- United States

- /

- Chemicals

- /

- NasdaqCM:PCT

Can PureCycle (PCT) Balance Global Ambitions and Profitability After Its Latest Board Shakeup?

Reviewed by Sasha Jovanovic

- PureCycle Technologies recently reported its third quarter 2025 results, showing US$2.43 million in sales and a significantly reduced net loss of US$28.37 million compared to the previous year.

- The company's appointment of Dr. Siri Jirapongphan to its board brings deep international energy expertise as PureCycle advances global expansion, especially in Asia.

- We'll examine how improved earnings and global leadership changes could influence PureCycle's investment narrative and operational trajectory.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

What Is PureCycle Technologies' Investment Narrative?

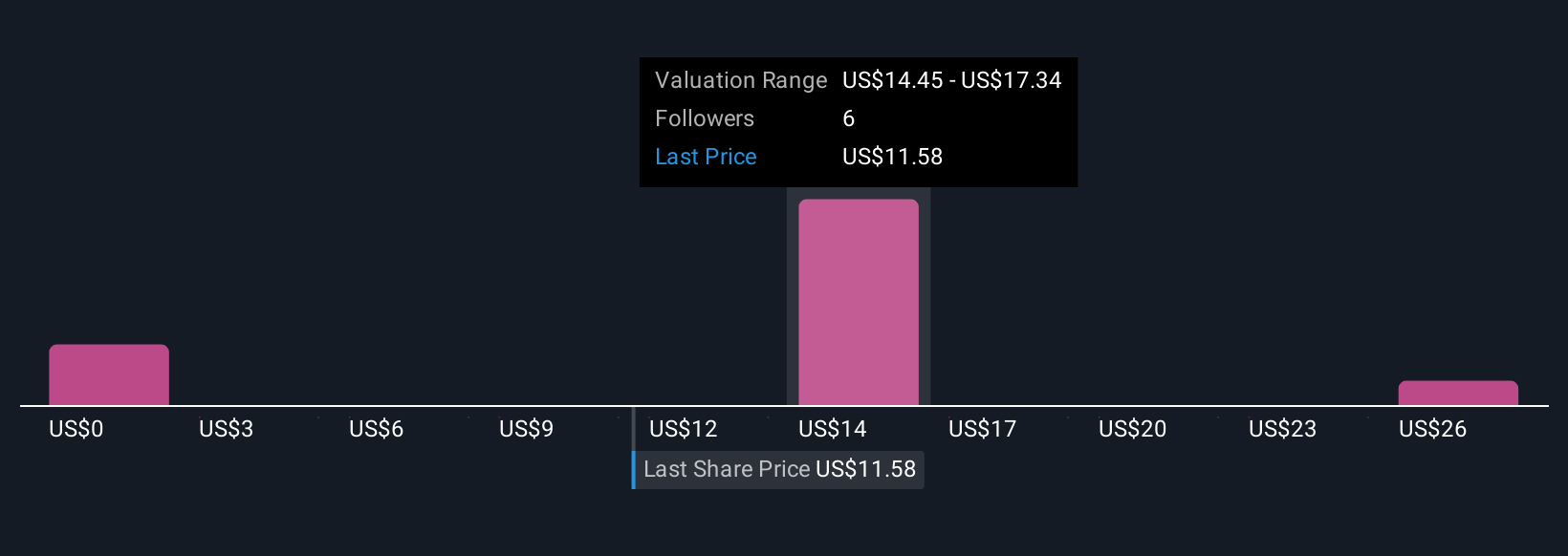

For anyone considering PureCycle Technologies, the core belief rests on the company’s potential to scale its recycling technology amid a rapidly evolving global waste management industry. The recent narrowing of net losses to US$28.37 million and sales growth to US$2.43 million in the third quarter suggest operational progress, though persistent unprofitability remains a hurdle. Dr. Siri Jirapongphan’s appointment to the board, bringing significant energy sector experience in Asian markets, could strengthen PureCycle’s push for international expansion, especially as it eyes new facilities abroad. However, with less than a year of cash runway, concerns around future funding and execution risk are front and center, only partly eased by these developments. Recent market declines indicate the latest news may not materially shift short-term risk, keeping liquidity and break-even timing in sharp investor focus.

But despite new board leadership, looming cash requirements could reshape the risk profile for shareholders. Upon reviewing our latest valuation report, PureCycle Technologies' share price might be too optimistic.Exploring Other Perspectives

Explore 4 other fair value estimates on PureCycle Technologies - why the stock might be worth over 2x more than the current price!

Build Your Own PureCycle Technologies Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PureCycle Technologies research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free PureCycle Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PureCycle Technologies' overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PCT

PureCycle Technologies

Engages in the production of recycled polypropylene (PP).

Mediocre balance sheet with limited growth.

Market Insights

Community Narratives