- United States

- /

- Chemicals

- /

- NYSE:HUN

How Huntsman’s (HUN) Deep Cost Cuts and Dividend Reduction Could Reshape Its Investment Case

Reviewed by Sasha Jovanovic

- Earlier this month, Huntsman Corporation announced third-quarter results showing US$1,460 million in sales and a net loss of US$25 million, alongside a 65% dividend reduction as part of a US$100 million cost-reduction program involving over 600 job cuts and seven site closures, primarily in Europe.

- This significant focus on preserving cash and reshaping operations signals a heightened response to ongoing financial pressures and continued weaker demand in its key markets.

- We'll examine how the renewed emphasis on cost savings and a sharply lower dividend influences Huntsman’s investment narrative moving forward.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

Huntsman Investment Narrative Recap

For Huntsman shareholders, the core investment thesis often centers on a recovery in demand for advanced materials and polyurethane products, as well as ongoing portfolio shifts toward higher-margin specialty chemicals. Recent news on cost reductions and the largest-ever dividend cut represent a material shift: preserving cash and closing higher-cost European sites could support margin improvement, but weak construction and housing demand remains a critical short-term catalyst and the biggest near-term risk.

The recent US$0.0875 per share dividend announcement, a 65% reduction, directly underscores Huntsman's emphasis on liquidity and financial sustainability in the current challenging operating environment. This move provides additional flexibility but also signals that management sees current market headwinds as persistent, maintaining the focus on strengthening the balance sheet rather than near-term shareholder returns.

However, investors should also be mindful that, while new cost-saving initiatives could help stabilize margins, persistent global overcapacity and rising competition in Europe could continue to weigh heavily on...

Read the full narrative on Huntsman (it's free!)

Huntsman's outlook anticipates $6.4 billion in revenue and $43.7 million in earnings by 2028. This is based on a 2.7% annual revenue growth rate and a $353.7 million increase in earnings from the current level of -$310.0 million.

Uncover how Huntsman's forecasts yield a $10.42 fair value, a 27% upside to its current price.

Exploring Other Perspectives

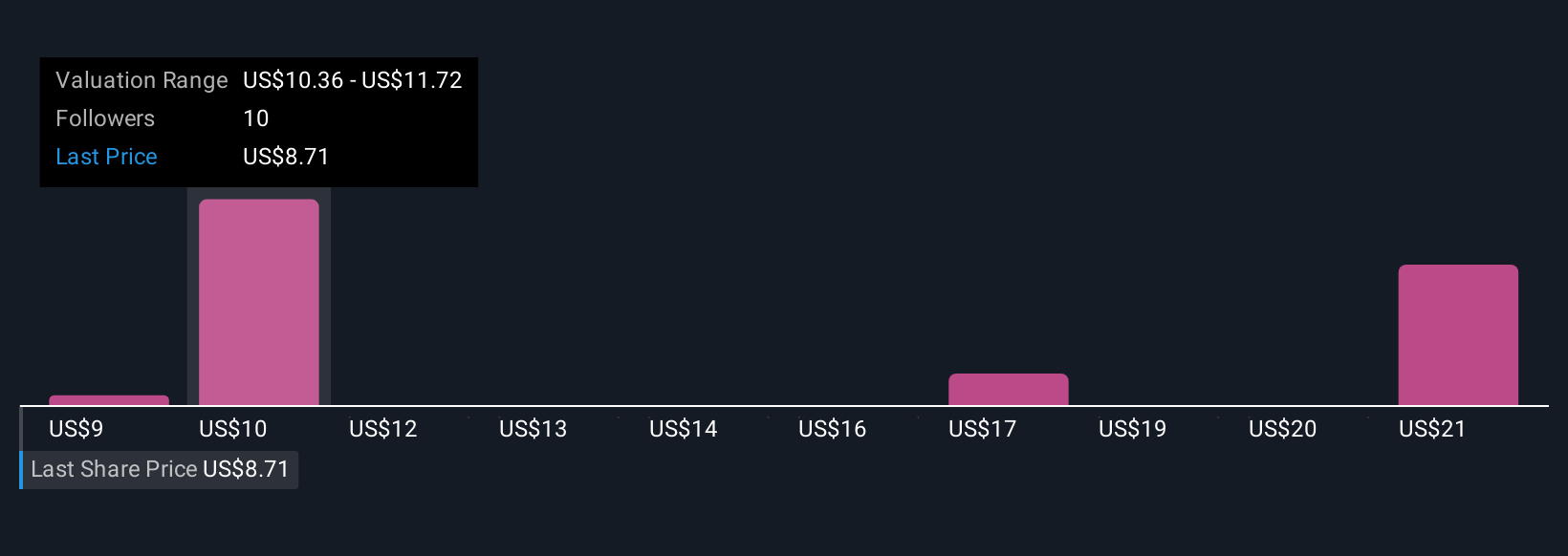

Simply Wall St Community estimates for fair value stretch from US$2.31 to US$17.16 across five viewpoints, showing wide disagreement. As you review these perspectives, keep in mind that ongoing cost pressures in Europe may shape Huntsman's earnings outlook for some time to come.

Explore 5 other fair value estimates on Huntsman - why the stock might be worth over 2x more than the current price!

Build Your Own Huntsman Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Huntsman research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Huntsman research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Huntsman's overall financial health at a glance.

No Opportunity In Huntsman?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Huntsman might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HUN

Huntsman

Manufactures and sells diversified organic chemical products worldwide.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives