- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:VMEO

Vimeo, Inc.'s (NASDAQ:VMEO) 35% Price Boost Is Out Of Tune With Revenues

Vimeo, Inc. (NASDAQ:VMEO) shareholders have had their patience rewarded with a 35% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 54% in the last year.

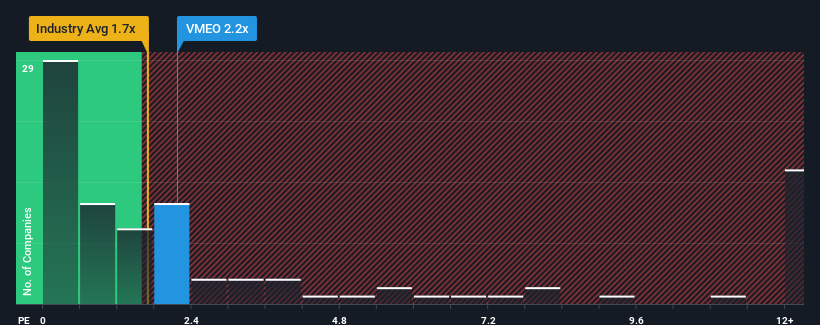

In spite of the firm bounce in price, there still wouldn't be many who think Vimeo's price-to-sales (or "P/S") ratio of 2.2x is worth a mention when the median P/S in the United States' Interactive Media and Services industry is similar at about 1.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Vimeo

How Vimeo Has Been Performing

Vimeo hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Vimeo will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

Vimeo's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 3.7%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 47% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to climb by 1.9% per year during the coming three years according to the seven analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 12% per annum, which is noticeably more attractive.

With this information, we find it interesting that Vimeo is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Final Word

Vimeo appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Given that Vimeo's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. A positive change is needed in order to justify the current price-to-sales ratio.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Vimeo with six simple checks will allow you to discover any risks that could be an issue.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:VMEO

Vimeo

Provides video software solutions in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives