- United States

- /

- Basic Materials

- /

- NYSE:MLM

How Recent Infrastructure Spending Impacts Martin Marietta’s Current Share Price

Reviewed by Bailey Pemberton

- Wondering if Martin Marietta Materials is trading at a bargain or riding high on market optimism? You are not alone. There has been plenty of chatter about whether its price matches up to its true worth.

- The stock has shown impressive resilience, holding a 19.6% gain year-to-date despite a slight dip of 0.4% over the past week and -3.4% in the last month. It has risen 138.7% in the past five years.

- Recent news has highlighted continued infrastructure spending across the U.S., positioning Martin Marietta Materials as a key beneficiary in the sector. Investors are watching closely as legislation and government contracts translate into a robust pipeline for building materials companies like Martin Marietta.

- According to valuation checks, the company currently scores 0 out of 6 for being undervalued, a figure that invites a closer look. Let us dig into the valuation models that analysts use and find out why there may be an even smarter way to understand the company's true value. The answer is revealed at the end of this article.

Martin Marietta Materials scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Martin Marietta Materials Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows based on reasonable assumptions and then discounting these projections to today using a required rate of return. This approach provides a grounded perspective on what a business might truly be worth, rather than relying solely on market sentiment.

For Martin Marietta Materials, the most recent Free Cash Flow stands at $1.03 billion. According to analysts, Free Cash Flow is expected to rise consistently over the next decade, reaching approximately $1.97 billion by 2035. The initial five years of these projections are backed by analyst estimates, while later years are extrapolated using measured growth rates.

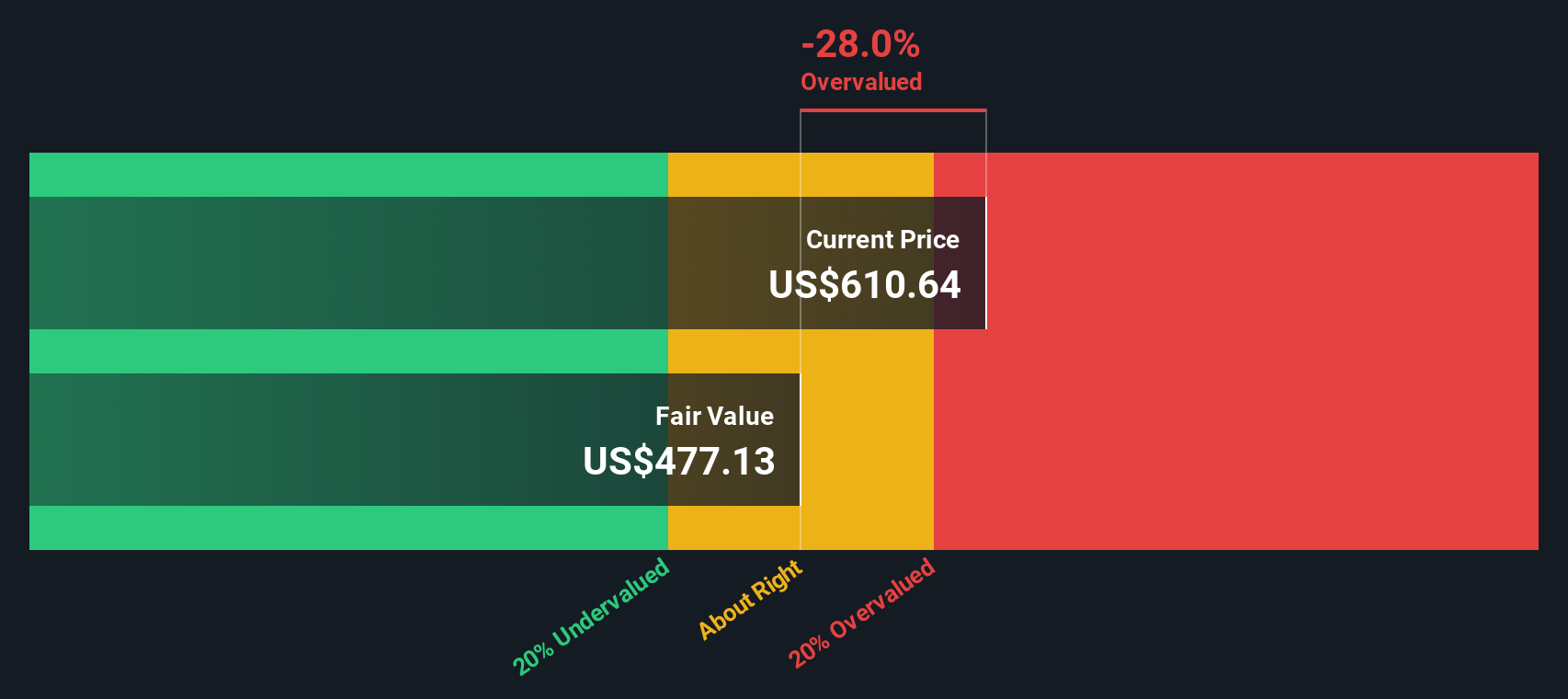

Based on this two-stage Free Cash Flow to Equity model, the DCF calculation delivers an estimated intrinsic value of $481.79 per share. However, when compared to the current share price, the model signals the stock may be 26.7% overvalued. In other words, the market seems to be pricing in more optimism than the cash flows alone might justify.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Martin Marietta Materials may be overvalued by 26.7%. Discover 876 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Martin Marietta Materials Price vs Earnings

For companies with reliable profits, the Price-to-Earnings (PE) ratio is often the first stop for valuation. The PE ratio helps investors quickly gauge what the market is willing to pay today for a dollar of current earnings, making it a go-to metric for profitable firms like Martin Marietta Materials.

However, it is important to remember that not all PE ratios are created equal. Growth prospects and the risks a company faces both play a big role in what counts as a "normal" or “fair” PE. High growth and low risk typically justify a higher multiple. In contrast, slow growth or added uncertainty calls for a discount.

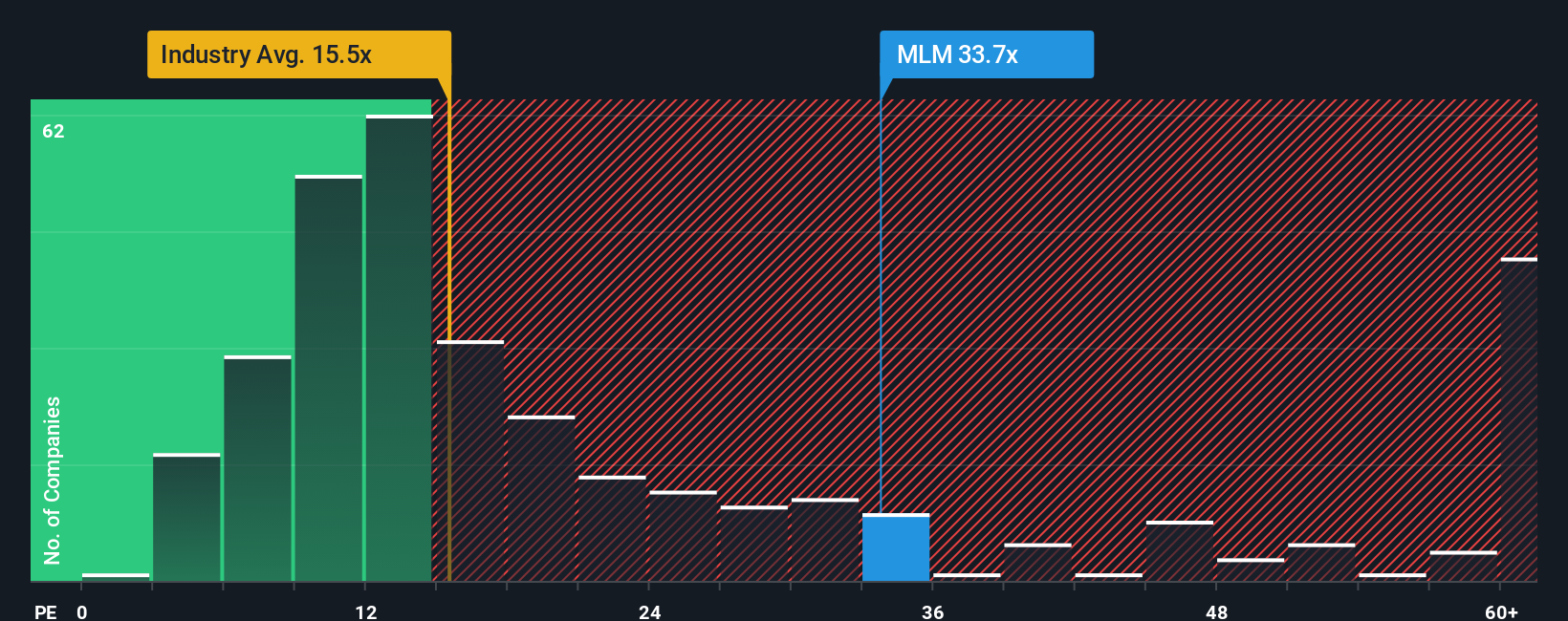

Right now, Martin Marietta Materials trades at a PE ratio of 31.1x. This is well above the Basic Materials industry average of 15.1x and also higher than its peer group average of 24.5x. At first glance, this may suggest the market is comparatively optimistic about the company's outlook.

Simply Wall St's proprietary "Fair Ratio," which customizes a fair PE based on factors like Martin Marietta's earnings growth, margins, size, industry conditions, and company-specific risks, lands at 22.8x. This approach aims to provide a more meaningful benchmark than just the industry or peers because it captures the nuances of the company's unique financial profile and growth trajectory.

Comparing the Fair Ratio of 22.8x to the current PE of 31.1x, Martin Marietta Materials appears to be trading at a premium. The gap indicates the stock may be overvalued compared to where a balanced, risk- and growth-adjusted valuation suggests it should trade.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1404 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Martin Marietta Materials Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is more than a number; it lets you capture your own story or perspective about a company by tying your expectations for its future revenue, earnings, and margins directly to a forecast and a fair value estimate.

On Simply Wall St’s Community page, Narratives are a powerful, easy-to-use tool trusted by millions of investors to see a clear link between a company’s story, its financials, and the fair value those assumptions imply. The beauty of Narratives is how they help you make real buy or sell decisions: you can compare your calculated Fair Value to today's Price, see if the market agrees with your outlook, and instantly update your view whenever news or new financial results come out.

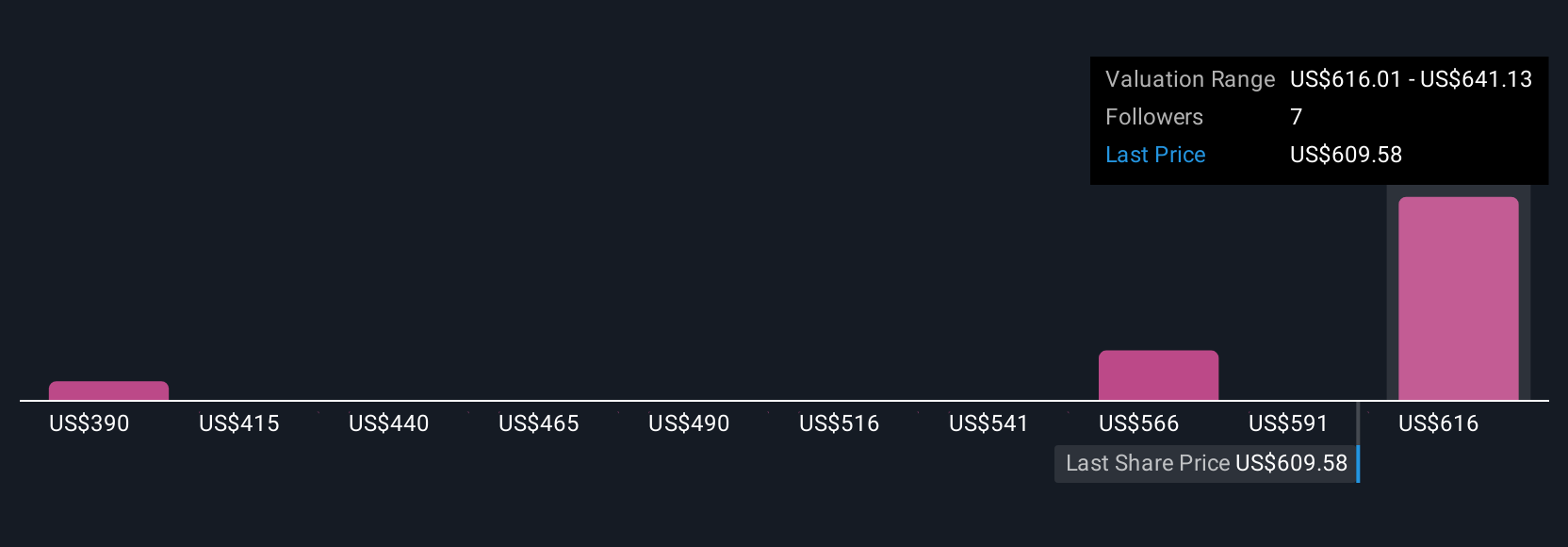

For Martin Marietta Materials, you might see one investor’s Narrative forecasting robust infrastructure demand and margin growth, resulting in a projected fair value as high as $725. Alternatively, a more cautious view might focus on regulatory risk or slowing construction, implying a fair value closer to $440. Narratives make it straightforward to see, share, and refine your investment reasoning as new information emerges.

Do you think there's more to the story for Martin Marietta Materials? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MLM

Martin Marietta Materials

A natural resource-based building materials company, supplies aggregates and heavy-side building materials to the construction industry in the United States and internationally.

Mediocre balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives