- United States

- /

- Chemicals

- /

- NYSE:PRM

Can New US Contract Help Perimeter Solutions (PRM) Balance Global Ambitions and Specialty Segment Hurdles?

Reviewed by Sasha Jovanovic

- Perimeter Solutions announced third quarter and nine-month 2025 results, highlighting an increase in sales to US$315.44 million and a reduction in net losses for the year-to-date period, despite continued operational challenges and litigation in its Specialty Products segment.

- Securing a new contract with the US Forest Service and expanding its Fire Safety operations internationally have positioned the company to enhance its presence in both domestic and global markets.

- We’ll explore how the US Forest Service contract and Fire Safety segment growth influence Perimeter Solutions’ investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Perimeter Solutions' Investment Narrative?

For investors to back Perimeter Solutions, the bet has always hinged on its ability to capture the expanding demand for wildfire protection amid rising global climate-related threats, while successfully navigating operational hurdles and litigation in its Specialty Products segment. The recent third-quarter earnings underscored strong top-line momentum, with sales climbing to US$315.44 million and notable year-to-date net loss improvement. The new US Forest Service contract is a clear positive, reinforcing Perimeter’s reputation as a key government partner which could speed up domestic growth initiatives, though the overall profit picture is still impacted by the Specialty Products issues. With losses largely narrowing, this new deal and continued global expansion shift short-term catalysts more firmly in favor of the Fire Safety business, but the unresolved litigation risk remains front and center, especially for investors focused on stability and predictable profit growth. On the flipside, continued global expansion comes with its own execution risks that shouldn’t be ignored.

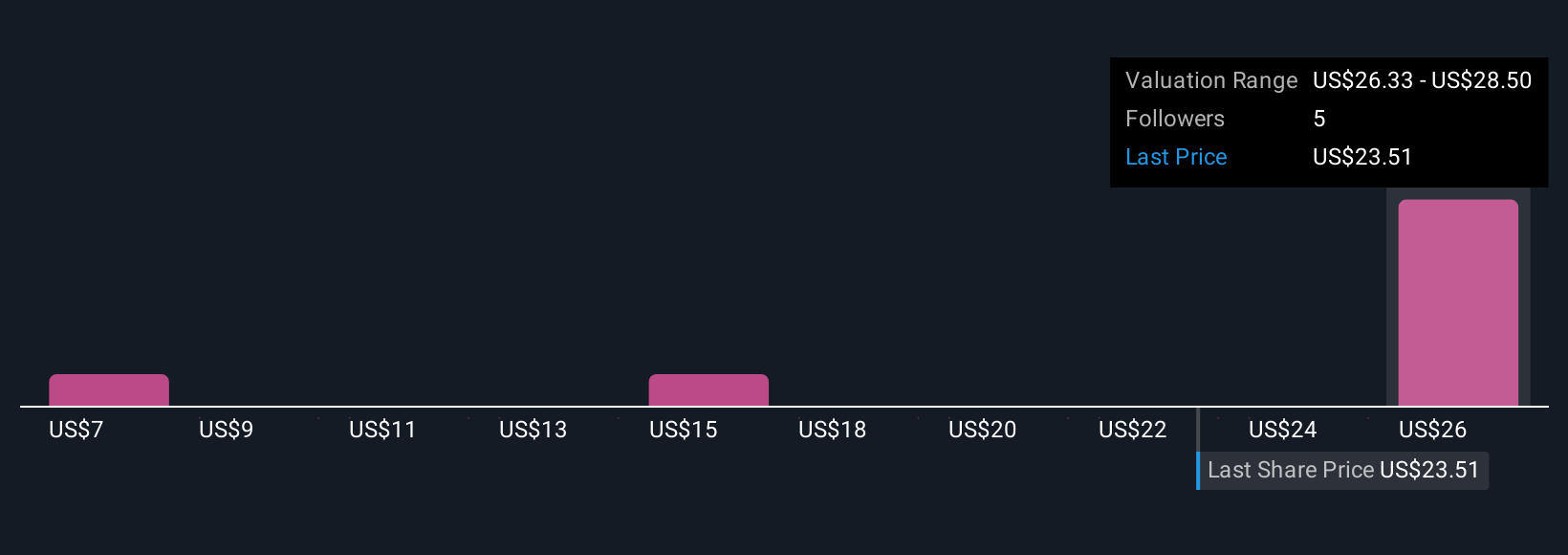

But despite the new contract, the unresolved litigation risk remains a pressing issue for shareholders. Despite retreating, Perimeter Solutions' shares might still be trading 17% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 4 other fair value estimates on Perimeter Solutions - why the stock might be worth as much as 20% more than the current price!

Build Your Own Perimeter Solutions Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Perimeter Solutions research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Perimeter Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Perimeter Solutions' overall financial health at a glance.

No Opportunity In Perimeter Solutions?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PRM

Perimeter Solutions

Manufactures and supplies firefighting products and lubricant additives in the United States, Germany, and internationally.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives