Stock Analysis

- United States

- /

- Entertainment

- /

- NasdaqCM:GMGI

Investors Appear Satisfied With Golden Matrix Group, Inc.'s (NASDAQ:GMGI) Prospects As Shares Rocket 39%

Golden Matrix Group, Inc. (NASDAQ:GMGI) shareholders would be excited to see that the share price has had a great month, posting a 39% gain and recovering from prior weakness. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 4.1% in the last twelve months.

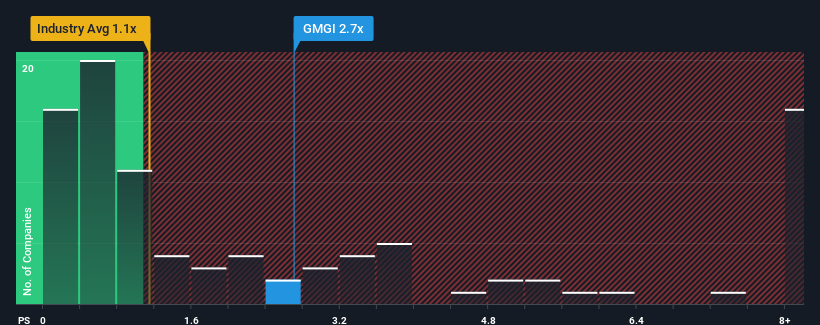

After such a large jump in price, when almost half of the companies in the United States' Entertainment industry have price-to-sales ratios (or "P/S") below 1.1x, you may consider Golden Matrix Group as a stock probably not worth researching with its 2.7x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Golden Matrix Group

How Golden Matrix Group Has Been Performing

Recent times have been advantageous for Golden Matrix Group as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Golden Matrix Group.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Golden Matrix Group would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 23%. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 172% as estimated by the sole analyst watching the company. That's shaping up to be materially higher than the 13% growth forecast for the broader industry.

With this information, we can see why Golden Matrix Group is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does Golden Matrix Group's P/S Mean For Investors?

Golden Matrix Group shares have taken a big step in a northerly direction, but its P/S is elevated as a result. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Golden Matrix Group maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Entertainment industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Golden Matrix Group (1 is a bit unpleasant!) that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're helping make it simple.

Find out whether Golden Matrix Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:GMGI

Golden Matrix Group

Golden Matrix Group, Inc. provides enterprise software-as-a-service solutions for online casino and sports betting operators.

Flawless balance sheet with weak fundamentals.