recent quarterly results, showing a return to net income for the year-to-date, provide some reassurance but do not fundamentally change the short-term catalyst: delivering sustained organic growth while integrating past acquisitions. The biggest risk, persistent headwinds in digital advertising and overdependence on inorganic growth, remains material at this stage.

Among recent announcements, Ziff Davis’s large share repurchase program stands out. Continuing buybacks, including nearly 1.1 million shares purchased last quarter, underscore management’s confidence despite volatile earnings. For investors, this aligns with short-term catalysts by supporting earnings per share but does not mitigate structural risks around ad-based revenues and integration burdens from acquisitions.

However, investors should remain aware that despite this move to profitability, ongoing integration challenges from past acquisitions could still pressure future earnings if synergies...

Read the full narrative on Ziff Davis (it's free!)

Ziff Davis' outlook anticipates $1.6 billion in revenue and $235.9 million in earnings by 2028. This scenario assumes a 3.9% annual revenue growth rate and an increase in earnings of $169.8 million from the current $66.1 million.

Uncover how Ziff Davis' forecasts yield a $45.29 fair value, a 39% upside to its current price.

Exploring Other Perspectives

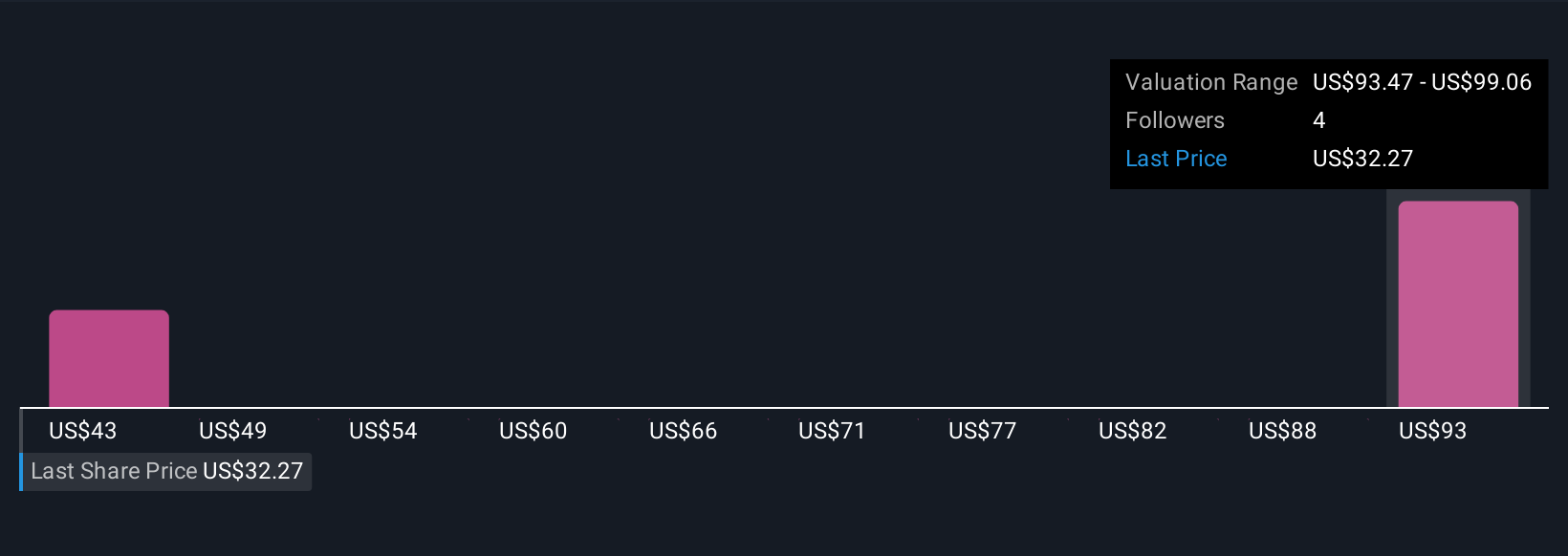

Simply Wall St Community members provided just 2 fair value estimates for Ziff Davis, ranging between US$45.29 and US$104.09 per share. While some see significant upside, ongoing exposure to shifts in digital advertising effectiveness continues to shape the company’s long-term performance outlook, so be sure to explore several viewpoints before forming your own assessment.

Explore 2 other fair value estimates on Ziff Davis - why the stock might be worth over 3x more than the current price!

Build Your Own Ziff Davis Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ziff Davis research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ziff Davis research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ziff Davis' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ziff Davis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZD

Ziff Davis

Operates as a digital media and internet company in the United States and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives