- United States

- /

- Chemicals

- /

- NYSE:KWR

Quaker Chemical (KWR): Assessing Valuation After Recent Share Price Momentum

Reviewed by Simply Wall St

Quaker Chemical (KWR) has seen shares move steadily in recent weeks, with the stock up 10% over the past month. Investors may be watching for underlying trends in demand or upcoming catalysts that could impact valuation.

See our latest analysis for Quaker Chemical.

Momentum has returned for Quaker Chemical. After a 1-month share price return of nearly 10%, the stock is recovering some ground even as its 1-year total shareholder return remains notably negative. Investors seem to be recalibrating growth expectations after a challenging stretch, signaling potential changes in risk perception and sentiment.

If you’re looking to uncover fresh opportunities outside the usual names, now is a great moment to broaden your search and discover fast growing stocks with high insider ownership

With shares still trading below analyst price targets and a recently improved growth outlook, the key question is whether Quaker Chemical’s current valuation leaves room for upside or if the market already reflects its future potential.

Most Popular Narrative: 14.9% Undervalued

Quaker Chemical's fair value is estimated at $162, notably higher than the latest closing price of $137.87. This gap hints at untapped upside, with several anticipated drivers shaping the valuation outlook.

The ongoing roll-out of FLUID INTELLIGENCE (breakthrough sensor technology, digitalization, and automation of services) creates stickier customer relationships and recurring revenue streams, while also differentiating Quaker in an environment increasingly focused on sustainability and efficiency. This supports more predictable cash flows and potentially higher net margins.

Want to know what powers this bullish outlook? One bold forecast about expanding profit margins and a swing in earnings momentum sets this price apart. Uncover the crucial assumptions behind these projections. Are the analysts seeing something the broader market is missing?

Result: Fair Value of $162 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent market volatility in EMEA and elevated debt levels may limit near-term earnings growth, which adds uncertainty to the current bullish outlook.

Find out about the key risks to this Quaker Chemical narrative.

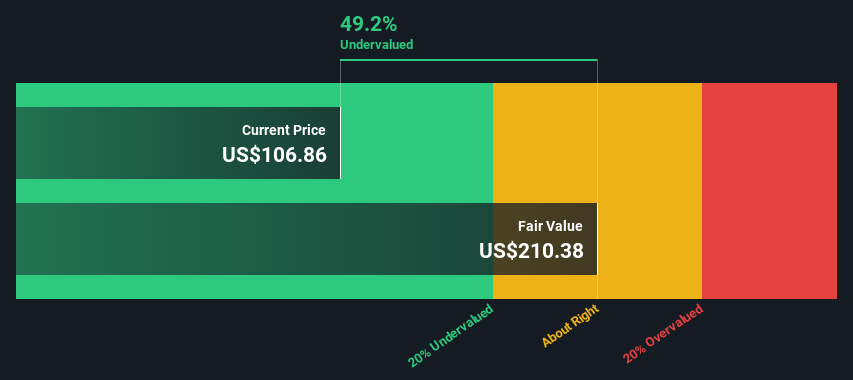

Another View: DCF Tells a Different Story

Looking from a different angle, our DCF model places Quaker Chemical’s fair value at $270.49. This suggests the shares are trading well below this mark, indicating a significant potential upside. This raises the question of whether the market might be undervaluing the company's future cash flows.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Quaker Chemical Narrative

If you have your own angle on the data or want to dig deeper, you can craft a personalized take in just a few minutes. So why not Do it your way

A great starting point for your Quaker Chemical research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Your next great stock pick could be just a click away. Go beyond the familiar and seize high-potential opportunities using these unique investment themes from Simply Wall Street.

- Tap into attractive yields that can boost your portfolio income by exploring these 16 dividend stocks with yields > 3%.

- Spot companies on the frontier of artificial intelligence when you check out these 25 AI penny stocks.

- Find value-packed shares that most investors might miss with a closer look at these 876 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quaker Chemical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KWR

Quaker Chemical

Quaker Chemical Corporation, doing business as Quaker Houghton, provides industrial process fluids worldwide.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives