- United States

- /

- Media

- /

- NasdaqGS:MGNI

Could Magnite's (MGNI) CTV Platform Expansion Reveal Its Edge in Programmatic Advertising?

Reviewed by Sasha Jovanovic

- In the past week, Viant Technology announced an expanded partnership with Magnite's SpringServe video platform, enabling advertisers direct integration for more transparent supply paths and streamlined CTV campaign execution.

- This move underscores a growing industry push toward interoperability and transparency in programmatic advertising, benefiting both media buyers and publishers by increasing efficiency and control.

- We'll explore how Magnite's deepening CTV integrations and publisher relationships are influencing its long-term investment narrative.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Magnite Investment Narrative Recap

To own Magnite, you need conviction in the long-term growth of independent, programmatic connected TV advertising and the company's ability to maintain deep relationships with top publishers and agencies. The expanded Viant partnership solidifies Magnite's competitive position in CTV and adds further weight to near-term growth catalysts, but it does not fundamentally reduce the biggest risks: customer concentration among large streamers and ongoing exposure to industry-wide shifts in ad budgets and regulatory developments.

Among recent events, the launch of the LocalLinear TV Private Marketplace is most relevant, as it signals Magnite's commitment to bridging the gap between digital and linear TV. This move directly supports the company's push to capture more ad spend in emerging CTV and local broadcast channels, further aligning with the view that success in this space hinges on delivering more efficient, transparent, and converged buying experiences.

However, despite major new partnerships and expanding capabilities, risks tied to concentration among a handful of dominant CTV platforms remain something investors should not overlook...

Read the full narrative on Magnite (it's free!)

Magnite's narrative projects $796.3 million in revenue and $189.5 million in earnings by 2028. This requires 5.1% yearly revenue growth and a $146.4 million increase in earnings from the current $43.1 million.

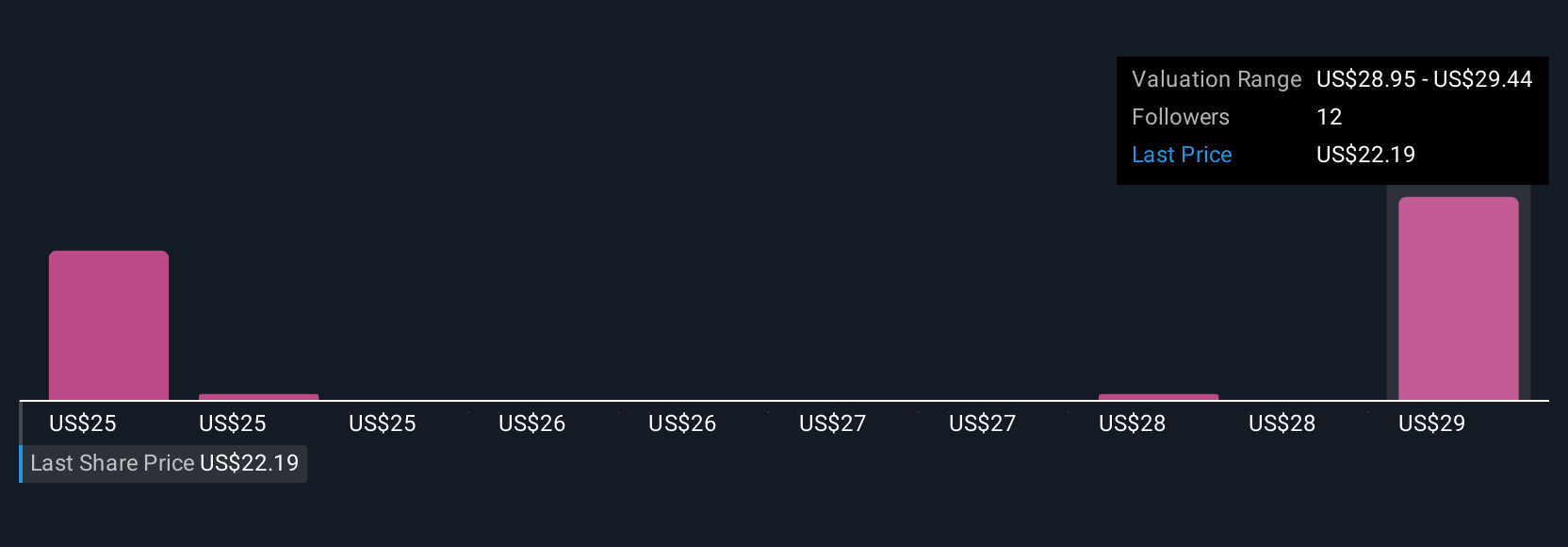

Uncover how Magnite's forecasts yield a $28.19 fair value, a 87% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community estimate Magnite’s fair value between US$24.70 and US$127.59 per share. While some forecast significant upside, the ongoing reliance on large CTV partners could shape future results in unexpected ways and merits attention from all sides.

Explore 5 other fair value estimates on Magnite - why the stock might be worth just $24.70!

Build Your Own Magnite Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Magnite research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Magnite research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Magnite's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MGNI

Magnite

Operates an independent omni-channel sell-side advertising platform in the United States and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives