- United States

- /

- Chemicals

- /

- NYSE:EMN

Will Index Downgrades and Weaker Earnings Shift Eastman Chemical’s (EMN) Investment Narrative?

Reviewed by Sasha Jovanovic

- In the past week, Eastman Chemical Company was removed from the S&P 500 and related indices, while being added to the S&P 600, S&P 1000, and Russell Small Cap Comp Value Index, and reported third-quarter sales of US$2,202 million and net income of US$47 million, both down from the prior year.

- This series of index changes coupled with weaker earnings highlights a shift in Eastman's market categorization and underscores ongoing operational challenges.

- We will examine how Eastman's transition to smaller-cap indices may influence its investment narrative and risk profile going forward.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Eastman Chemical Investment Narrative Recap

To be a shareholder in Eastman Chemical, you’d need confidence in the company’s ability to rebound operationally and capture new growth through its advanced recycling initiatives and specialty materials, despite recent operational headwinds. The shift to smaller-cap indices and recent earnings shortfall reflects current challenges but does not materially alter the key near-term catalyst, successful commercialization and volume ramp-up in recycled products, nor the largest current risk of prolonged weak demand from core end markets.

Among recent developments, Eastman’s shelf registration filing for up to US$303.7 million in common stock stands out. While this announcement does not directly affect its primary business drivers or immediate catalysts, it highlights Eastman’s intent to maintain financial flexibility as the company targets growth opportunities in sustainable product lines and pursues ongoing cost reduction efforts.

On the flip side, investors should be aware that persistent uncertainty in customer demand...

Read the full narrative on Eastman Chemical (it's free!)

Eastman Chemical's outlook anticipates $9.6 billion in revenue and $904.5 million in earnings by 2028. This is based on a projected annual revenue decline of 1.0% and an earnings increase of $72.5 million from the current earnings of $832.0 million.

Uncover how Eastman Chemical's forecasts yield a $74.59 fair value, a 25% upside to its current price.

Exploring Other Perspectives

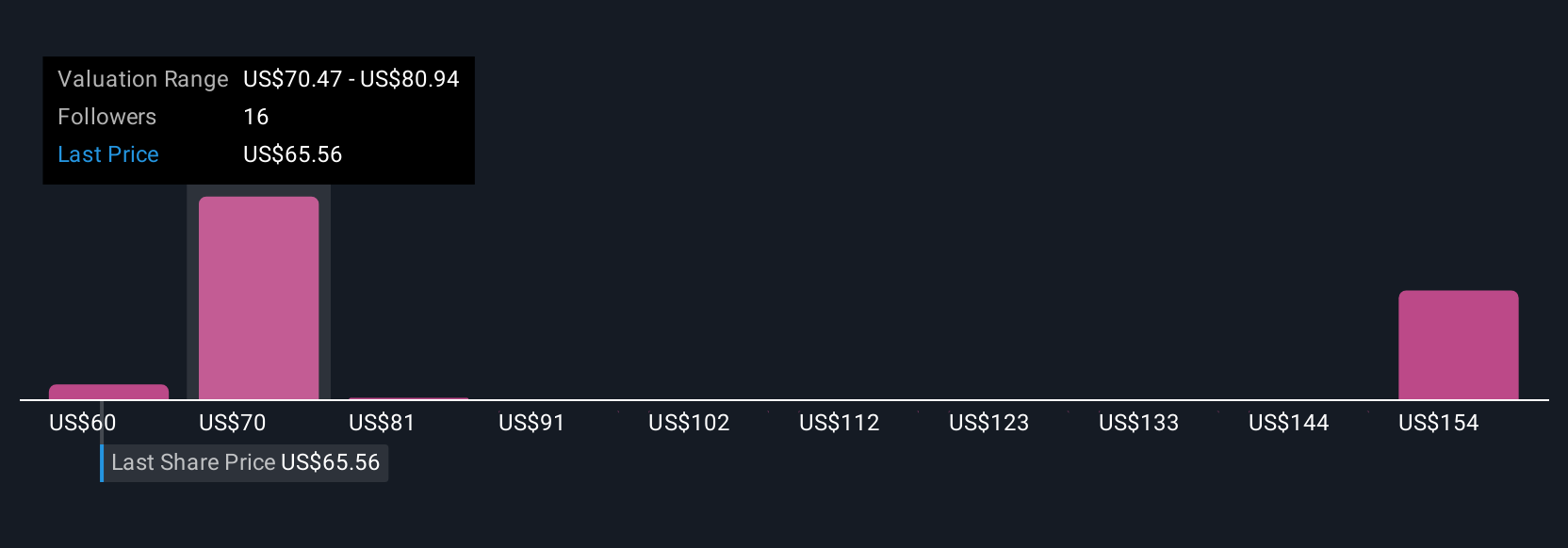

Fair value estimates by nine members of the Simply Wall St Community range widely from US$46.21 to US$116.21 per share. This diversity of opinion stands alongside concerns about weak demand in core segments and reminds you to consider multiple viewpoints as you assess Eastman’s potential.

Explore 9 other fair value estimates on Eastman Chemical - why the stock might be worth 23% less than the current price!

Build Your Own Eastman Chemical Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Eastman Chemical research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Eastman Chemical research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Eastman Chemical's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 34 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eastman Chemical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EMN

Eastman Chemical

Operates as a specialty materials company in the United States, China, and internationally.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives