- United States

- /

- Paper and Forestry Products

- /

- NYSE:SLVM

Can Sylvamo's (SLVM) Weaker Earnings Reveal More About Its Long-Term Competitive Strength?

Reviewed by Sasha Jovanovic

- Sylvamo Corporation recently reported third quarter 2025 results showing a decline in sales to US$846 million and net income to US$57 million, compared to the same period last year.

- An important aspect is that these earnings fell well short of the prior year’s results, reflecting reduced profitability and operational headwinds during the year so far.

- We’ll explore how these weaker earnings results could impact Sylvamo’s investment narrative, particularly in light of ongoing operational challenges.

Find companies with promising cash flow potential yet trading below their fair value.

Sylvamo Investment Narrative Recap

To be a Sylvamo shareholder right now, you need to believe that the company's operational efficiency improvements and cost-cutting efforts can help counteract both the cyclical weakness and secular challenges in paper markets. The latest quarterly results, with sales and net income falling sharply from the prior year, reinforce that the biggest near-term catalyst, lower maintenance outage costs in the second half, remains unchanged, but highlight rising risk from persistent earnings pressure; this earnings miss does not materially shift the immediate investment case, but ongoing margin compression is critical to watch. On the company front, the recent resignation of two directors and the conclusion of a cooperation agreement with the Atlas Group is the most relevant development beyond earnings for investors. While board changes themselves do not usually affect operations in the short term, this announcement comes at a moment when strong governance and board stability are arguably more important amid strategic execution challenges and the upcoming CEO transition. In contrast, Sylvamo’s heavy reliance on uncoated freesheet paper, a segment under long-term threat from digital substitution, remains a risk investors should be fully aware of…

Read the full narrative on Sylvamo (it's free!)

Sylvamo's outlook anticipates $3.5 billion in revenue and $238.5 million in earnings by 2028. This implies a 0.8% annual revenue decline and a $20.5 million increase in earnings from the current $218.0 million.

Uncover how Sylvamo's forecasts yield a $53.67 fair value, a 25% upside to its current price.

Exploring Other Perspectives

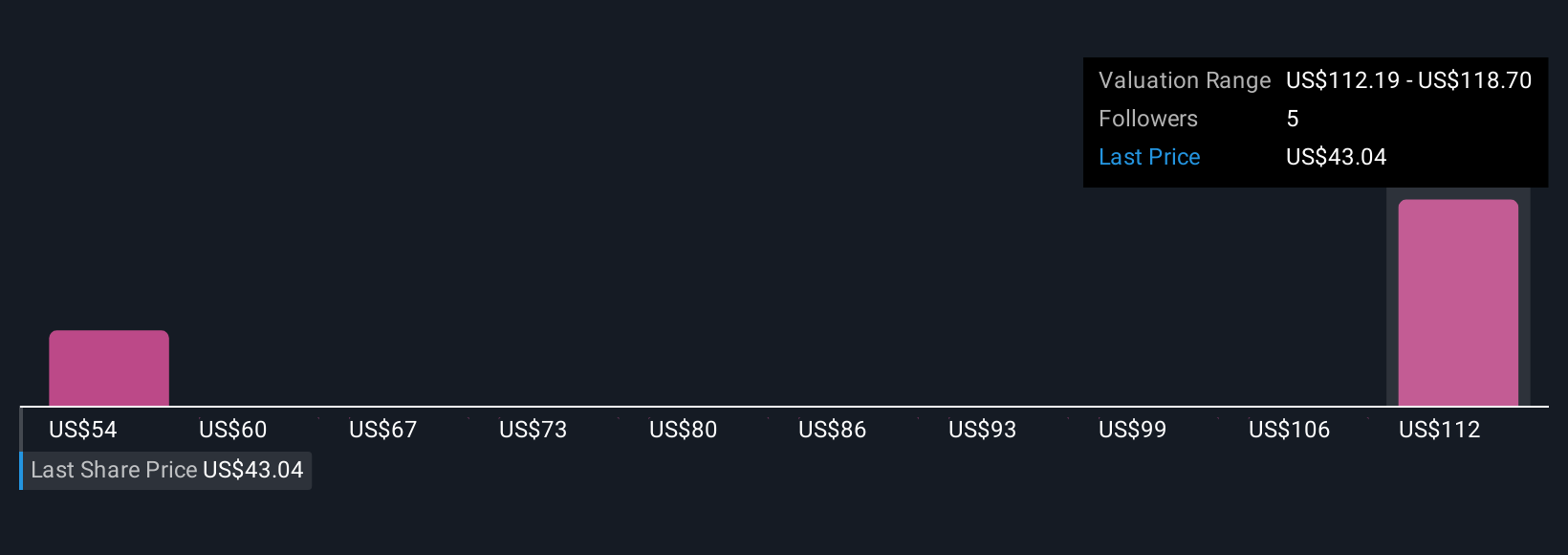

Simply Wall St Community members have shared two fair value estimates between US$53.67 and US$96.90. With ongoing earnings pressure and exposure to structurally declining paper demand, perspectives vary widely, check out alternative viewpoints to see how others weigh the risks and upside potential.

Explore 2 other fair value estimates on Sylvamo - why the stock might be worth over 2x more than the current price!

Build Your Own Sylvamo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sylvamo research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Sylvamo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sylvamo's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SLVM

Sylvamo

Produces and markets uncoated freesheet for cutsize, offset paper, and pulp in Europe, Latin America, and North America.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives