- United States

- /

- Media

- /

- NasdaqGM:PUBM

PubMatic (PUBM) Valuation in Focus After Q3 Sales Decline and Wider Net Loss

Reviewed by Simply Wall St

PubMatic (PUBM) just released its third quarter earnings report, highlighting a drop in sales and a larger net loss compared to last year. In addition to these results, the company shared new revenue guidance for the upcoming quarter.

See our latest analysis for PubMatic.

After a tough year marked by a 33.2% total shareholder loss, PubMatic’s share price staged a dramatic turnaround, soaring 43% in just one day and rallying over 37% in the past month. This sudden momentum suggests a sharp shift in investor sentiment, likely fueled by the company’s outlook and recent financial disclosures.

If PubMatic’s surge has you rethinking what’s possible in the market, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

But after such a rapid rebound, the key question remains: is PubMatic now trading at a bargain, or are investors already factoring in the company’s potential turnaround and future growth?

Most Popular Narrative: 1.8% Undervalued

At $10.97, PubMatic trades just below the most popular narrative's fair value estimate of $11.17. This proximity reflects a market that is moving almost in sync with the consensus view, but with just enough of a discount to catch attention.

PubMatic's ongoing AI-driven product innovation, such as generative AI media buying tools, automated optimization, and predictive analytics, are delivering operational efficiencies and performance improvements for customers. Management states these advances are funding increased investments in go-to-market and tech capabilities without adding material costs, supporting future margin expansion.

Why does this estimate stand out? Hint: it is not just the AI buzz, but bold financial forecasts for margin expansion and strategic pivots that shape the calculation. If you want to see how revenue assumptions, margin turns, and one big industry shift all fuel this fair value, the full narrative unpacks it all. Do you want to know what could truly move the needle for PubMatic's next chapter?

Result: Fair Value of $11.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent dependence on major DSP partners and ongoing industry shifts could disrupt PubMatic’s outlook. This could challenge the turnaround narrative from here.

Find out about the key risks to this PubMatic narrative.

Another View: Caution from Revenue Multiples

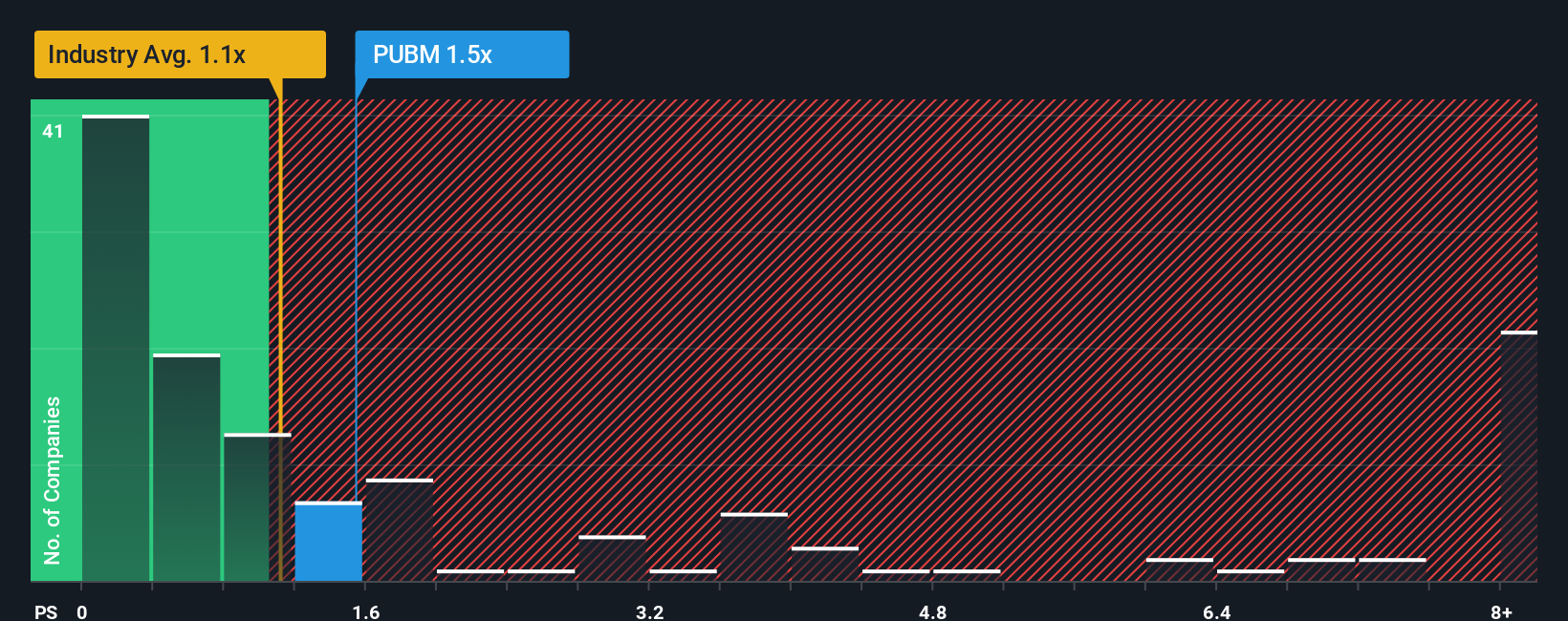

Looking at PubMatic from the perspective of its revenue ratio, the picture is less optimistic. The company currently trades at 1.8 times revenue, which is notably higher than both the US Media industry average of 1.0x and its own fair ratio of 0.8x. This premium suggests investors are already paying up for potential, leaving less margin for safety if growth stalls. If the market eventually adjusts toward that fair ratio, what would happen to today's upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own PubMatic Narrative

If these stories do not quite capture your take, you can dive into the numbers and assemble your own narrative from scratch in just a few minutes, your way with Do it your way.

A great starting point for your PubMatic research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investing means keeping your options open and acting before the crowd moves. Don’t miss out on these hand-picked opportunities waiting for your next move:

- Boost your portfolio’s earning power and secure high potential income by tapping into these 15 dividend stocks with yields > 3%, with yields that go beyond the ordinary.

- Ride the innovation wave and stay ahead of the curve by investing in these 26 AI penny stocks, which are transforming industries with artificial intelligence breakthroughs.

- Position yourself early in tomorrow’s trends by seizing value in these 872 undervalued stocks based on cash flows before others spot the hidden upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:PUBM

PubMatic

A technology company, engages in the provision of a cloud infrastructure platform that enables real time programmatic advertising transactions for digital content creators, advertisers, agencies, agency trading desks, and demand side platforms worldwide.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives