- United States

- /

- Chemicals

- /

- NYSE:ALB

A Look at Albemarle’s Valuation After Strong Earnings and Renewed Confidence in Its Lithium Growth Story

Reviewed by Simply Wall St

Albemarle (ALB) just reported third-quarter results that topped expectations, even as lithium prices dipped. Revenue and earnings both exceeded estimates, due to improvements in operational efficiency and careful cost management.

See our latest analysis for Albemarle.

Albemarle’s latest results arrive as the stock starts regaining its footing. The 1-day share price return jumped 6.5% on earnings, adding to a 20% run over the past 90 days. While longer-term total shareholder returns remain deeply negative, recent momentum suggests shifting sentiment as the company’s streamlining moves and focus on efficiency get noticed. A string of announcements, from cost-saving initiatives and revised capital spending to a fresh dividend affirmation and pending asset sales, have helped restore some confidence in Albemarle’s outlook.

If Albemarle’s rebound has you watching for more opportunities, it could be the perfect time to discover fast growing stocks with high insider ownership.

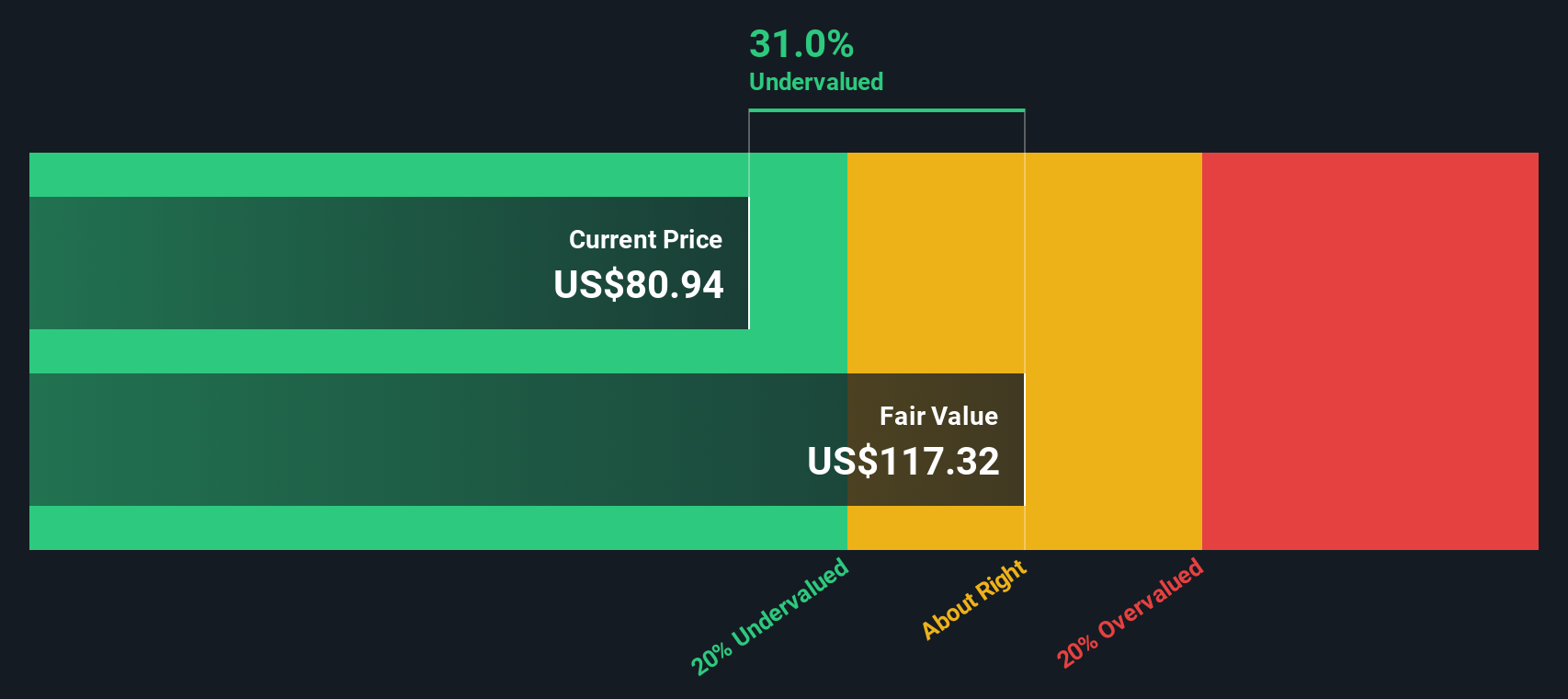

With the stock now rebounding and analyst optimism rising, investors may be wondering if Albemarle is still trading at a discount or if the market is already anticipating the company’s next phase of growth.

Most Popular Narrative: Fairly Valued

Albemarle’s most widely followed narrative values the stock nearly in line with the market price, hinting at a delicate balance between future earnings optimism and persistent challenges. Investors are weighing a fair value of around $96.45 versus the latest close near $97.18. This remarkably close spread implies the market may already be factoring in the next chapter for Albemarle.

Despite recent lithium price weakness, Albemarle is benefitting from exceptional global growth in lithium demand (up ~35% year-to-date), especially from accelerating EV adoption in China and Europe and surging stationary energy storage. This supports continued top-line revenue growth as supply and demand rebalance.

This narrative is built on a bold set of projections. It hints at double-digit top-line growth, dramatic margin expansion, and a valuation multiple that will surprise many chemicals sector watchers. Find out whether that future upside is just hype, or if the narrative exposes a fundamentally different outlook for Albemarle’s path from here.

Result: Fair Value of $96.45 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent low lithium prices and regulatory uncertainties in key regions could quickly change the outlook for Albemarle's recovery and valuation.

Find out about the key risks to this Albemarle narrative.

Another View: Discounted Cash Flow Perspective

The SWS DCF model offers a different lens and suggests Albemarle could be undervalued by a wide margin. With our estimate of fair value at $161.35 per share, current prices look much lower than what future cash flows might justify. Does this imply a hidden opportunity, or are market concerns still in play?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Albemarle for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Albemarle Narrative

If you want a different perspective or trust your own analysis more, why not explore the numbers yourself and share your story: Do it your way.

A great starting point for your Albemarle research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep their options open. Don’t let opportunity pass you by when you could quickly target the next breakthrough stock or market trend.

- Spot undervalued opportunities with strong cash flow by narrowing in on these 876 undervalued stocks based on cash flows. Get ahead before the crowd.

- Uncover tomorrow’s blockchain innovations by tracking these 82 cryptocurrency and blockchain stocks as it transforms how the world thinks about value and transactions.

- Benefit from reliable income streams by checking out these 16 dividend stocks with yields > 3%, which delivers yields above 3% for true staying power in your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALB

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives