- United States

- /

- Chemicals

- /

- NYSE:GCP

With EPS Growth And More, GCP Applied Technologies (NYSE:GCP) Is Interesting

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like GCP Applied Technologies (NYSE:GCP). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for GCP Applied Technologies

How Fast Is GCP Applied Technologies Growing Its Earnings Per Share?

In a capitalist society capital chases profits, and that means share prices tend rise with earnings per share (EPS). So like a ray of sunshine through a gap in the clouds, improving EPS is considered a good sign. It is therefore awe-striking that GCP Applied Technologies's EPS went from US$0.34 to US$1.52 in just one year. Even though that growth rate is unlikely to be repeated, that looks like a breakout improvement.

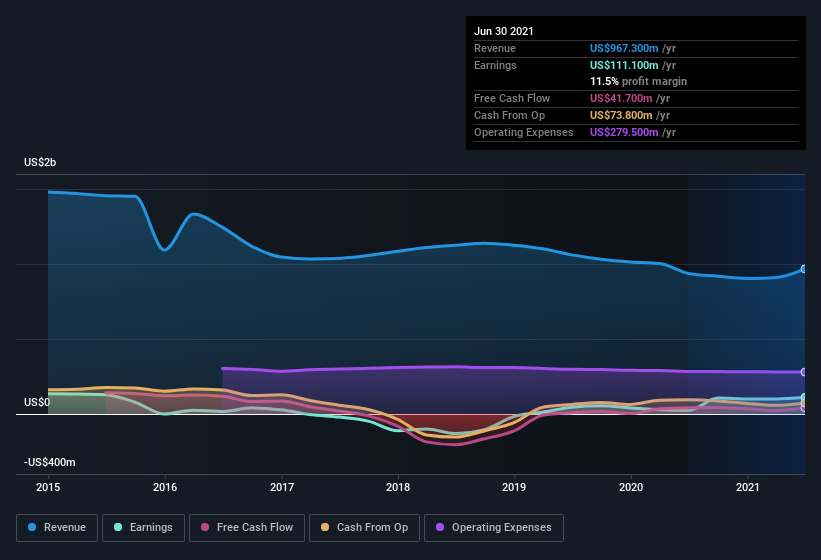

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. GCP Applied Technologies maintained stable EBIT margins over the last year, all while growing revenue 3.2% to US$967m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future GCP Applied Technologies EPS 100% free.

Are GCP Applied Technologies Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

First things first; I didn't see insiders sell GCP Applied Technologies shares in the last year. But the really good news is that Independent Director Armand Lauzon spent US$390k buying stock stock, at an average price of around US$24.36. To me that means at least one insider thinks that the company is doing well - and they are backing that view with cash.

The good news, alongside the insider buying, for GCP Applied Technologies bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they hold US$23m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Despite being just 1.4% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Is GCP Applied Technologies Worth Keeping An Eye On?

GCP Applied Technologies's earnings have taken off like any random crypto-currency did, back in 2017. The cherry on top is that insiders own a bunch of shares, and one has been buying more. Because of the potential that it has reached an inflection point, I'd suggest GCP Applied Technologies belongs on the top of your watchlist. Before you take the next step you should know about the 2 warning signs for GCP Applied Technologies that we have uncovered.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of GCP Applied Technologies, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading GCP Applied Technologies or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:GCP

GCP Applied Technologies

GCP Applied Technologies Inc. produces and sells specialty construction chemicals and specialty building materials worldwide.

Excellent balance sheet with poor track record.

Similar Companies

Market Insights

Community Narratives