- United States

- /

- Media

- /

- NasdaqGM:TTGT

Bearish: Analysts Just Cut Their TechTarget, Inc. (NASDAQ:TTGT) Revenue and EPS estimates

The analysts covering TechTarget, Inc. (NASDAQ:TTGT) delivered a dose of negativity to shareholders today, by making a substantial revision to their statutory forecasts for this year. Both revenue and earnings per share (EPS) estimates were cut sharply as the analysts factored in the latest outlook for the business, concluding that they were too optimistic previously.

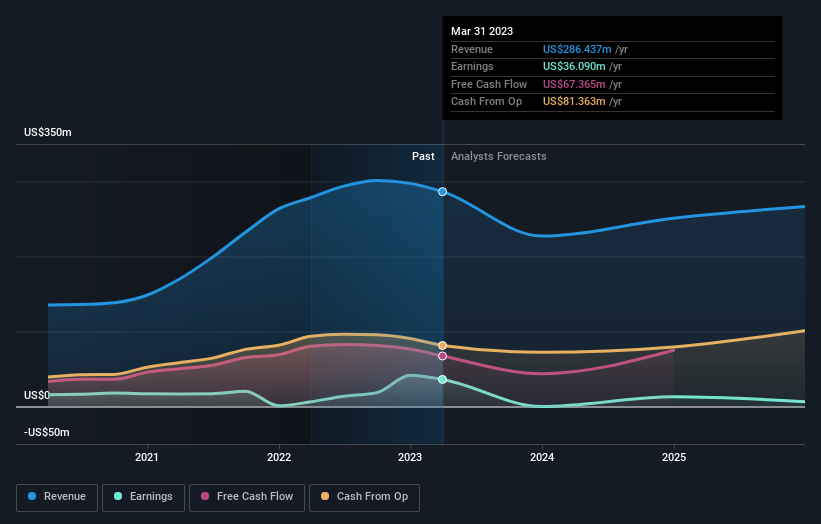

After the downgrade, the consensus from TechTarget's nine analysts is for revenues of US$227m in 2023, which would reflect a stressful 21% decline in sales compared to the last year of performance. Statutory earnings per share are supposed to crater 100% to US$0.00065 in the same period. Previously, the analysts had been modelling revenues of US$259m and earnings per share (EPS) of US$0.53 in 2023. Indeed, we can see that the analysts are a lot more bearish about TechTarget's prospects, administering a measurable cut to revenue estimates and slashing their EPS estimates to boot.

View our latest analysis for TechTarget

The consensus price target fell 20% to US$36.78, with the weaker earnings outlook clearly leading analyst valuation estimates. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. The most optimistic TechTarget analyst has a price target of US$55.00 per share, while the most pessimistic values it at US$27.00. Note the wide gap in analyst price targets? This implies to us that there is a fairly broad range of possible scenarios for the underlying business.

Of course, another way to look at these forecasts is to place them into context against the industry itself. We would highlight that sales are expected to reverse, with a forecast 27% annualised revenue decline to the end of 2023. That is a notable change from historical growth of 23% over the last five years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 3.8% per year. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - TechTarget is expected to lag the wider industry.

The Bottom Line

The most important thing to take away is that analysts cut their earnings per share estimates, expecting a clear decline in business conditions. Regrettably, they also downgraded their revenue estimates, and the latest forecasts imply the business will grow sales slower than the wider market. Given the scope of the downgrades, it would not be a surprise to see the market become more wary of the business.

Still, the long-term prospects of the business are much more relevant than next year's earnings. We have estimates - from multiple TechTarget analysts - going out to 2025, and you can see them free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if TechTarget might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:TTGT

TechTarget

Provides marketing and sales services that deliver business impact for business-to-business technology companies in North America and internationally.

Fair value with moderate growth potential.