- United States

- /

- Chemicals

- /

- NYSE:GCP

Would Shareholders Who Purchased GCP Applied Technologies' (NYSE:GCP) Stock Three Years Be Happy With The Share price Today?

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But if you try your hand at stock picking, your risk returning less than the market. Unfortunately, that's been the case for longer term GCP Applied Technologies Inc. (NYSE:GCP) shareholders, since the share price is down 27% in the last three years, falling well short of the market return of around 45%. It's down 1.6% in the last seven days.

View our latest analysis for GCP Applied Technologies

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

GCP Applied Technologies became profitable within the last five years. We would usually expect to see the share price rise as a result. So given the share price is down it's worth checking some other metrics too.

Arguably the revenue decline of 5.4% per year has people thinking GCP Applied Technologies is shrinking. After all, if revenue keeps shrinking, it may be difficult to find earnings growth in the future.

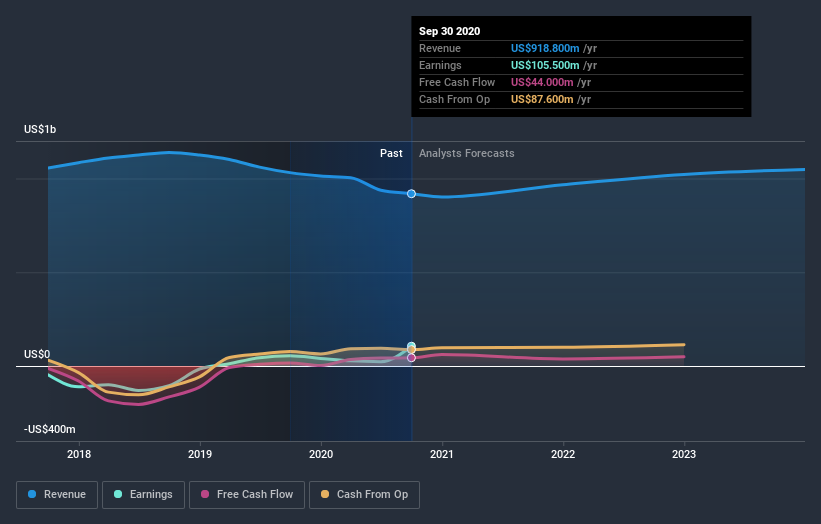

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. You can see what analysts are predicting for GCP Applied Technologies in this interactive graph of future profit estimates.

A Different Perspective

Over the last year GCP Applied Technologies shareholders have received a TSR of 5.5%. While you don't go broke making a profit, this return was actually lower than the average market return of about 22%. The silver lining is that the recent rise is far preferable to the annual loss of 8% that shareholders have suffered over the last three years. We hope the turnaround in fortunes continues. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - GCP Applied Technologies has 2 warning signs we think you should be aware of.

GCP Applied Technologies is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

When trading GCP Applied Technologies or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:GCP

GCP Applied Technologies

GCP Applied Technologies Inc. produces and sells specialty construction chemicals and specialty building materials worldwide.

Excellent balance sheet with poor track record.

Similar Companies

Market Insights

Community Narratives