- United States

- /

- Packaging

- /

- NYSE:SON

Should Sonoco Products' (SON) Packaging Division Realignment Prompt a Rethink of Its Regional Strategy?

Reviewed by Sasha Jovanovic

- Earlier this week, Sonoco Products announced a major consolidation of its Metal Packaging and Rigid Paper Containers businesses into two new geographic divisions, alongside senior leadership appointments for its Consumer Packaging operations in EMEA/APAC and the Americas.

- This realignment signals a sharpened focus on regional management and operational integration, with experienced leaders stepping into pivotal roles to oversee growth and efficiency across these core packaging segments.

- We'll examine how the consolidation and new leadership roles could shape Sonoco's investment outlook and operational priorities going forward.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Sonoco Products Investment Narrative Recap

To be a long-term Sonoco shareholder, you need confidence in the company's ability to execute on sustainable packaging growth while managing integration risks and shifting demand dynamics in Europe and Asia. The recent consolidation of Metal Packaging and Rigid Paper Containers into regional Consumer Packaging divisions is unlikely to materially change the most important near-term catalyst, which remains the successful realization of cost synergies from recent acquisitions, though integration risk remains heightened during transitions of this scale.

Of the latest corporate updates, the October 2025 earnings announcement stands out, with Sonoco reporting year-over-year increases in quarterly sales and net income. These results are pivotal for investors focused on the company's ability to generate the margin and productivity improvements targeted as part of its reorganization and synergy programs.

However, it's important to remember that beneath these developments, exposure to macroeconomic slowdowns in key regions could hinder growth potential if...

Read the full narrative on Sonoco Products (it's free!)

Sonoco Products' outlook anticipates $8.3 billion in revenue and $584.7 million in earnings by 2028. Achieving this would require 9.5% annual revenue growth and an increase in earnings of about $491.6 million from the current $93.1 million.

Uncover how Sonoco Products' forecasts yield a $53.75 fair value, a 32% upside to its current price.

Exploring Other Perspectives

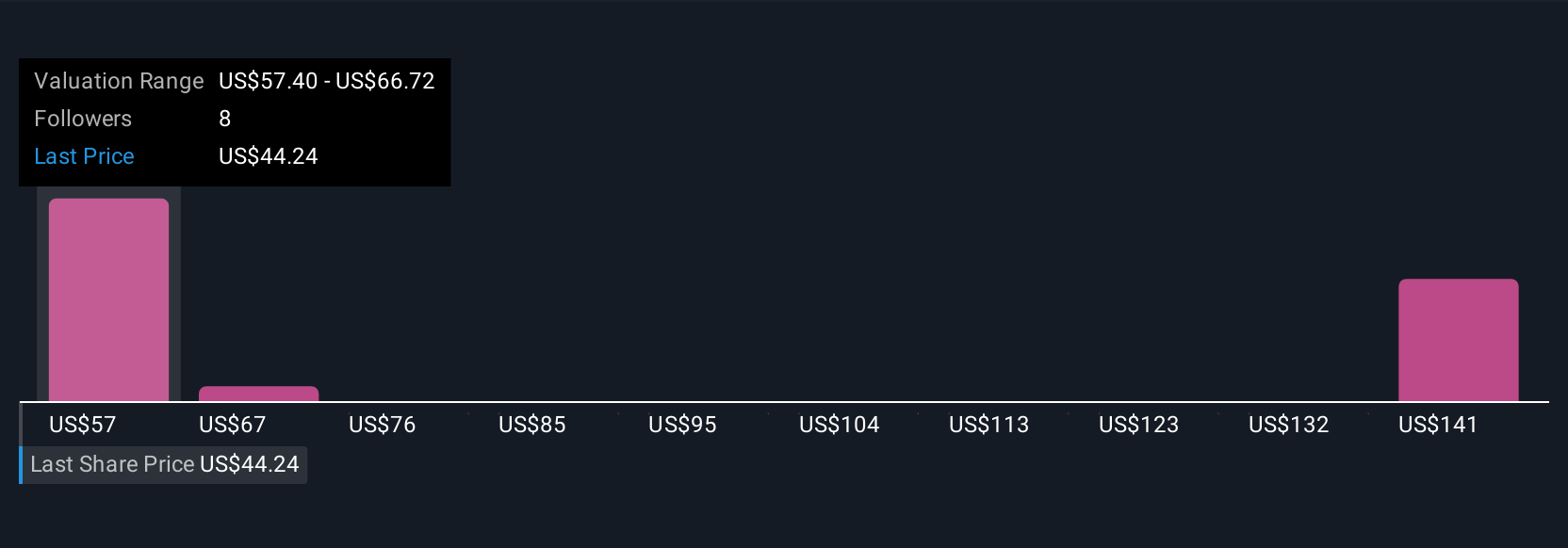

Three fair value estimates from the Simply Wall St Community range from US$53.75 to US$123.27 per share, reflecting a wide span of investor outlooks. With the company's future tied to the success of its acquisition integrations and synergy delivery, readers can explore how these opinions align with high-impact operational shifts.

Explore 3 other fair value estimates on Sonoco Products - why the stock might be worth over 3x more than the current price!

Build Your Own Sonoco Products Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sonoco Products research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Sonoco Products research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sonoco Products' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SON

Sonoco Products

Designs, develops, manufactures, and sells various engineered and sustainable packaging products in the United States, Europe, Canada, the Asia Pacific, and internationally.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives