- United States

- /

- Chemicals

- /

- NYSE:ASH

Ashland (ASH): Assessing Valuation After Earnings Miss and Net Loss Linked to Impairments

Reviewed by Simply Wall St

Ashland (NYSE:ASH) just released its latest quarterly results, and the numbers are drawing attention. Revenue slipped for both the fourth quarter and full year, and net loss was notably affected by non-cash impairments.

See our latest analysis for Ashland.

After a rocky year marked by an earnings shortfall and major non-cash impairments, Ashland’s share price has struggled to gain real momentum. Despite a modest 5.4% share price return over the past month, the year-to-date price return sits at -28.2% and the total shareholder return for the past twelve months is a steep -36.5%. This prolonged slide suggests market confidence is yet to recover, even as management signals operational improvements and guidance for growth in 2026.

If volatility like this makes you curious about other trends, it’s a perfect moment to expand your search and discover fast growing stocks with high insider ownership

With shares trading well below analysts’ targets and management projecting a return to growth next year, is Ashland now an overlooked value play, or is the market already factoring in all future gains?

Most Popular Narrative: 19.8% Undervalued

At $50.05 per share, Ashland’s latest close falls well below the narrative's fair value estimate of $62.40. The stage is set by a fair value cut, yet the case for a turnaround is far from closed.

The global shift toward sustainable and bio-based materials, driven by regulatory requirements and consumer preference, continues to gain momentum. This benefits Ashland's specialty chemicals portfolio, which is now more focused on high-value, sustainable, and compliant solutions. This focus is expected to support top-line revenue growth and margin resilience over the long term.

Want to know what’s fueling this big-value gap? The narrative is built on projections that hinge on a future earnings comeback and a striking swing in profit margins. Are you curious about which bold assumptions about next-level growth and profitability are driving that eye-catching fair value? Only the full narrative reveals the story.

Result: Fair Value of $62.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing demand softness in key export markets and a heavy tilt toward personal care and life sciences could present challenges to Ashland’s growth rebound.

Find out about the key risks to this Ashland narrative.

Another View: What Do Market Ratios Say?

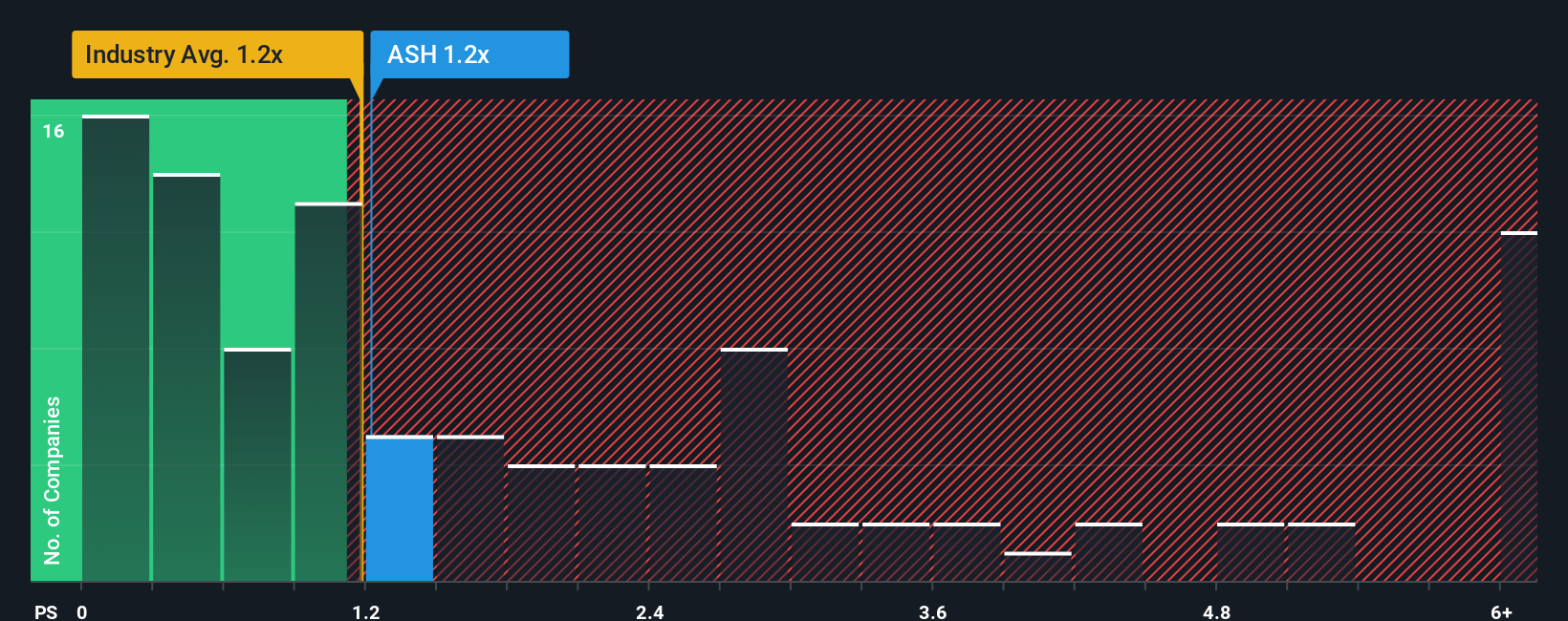

While the narrative points to undervaluation, price-to-sales tells a different story. Ashland trades at 1.3 times sales, which is pricier than both the US Chemicals industry average of 1.1x and its closest peers. The fair ratio model suggests a more reasonable level is 1.2x. Does this put investors at risk of overpaying, or is the market missing something deeper?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ashland Narrative

Feeling skeptical or want to investigate further? Dive into the numbers yourself and craft your own Ashland story in just minutes. Do it your way

A great starting point for your Ashland research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know the best opportunities go fast, so make sure you’re keeping up with the latest stock ideas beyond Ashland. Check out these standout screens to find the next big mover before the crowd:

- Maximize your income by uncovering these 16 dividend stocks with yields > 3% with robust yields and strong payout histories.

- Capitalize on breakthroughs in healthcare with these 32 healthcare AI stocks that are leveraging artificial intelligence to transform patient outcomes and diagnostics.

- Get ahead of the market by scanning these 876 undervalued stocks based on cash flows that are priced well below their intrinsic worth and may offer real upside for forward-thinking investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ASH

Ashland

Provides additives and specialty ingredients in the North and Latin America, Europe, Asia Pacific, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives