- United States

- /

- Chemicals

- /

- NYSE:KWR

Can Quaker Chemical's (KWR) Rising Sales Offset Its Profitability Pressures?

Reviewed by Sasha Jovanovic

- Quaker Chemical announced its third quarter 2025 results in late October, reporting year-over-year sales growth to US$493.84 million but a slight decline in net income to US$30.47 million, along with an update on its share buyback program nearing completion.

- One important insight is that, despite higher sales, the company recorded a net loss for the first nine months of 2025, compared to a net income over the same period last year, suggesting margin and profitability pressures.

- We'll examine how the combination of higher sales and reduced profitability impacts Quaker Chemical's investment narrative and outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Quaker Chemical Investment Narrative Recap

To be a shareholder in Quaker Chemical, you need to believe in its long-term potential to benefit from growing demand for specialty solutions and new manufacturing capacity, despite current headwinds. The latest earnings report, with higher sales but a year-to-date net loss, reinforces margin pressures as the biggest risk, while successful expansion and integration in high-growth regions remain the most important catalyst. For now, this quarterly update does not fundamentally alter either the near-term risk or catalyst, but it does underscore how sensitive profitability is to margin shifts.

Among the recent announcements, the company’s near-completion of its US$85.75 million share buyback program stands out. Although buybacks can bolster per-share metrics and signal management’s confidence, their benefits can be limited if underlying profitability remains challenged. With Quaker’s margins under pressure, investors may wish to consider whether capital returns or business reinvestment is the greater priority given current profit trends.

However, investors should not overlook how persistent cost inflation and shifting product mix could…

Read the full narrative on Quaker Chemical (it's free!)

Quaker Chemical's outlook projects $2.1 billion in revenue and $531.8 million in earnings by 2028. This scenario requires 3.9% annual revenue growth and a $538.9 million increase in earnings from the current -$7.1 million.

Uncover how Quaker Chemical's forecasts yield a $162.00 fair value, a 16% upside to its current price.

Exploring Other Perspectives

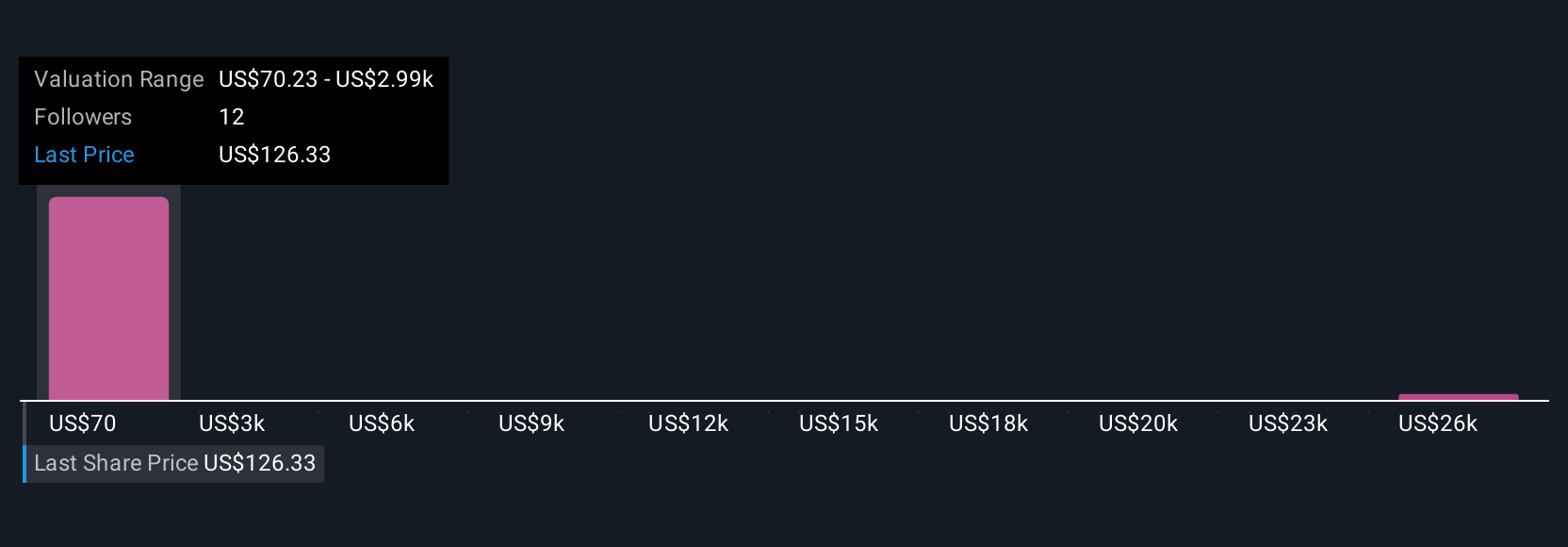

Simply Wall St Community members provided 5 unique fair value estimates ranging from US$70 to over US$29,000 per share. While optimism about future growth is common, ongoing margin declines remain an important concern shaping the company’s broader performance. Explore how these valuation opinions differ and what that might mean for your own outlook.

Explore 5 other fair value estimates on Quaker Chemical - why the stock might be a potential multi-bagger!

Build Your Own Quaker Chemical Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Quaker Chemical research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Quaker Chemical research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Quaker Chemical's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quaker Chemical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KWR

Quaker Chemical

Quaker Chemical Corporation, doing business as Quaker Houghton, provides industrial process fluids worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives