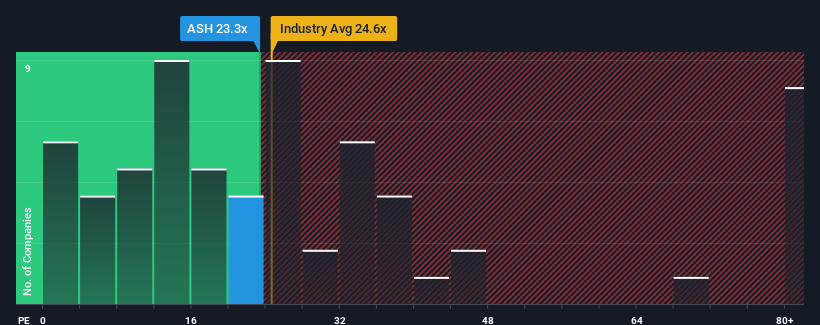

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 17x, you may consider Ashland Inc. (NYSE:ASH) as a stock to potentially avoid with its 23.3x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

With earnings that are retreating more than the market's of late, Ashland has been very sluggish. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Ashland

How Is Ashland's Growth Trending?

In order to justify its P/E ratio, Ashland would need to produce impressive growth in excess of the market.

Retrospectively, the last year delivered a frustrating 24% decrease to the company's bottom line. Even so, admirably EPS has lifted 186% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the nine analysts covering the company suggest earnings should grow by 13% over the next year. Meanwhile, the rest of the market is forecast to expand by 15%, which is noticeably more attractive.

With this information, we find it concerning that Ashland is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Ashland currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You always need to take note of risks, for example - Ashland has 2 warning signs we think you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ASH

Ashland

Provides additives and specialty ingredients in the North and Latin America, Europe, Asia Pacific, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives