- United States

- /

- Basic Materials

- /

- NYSE:EXP

Evaluating Eagle Materials (EXP) Valuation After Analyst Downgrades And Mixed Performance Signals

Several big banks have turned more cautious on Eagle Materials (EXP), trimming their ratings and outlooks. This shift comes even as the company reports firm cement and aggregates volumes and attracts sizeable institutional interest.

See our latest analysis for Eagle Materials.

Recent moves in Eagle Materials’ share price have been relatively steady, with a 15.41% 90 day share price return and a 73.34% three year total shareholder return contrasting with a 5.72% one year total shareholder return decline. This suggests longer term momentum while shorter term sentiment cools following analyst downgrades, a fresh dividend declaration, and sizeable new institutional buying.

If you are looking beyond building materials and want more ideas, this could be a good moment to scan 23 top founder-led companies as potential next candidates for your watchlist.

With analysts trimming price targets even as institutional buyers commit fresh capital and a discounted intrinsic value is flagged, is Eagle Materials quietly undervalued today, or are markets already pricing in its future growth?

Most Popular Narrative: 4.3% Overvalued

The most followed narrative currently pegs Eagle Materials’ fair value at $225.50, slightly below the last close at $235.11. This frames the recent analyst caution in a different light.

Fair Value: Model fair value has been revised from $236.80 to $225.50, a small downward adjustment of about $11.30 per share.

Discount Rate: The discount rate used in the valuation has edged up from 8.26% to 8.36%, indicating a slightly higher required return in the updated assumptions.

Read the complete narrative. Read the complete narrative.

The story behind that fair value hinges on slower forecast revenue growth, leaner profit margins, and a slightly richer future earnings multiple, all pulled together using an 8.36% discount rate. The full narrative walks through how those moving parts connect, and which assumptions really drive the gap between price and value.

Result: Fair Value of $225.50 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you still have to weigh risks like softer wallboard demand and higher operating costs, which could pressure margins and shake confidence in the current narrative.

Find out about the key risks to this Eagle Materials narrative.

Another View: Earnings Multiple Sends a Different Signal

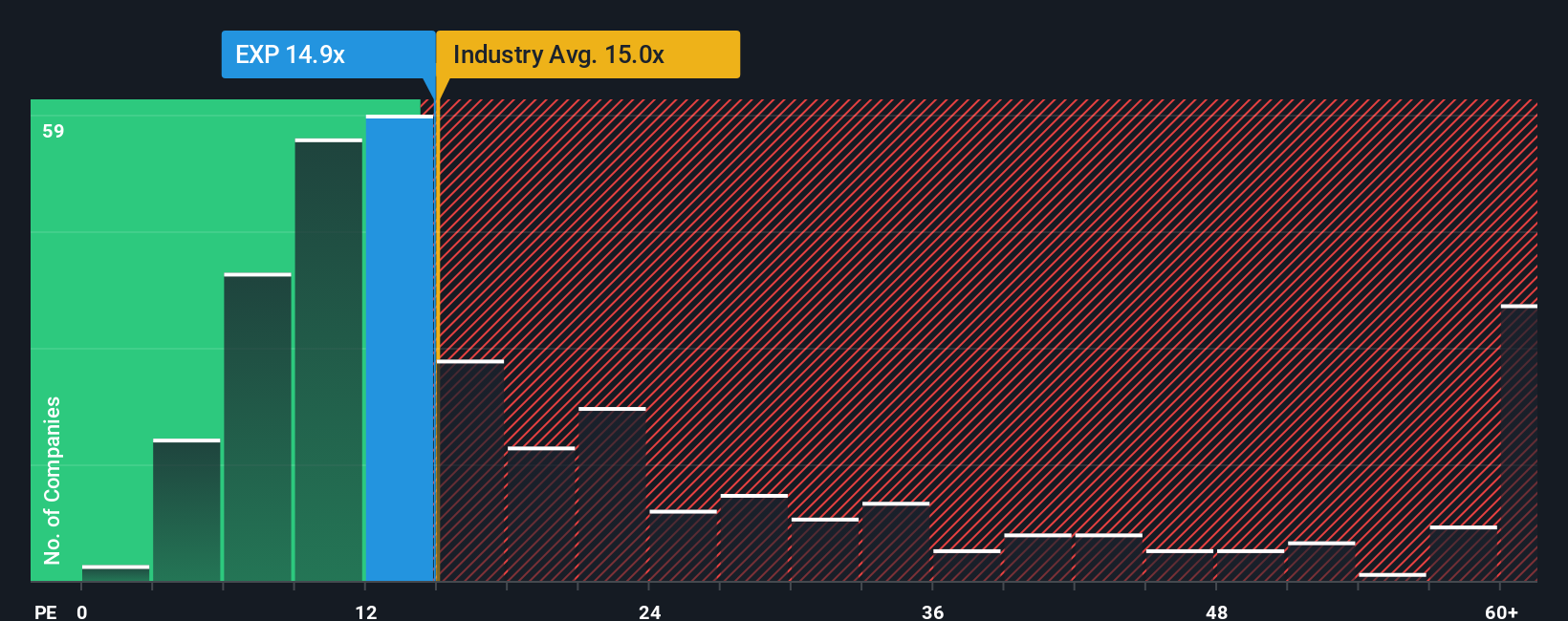

While the narrative-based fair value suggests Eagle Materials is 4.3% overvalued at $235.11 versus $225.50, the picture looks different when you focus on the P/E ratio. At 17.2x, the current P/E matches its fair ratio of 17.2x and sits well below the 28.9x peer average, even though it is above the 15.6x global Basic Materials average. For you, that split raises a real question: is the market underestimating risk here, or is there still room for re rating if sentiment swings back?

See what the numbers say about this price — find out in our valuation breakdown.

Next Steps

If this combination of caution and optimism feels conflicted to you, that is the point. It is your call to weigh the trade offs using 1 key reward and 1 important warning sign.

Looking for more investment ideas?

Do not stop with one company when the wider market is full of opportunities that might suit your goals better right now.

- Spot potential mispricings early by scanning our list of 55 high quality undervalued stocks that combine strong fundamentals with prices that may not fully reflect their underlying strength.

- Prioritise resilience by reviewing 81 resilient stocks with low risk scores, where companies are assessed through a consistent risk framework to help you focus on steadier profiles.

- Get ahead of the crowd by checking the screener containing 24 high quality undiscovered gems, a set of under the radar names filtered for quality so you can consider them before they appear on more screens.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eagle Materials might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EXP

Eagle Materials

Through its subsidiaries, manufactures and sells heavy construction products and light building materials in the United States.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

UnitedHealth Group's Future Revenue Grows by 3.59%: What Will It Mean?

Why EnSilica is Worth Possibly 13x its Current Price

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.